Ethereum has not too long ago displayed notable volatility, witnessing a ten% surge attributed to elevated market exercise surrounding President Trump’s inauguration.

However, the asset faces a pivotal resistance at $3.5K, and the upcoming value motion will possible outline its subsequent development.

Technical Evaluation

By Shayan

The Each day Chart

ETH encountered vital shopping for curiosity close to the 100-day transferring common on the $3.2K mark, propelling the value upward by 10%. This heightened shopping for stress has introduced the asset nearer to a essential resistance area at $3.5K, which aligns with the bullish flag’s higher boundary.

If this momentum persists, Ethereum is more likely to break above the $3.5K threshold, paving the way in which for a contemporary surge towards the $4K resistance zone. Nonetheless, the short-term value motion can be essential in figuring out the market’s course, with elevated volatility anticipated.

The 4-Hour Chart

On the 4-hour timeframe, ETH’s volatility is obvious as the value fluctuates close to the 0.5-0.618 Fibonacci retracement ranges. This vary, bounded by $3.2K as help and $3.5K as resistance, highlights the continued battle between consumers and sellers. The present market construction reveals optimism, with the potential for a bullish breakout gaining momentum.

If consumers succeed, Ethereum may embark on a sustained rally towards $4K. Nonetheless, the elevated volatility and potential liquidations necessitate cautious danger administration, as a rejection at $3.5K may result in short-term retracements.

Onchain Evaluation

By Shayan

Whereas Ethereum has been consolidating inside a decent vary of $3.2K-$3.5K, market contributors are contemplating the chance of a bullish breakout following President Trump’s inauguration.

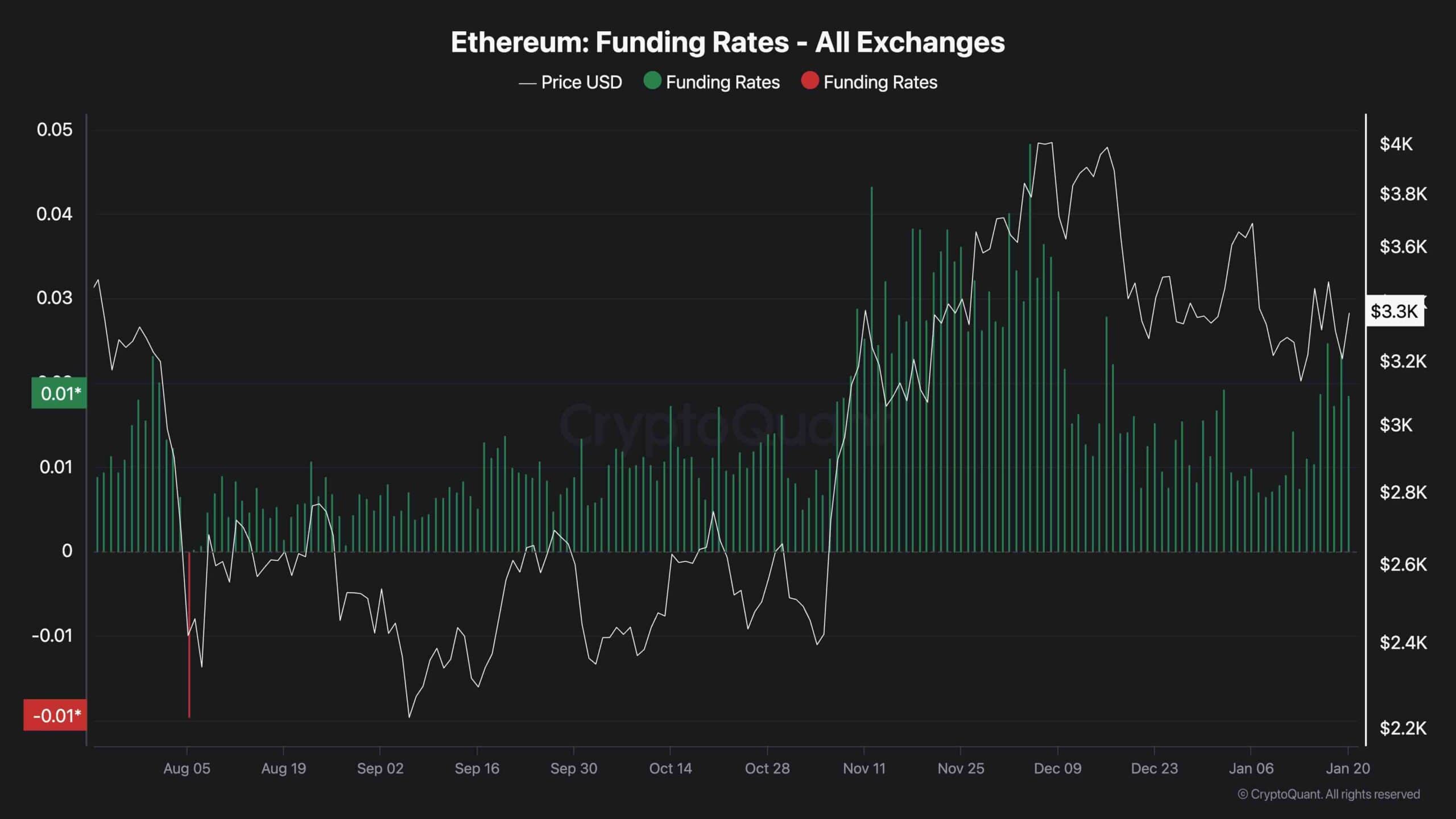

The funding charges metric, a key indicator of market sentiment, has proven declining values not too long ago, suggesting a discount in lengthy positions and fading bullish sentiment. Nonetheless, the metric has sharply elevated most not too long ago, hinting at rising bullish momentum within the perpetual markets.

As Ethereum approaches the $3.5K resistance degree, the presence of notable provide at this juncture underscores the need of sustained bullish momentum. For a decisive breakout to happen, the funding charges metric should rise additional, reflecting heightened market optimism and elevated lengthy positions.

A break above $3.5K stays contingent on stronger bullish sentiment within the futures market. The funding charges metric will play a pivotal position in figuring out whether or not Ethereum can overcome the $3.5K threshold, making the upcoming market motion essential.