Cryptocurrencies have reworked the monetary panorama, fascinating tech lovers, buyers, and regulators worldwide. Nonetheless, as digital belongings achieve prominence, essential questions come up concerning the position of monetary literacy and cognitive biases in shaping funding behaviours.

Empirical proof underscores that monetary literacy considerably influences monetary stability by enhancing particular person decision-making. Individuals with increased monetary literacy make prudent decisions, akin to budgeting successfully, saving for emergencies, and understanding borrowing prices.

Conversely, low monetary literacy typically results in poor selections, over-indebtedness, and susceptibility to distorted expectations, amplifying systemic dangers.

Why does monetary literacy play a pivotal position within the cryptocurrency ecosystem? The inherent complexity of digital belongings like cryptocurrencies necessitates correct monetary information to navigate their dangers. Understanding blockchain expertise, digital wallets, and buying and selling platforms—all essential elements of cryptocurrency funding—requires a degree of digital and monetary literacy that many buyers lack.

Cryptocurrencies themselves are various, starting from established names like Bitcoin and Ethereum to speculative altcoins. With out the flexibility to critically assess expertise stacks and market tendencies, buyers might fall prey to speculative bubbles or initiatives with little intrinsic worth.

A scarcity of monetary literacy exacerbates these challenges, making it tough to grasp the potential penalties of market fluctuations, thereby growing vulnerability to shocks. The connection between monetary literacy and cryptocurrency possession is especially important given the complexity of those belongings in comparison with conventional monetary devices and the dangers they pose to monetary stability.

Research Hyperlinks Overconfidence to Crypto Investments

A latest examine, Cryptocurrency Possession and Cognitive Biases in Perceived Monetary Literacy, performed in Spain by Santiago Carbó, Pedro J. Cuadros, and Francisco Rodríguez and funded by Funcas, sheds mild on this difficulty. The analysis investigates how monetary literacy bias—the hole between perceived and precise monetary information—impacts cryptocurrency possession.

