Ethereum has suffered an enormous decline, dropping over 50% of its worth since late December, fueling worry and panic promoting throughout the market. The downturn has led many analysts to query the potential for an altseason this 12 months, as Ethereum and most altcoins battle to reclaim key bullish ranges. With ETH failing to interrupt above vital resistance zones, buyers stay unsure about its short-term path, and market sentiment continues to lean bearish.

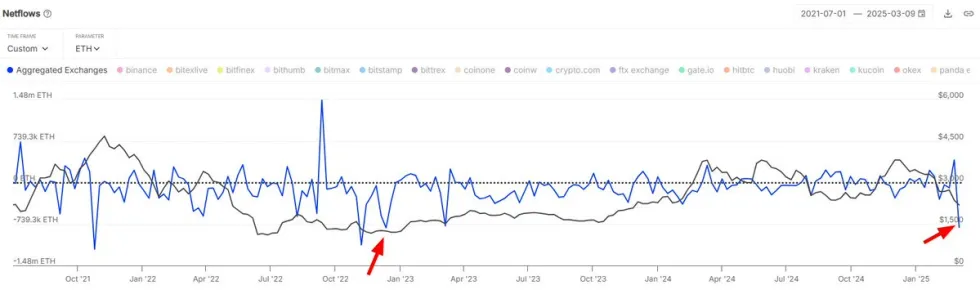

Regardless of the pessimism, there are indicators of potential restoration. On-chain knowledge from IntoTheBlock reveals that $1.8 billion price of ETH left exchanges final week, marking the biggest weekly outflow since December 2022. Massive outflows from exchanges sometimes point out that buyers are transferring ETH into personal wallets, suggesting long-term accumulation reasonably than rapid promoting. This pattern might suggest that whales and institutional gamers are viewing present costs as a chance, regardless of the broader market uncertainty.

If Ethereum can maintain key help ranges and stabilize, it might be positioned for a powerful rebound within the coming weeks. Nonetheless, for ETH to substantiate a real restoration, bulls should reclaim vital resistance zones and maintain shopping for momentum. Till then, merchants stay cautious, watching whether or not Ethereum will stage a comeback or if additional draw back is forward.

The following few weeks can be essential, as ETH’s potential to carry above key demand zones might decide whether or not a pattern reversal is feasible or if continued promoting stress will push costs decrease.

Ethereum Bulls Should Maintain $2K Assist

Ethereum is at present buying and selling above the $2,000 mark, however bulls are discovering it tough to reclaim increased ranges amid persistent promoting stress. The market stays in a fragile state, with buyers intently watching whether or not ETH can set up a restoration or proceed its downward trajectory.

For a significant restoration, ETH should reclaim the $2,350 stage, which might set the muse for a possible rebound. Nonetheless, the primary resistance zone for bulls stays at $2,500—a vital stage that has traditionally acted as a powerful barrier. A break and maintain above $2,500 would seemingly spark a restoration rally, shifting momentum again in favor of patrons.

On the flip facet, failing to carry $2,000 might prolong Ethereum’s downtrend, rising the chance of additional declines. Dropping this key stage would put ETH vulnerable to testing decrease demand zones, doubtlessly resulting in extra aggressive promoting stress.

Featured picture from Dall-E, chart from TradingView