Ethereum value has crashed this 12 months and is hovering close to its lowest degree since September final 12 months.

Ethereum (ETH) was buying and selling above $2,200 ultimately test Sunday, down by over 45% from its highest level in November final 12 months. A number of essential charts clarify why the ETH value has crashed, and supply hints of what to anticipate this 12 months.

Ethereum value fashioned a triple-top sample

The weekly chart exhibits that the ETH value discovered robust resistance at round $4,000 in 2024. This sample is characterised by three peaks and a neckline, and is among the most bearish patterns available in the market.

ETH has now dropped to the neckline at $2,150. Due to this fact, a transparent break beneath that degree dangers extra draw back, doubtlessly to $1,176, down by 45% from the present degree.

ETH value chart | Supply: crypto.information

Spot ETH ETFs are having outflows

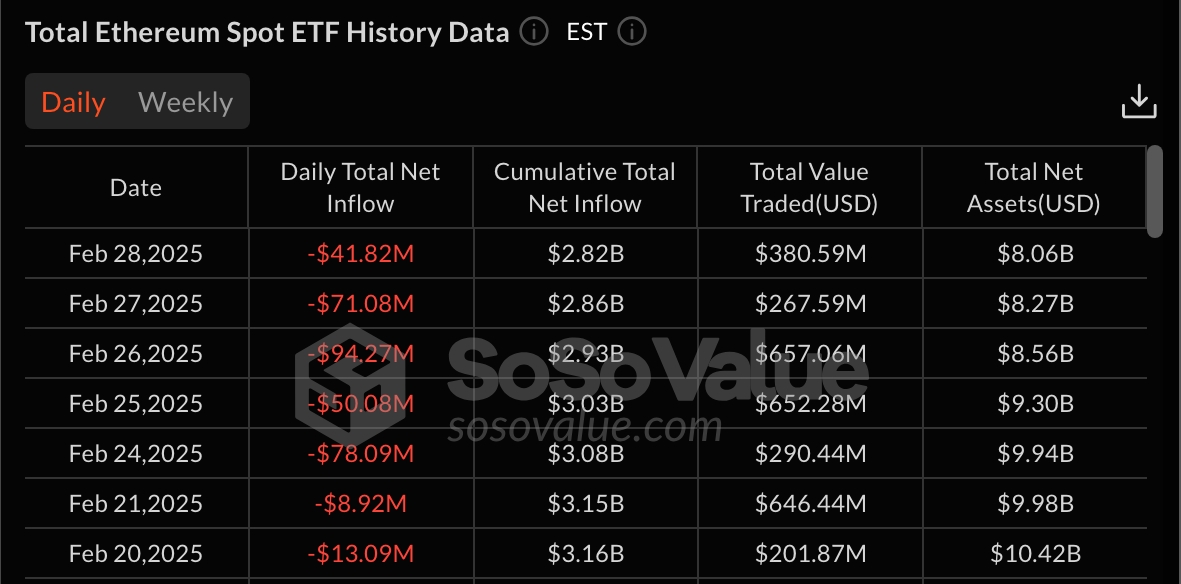

In the meantime, spot ETH ETFs have had substantial outflows prior to now few weeks.

And whereas these funds have attracted cumulative inflows of $2.82 billion, it’s a a lot smaller determine in comparison with Bitcoin’s $38 billion.