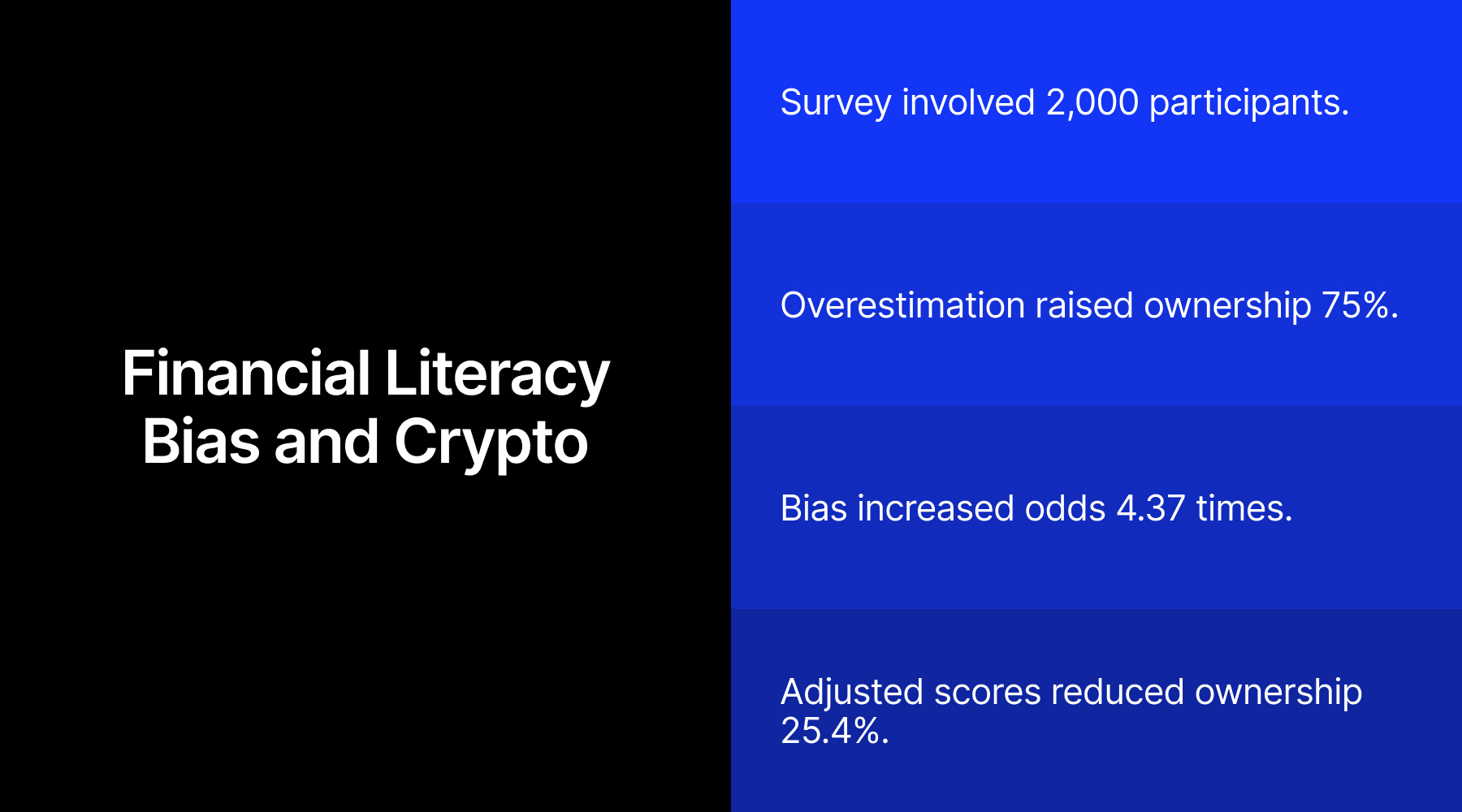

Based mostly on a survey of over 2,000 contributors, the examine identifies monetary literacy bias as a essential determinant of cryptocurrency possession, even after controlling for variables akin to age, earnings, and digital exercise.

Machine Studying Highlights Crypto Possession Components

Utilizing superior machine studying methods, the examine reveals that people who overestimate their monetary information are considerably extra prone to spend money on cryptocurrencies. Particularly, those that overestimated their monetary literacy had been 75% extra prone to maintain digital belongings in comparison with these with correct self-assessments. For each unit improve in monetary literacy bias, the percentages of proudly owning cryptocurrencies rose by roughly 4.37 occasions.

In case you persistently earn cash and lose it again to the market even when you understand you might be clever, then what’s lacking out of your training is monetary literacy.

💥What you do along with your cash when you make it

💥How one can preserve the market /folks from taking the cash from you…— Adaora Favour Nwankwo (@adaora_crypto) January 6, 2025

Why does this occur? People who overestimate their monetary literacy might really feel overly assured in dealing with the complexities of the cryptocurrency market. Cognitive biases, akin to affirmation bias, can additional reinforce this confidence by main people to deal with info that validates their funding decisions whereas disregarding proof of potential dangers. Addressing these biases is important for fostering extra rational and knowledgeable funding behaviour.

Cognitive Biases Gasoline Crypto Speculative Bubbles

Curiously, the examine additionally discovered that when monetary literacy scores had been adjusted to account for bias, the probability of cryptocurrency possession decreased by 25.4%. This highlights the significance of correct self-assessment in mitigating dangerous funding behaviours.

Whereas cryptocurrency adoption just isn’t inherently dangerous, it might probably pose systemic dangers when pushed by misinformation or cognitive biases. Cryptocurrencies typically entice people looking for fast returns, doubtlessly fueling speculative bubbles and growing market volatility. Such situations additionally create alternatives for fraud and scams, additional destabilising the monetary ecosystem.

Save for later✅ Comply with for extra ❤️

Since Crypto is a excessive threat asset and may make your funding zero too, so make investments properly and Do your correct analysis earlier than investing and develop your portfolio properly! pic.twitter.com/zU8kyUxkGl

— Mohini Of Investing (@MohiniWealth) January 5, 2025

Selling Monetary Training to Mitigate Dangers

For policymakers and regulators, these findings emphasize the urgency of selling monetary training. Initiatives that handle cognitive biases and improve goal monetary literacy will help mitigate dangers and encourage accountable funding behaviour. Regulators and business leaders ought to collaborate to make sure that buyers have entry to dependable info and safeguards in opposition to deceptive claims.

By fostering a tradition of monetary literacy and addressing cognitive biases, we will help make sure that the cryptocurrency revolution is each inclusive and sustainable. Whether or not as buyers, educators, or policymakers, recognizing the interaction between information, notion, and behavior is essential to succeeding on this dynamic monetary panorama.

Francisco Rodríguez additionally contributed to this text.