As blockchain expertise continues to evolve, understanding consumer engagement is essential to assessing the success of any community. One significantly insightful metric is each day energetic addresses. This refers back to the variety of distinctive blockchain addresses that take part in transactions on a given day, whether or not by sending or receiving property. Basically, it gives a snapshot of what number of customers are actively interacting with a blockchain at any given time, making it a dependable measure of real-world utilization and recognition.

On Dec. 27, 2024, CryptoRank revealed a chart rating the highest 10 blockchains of the 12 months primarily based on their common each day energetic addresses. This information, sourced from CryptoRank and Artemis.xyz, highlights some fascinating developments in blockchain adoption and affords insights into the platforms that led the way in which in driving consumer engagement. Let’s delve into the highest three blockchains dominating this metric, adopted by a fast overview of the remaining networks within the prime 10.

https://twitter.com/crypto_rand/standing/1873617510425309267

1. NEAR Protocol: 2.7 Million Every day Lively Addresses (+766% YoY)

NEAR Protocol emerged because the chief in 2024, boasting 2.7 million each day energetic addresses. This marks an astounding 766% year-on-year development, largely pushed by its give attention to scalability and user-friendly instruments for builders. NEAR employs an progressive sharding expertise referred to as Nightshade, which splits the blockchain into smaller, extra manageable items, enabling excessive transaction throughput at low prices. This effectivity has made NEAR a best choice for builders creating decentralized functions (dApps).

NEAR’s success was additional bolstered by the speedy adoption of blockchain-based gaming and social dApps on its platform. These functions attracted new customers unfamiliar with blockchain expertise, serving to NEAR construct a sturdy and rising ecosystem. Mixed with vital investments from the NEAR Basis in developer grants, the protocol’s rise to the highest underscores its enchantment to each customers and builders alike.

2. Solana: 2.6 Million Every day Lively Addresses (+702% YoY)

Solana ranked second, with 2.6 million each day energetic addresses and a formidable 702% year-on-year development. The community’s reputation in 2024 was fueled largely by its vibrant memecoin ecosystem, which noticed huge buying and selling exercise on platforms like Pump.enjoyable. These memecoins attracted retail and institutional buyers alike, considerably boosting Solana’s utilization metrics.

Along with memecoins, Solana’s high-speed, low-cost infrastructure made it a go-to blockchain for decentralized finance (DeFi) and non-fungible token (NFT) tasks. Builders and customers flocked to the community to reap the benefits of its effectivity, whereas institutional curiosity grew as Solana proved its scalability and reliability. This mixture of things cemented Solana as one of many prime blockchains of the 12 months.

3. TRON: 1.9 Million Every day Lively Addresses (+20.3% YoY)

TRON secured the third spot with 1.9 million each day energetic addresses, representing a gradual 20.3% development in comparison with the earlier 12 months. TRON’s dominance in stablecoin transactions, particularly these involving Tether (USDT), has been a key driver of its consumer base. With low transaction charges and high-speed transfers, TRON turned a most well-liked platform for customers in search of seamless, cost-effective stablecoin operations.

The blockchain additionally maintained a robust presence within the decentralized finance (DeFi) sector, partnering with numerous world fee programs and monetary establishments. Whereas its development was not as dramatic as NEAR or Solana, TRON’s constant efficiency and utility ensured its place among the many prime blockchains of 2024.

A Fast Take a look at the Remainder of the Prime 10

Past the highest three, the remaining blockchains on the checklist showcased various strengths and challenges.

BNB Chain noticed 1 million each day energetic addresses, a slight decline of 4.8% from the earlier 12 months. Regardless of the drop, BNB Chain stays a hub for DeFi and token buying and selling, retaining its significance within the blockchain ecosystem.

Polygon (MATIC) recorded 855,000 each day energetic addresses, attaining a sturdy 139% year-on-year development. As a Layer 2 scaling resolution for Ethereum, Polygon continues to draw gaming, NFT, and DeFi tasks, solidifying its function as an important a part of Ethereum’s ecosystem.

Base, Coinbase’s Layer 2 resolution, achieved 655,000 each day energetic addresses, experiencing an distinctive 2,098% year-on-year development. Its shut integration with Ethereum and Coinbase’s user-friendly platform have considerably boosted its adoption.

Sui emerged as a standout performer with 519,000 each day energetic addresses, experiencing a rare 908% year-on-year enhance. This development is attributed to its progressive programming language and quickly increasing ecosystem of decentralized functions (dApps).