ETH ETF outflows | Supply: SoSoValue

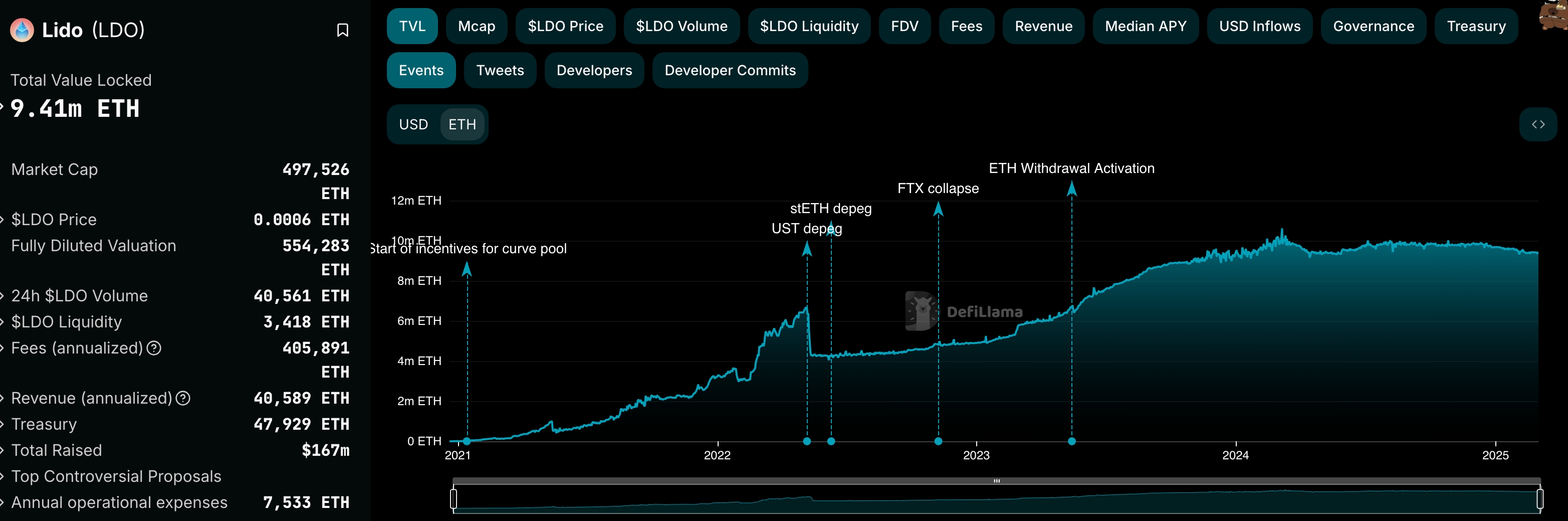

Ethereum staking outflows rise

ETH value has additionally crashed as staking outflows rise. Knowledge by StakingRewards exhibits that the staking market cap has dropped by 20% within the final seven days to $74.5 billion. It has had outflows within the final 4 straight days.

instance of that is Lido, the most important liquid staking community within the crypto business. Lido’s complete worth locked has dropped from over 10.1 million ETH to 9.41 million.

Lido staked ETH | Supply: DeFi Llama

You may also like: Solana meme cash rebound, however is it a lifeless cat bounce? Key dangers defined

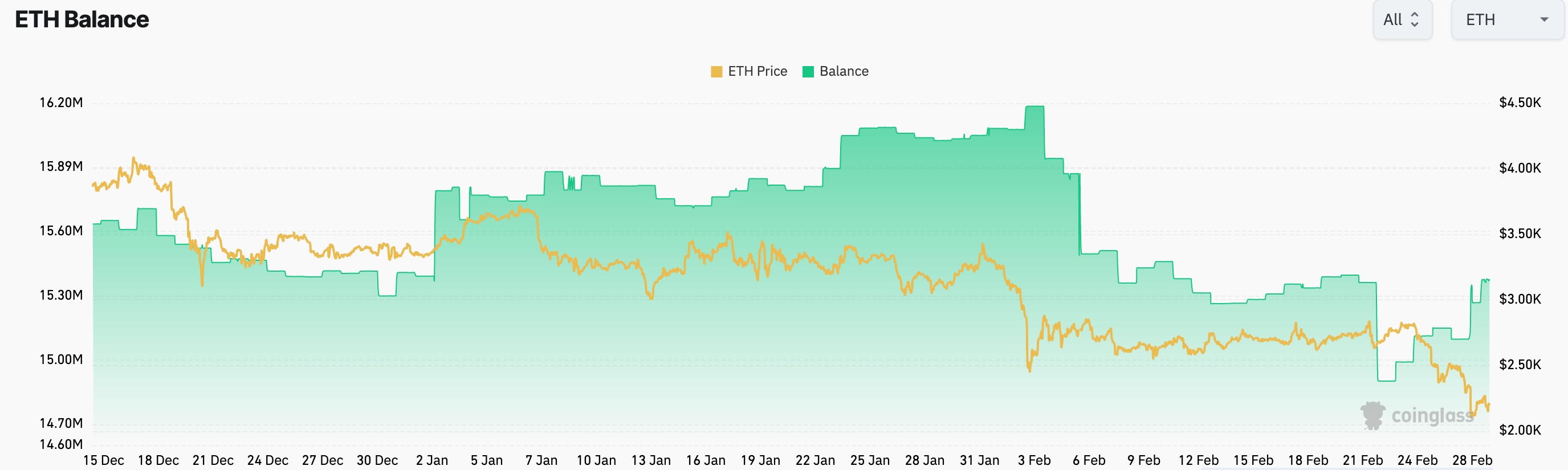

Ethereum balances on exchanges are rising

Additional, there are indicators that extra traders are promoting their ETH cash. A method of discovering that is to contemplate the balances on exchanges. Knowledge by CoinGlass exhibits that the balances have risen prior to now few days. These balances rose to fifteen.40 million, the very best degree since Feb. 1.

ETH balances on exchanges | Supply: CoinGlass

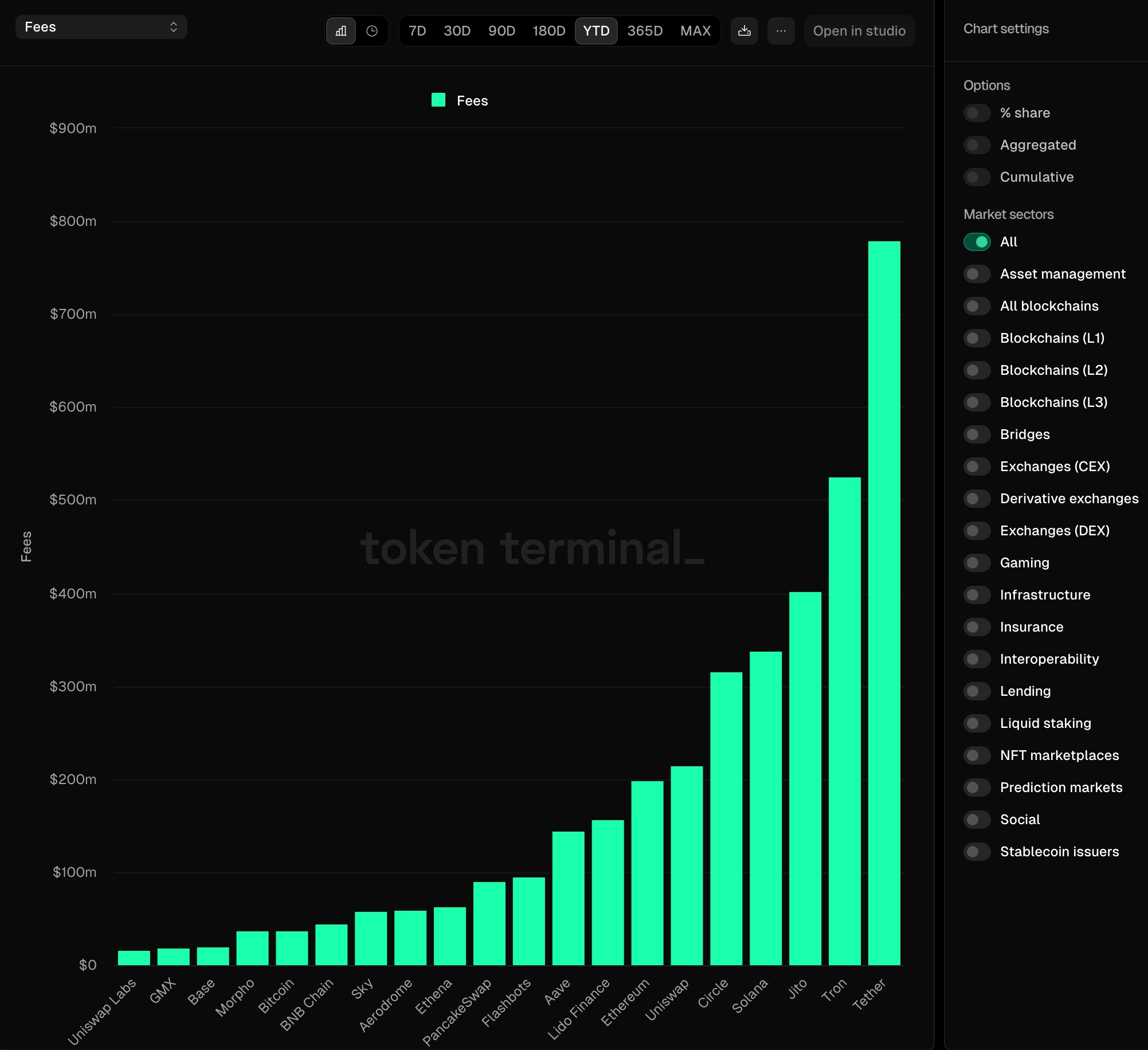

Ethereum charges have dropped

Additional, Ethereum’s value has dropped as a result of it’s now not essentially the most worthwhile participant within the crypto business. Ethereum has made $198 million this 12 months, which means that it has been overtaken by different gamers within the crypto business like Uniswap (UNI), Circle, Solana (SOL), Jito (JTO), and Tron (TRX).

Blockchain community charges | Supply: TokenTerminal

Different charts clarify the continued ETH value crash. For instance, this chart exhibits that Ethereum is shedding market share within the DEX business, the place layer-2 networks like Arbitrum and Base are struggling. One other chart by Santiment exhibits that Ethereum whales have been promoting the coin.

Learn extra: Tezos value prediction: Will XTZ value get better from its dip?