Bitcoin (BTC), the world’s most acknowledged blockchain, recorded 496,000 each day energetic addresses, a 19% decline year-on-year. Whereas Bitcoin stays the dominant asset when it comes to market capitalization, its lower in each day energetic addresses displays shifting consumer priorities.

The Open Community (TON), the blockchain related to Telegram, skilled exponential development in 2024, with each day energetic addresses surging by 5,185% to succeed in 414,000. This development was fueled by TON’s integration with Telegram, leveraging the messaging platform’s huge consumer base to spice up adoption.

Lastly, Arbitrum, a number one Ethereum Layer 2 resolution, achieved 413,000 each day energetic addresses, a 180% enhance year-on-year. Arbitrum’s capacity to scale Ethereum functions whereas sustaining low charges and excessive throughput has made it a key participant within the Ethereum ecosystem.

Evaluating Exercise with Complete Worth Locked: A Broader Perspective

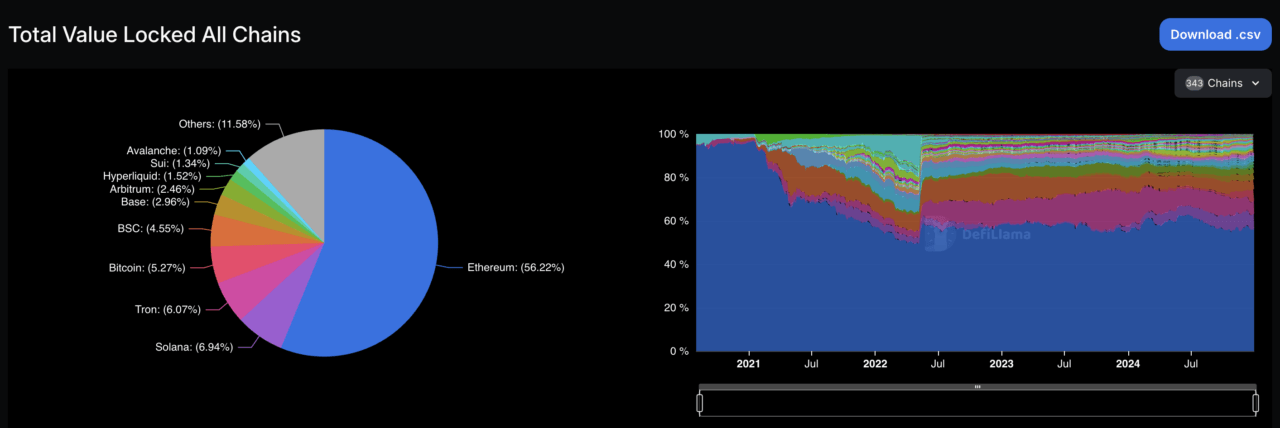

A further lens to judge blockchain ecosystems is Complete Worth Locked (TVL), a metric that displays the overall greenback worth of property locked in decentralized finance (DeFi) protocols on a blockchain. TVL measures how a lot capital customers have dedicated to DeFi functions, equivalent to lending, staking, and liquidity provision. Not like each day energetic addresses, which emphasize consumer exercise, TVL gives insights into the monetary depth and maturity of a blockchain’s DeFi ecosystem.

By this measure, Ethereum stands unequalled, commanding 56.22% of the overall TVL throughout all chains as of Dec. 30, 2024, in keeping with information from DeFiLlama.

Supply: DefiLlama

Ethereum’s dominance stems from its well-established DeFi ecosystem, which homes essentially the most various and superior set of decentralized functions, supported by its early adoption and a robust developer group. Nonetheless, Ethereum’s supremacy in TVL contrasts with its place in each day energetic addresses, the place it doesn’t lead. This divergence highlights the differing nature of those metrics: TVL captures capital locked in protocols, which requires fewer however bigger transactions, whereas each day energetic addresses spotlight the frequency of consumer interactions, usually linked to smaller, retail-driven actions.

Solana and TRON, ranked second and third in each day energetic addresses, maintain considerably decrease TVL rankings. Solana accounts for six.94% of whole TVL, and TRON makes up 6.07%, putting them behind Ethereum.

The distinction between TVL and each day energetic addresses highlights the varied strengths of blockchain networks. Whereas Ethereum excels in monetary liquidity and high-value functions, chains like Solana and TRON thrive on consumer engagement and transaction exercise. Collectively, these metrics present a extra nuanced understanding of the blockchain panorama, showcasing that no single measure can seize the total image of a community’s adoption and utility.

Featured Picture by way of Pixabay