Ethereum (ETH) is charting a bullish course, with technical indicators hinting at a possible rally.

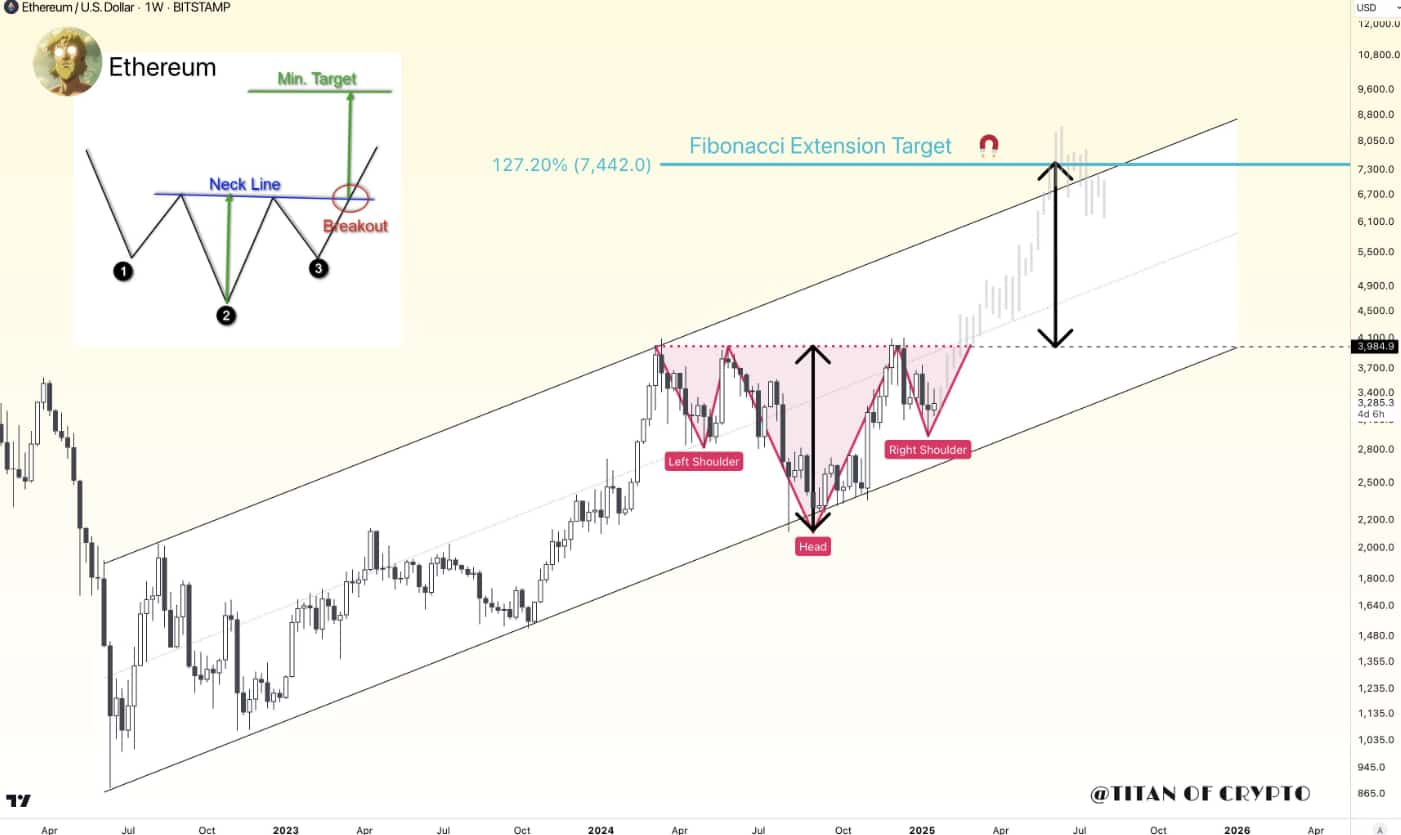

In accordance with a current evaluation by Titan of Crypto, Ethereum seems to be forming a possible Inverse Head and Shoulders (H&S) sample inside an upward channel, with a goal of $7,400 in sight.

If confirmed, this sample may sign the start of a big upward transfer within the coming months.

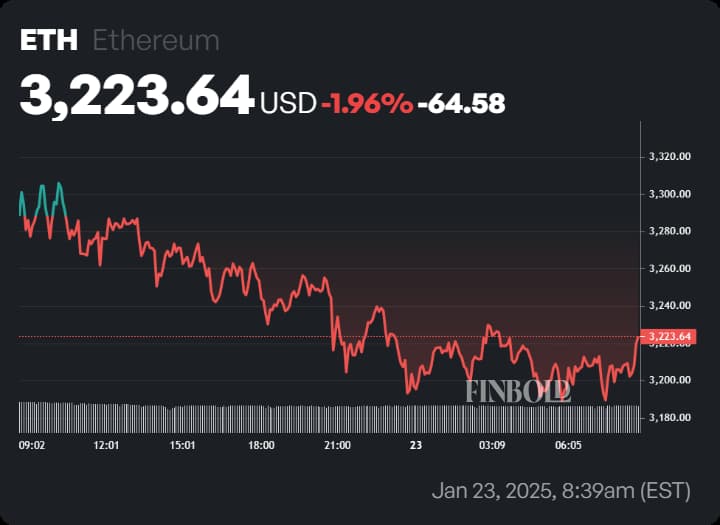

Nevertheless, at press time, Ethereum is buying and selling at $3,223, reflecting a every day decline of 1.96% and a weekly drop of almost 3%, indicating the present market uncertainty.

Ethereum technical evaluation paints a bullish image

The inverse Head and Shoulders sample, a widely known bullish reversal construction, is changing into more and more obvious in Ethereum’s present value motion. The neckline, which serves as a essential resistance degree, is positioned above the present value close to $4,000.

A decisive breakout above this neckline, backed by substantial buying and selling quantity, may validate the sample and set the stage for a big upward transfer.

Additional supporting this bullish narrative, the Fibonacci extension at 127.20% factors to a goal of $7,442, aligning intently with the projection from the H&S setup.

Since early 2023, Ethereum has been buying and selling inside a well-defined upward channel, providing constant help and resistance ranges. This channel strengthens Ethereum’s broader bullish momentum, with the technical framework signaling the potential for additional good points.

Ethereum’s bullish confluence with Ascending Triangle

Including to the bullish case, long-term crypto investor Jelle recognized that Ethereum is showcasing a compelling technical setup on the weekly chart, with two vital bullish patterns growing concurrently.

Jelle famous that the inverse H&S sample is forming with the neckline resistance round $4,000, inside the broader construction of an ascending triangle, one other bullish continuation sign.

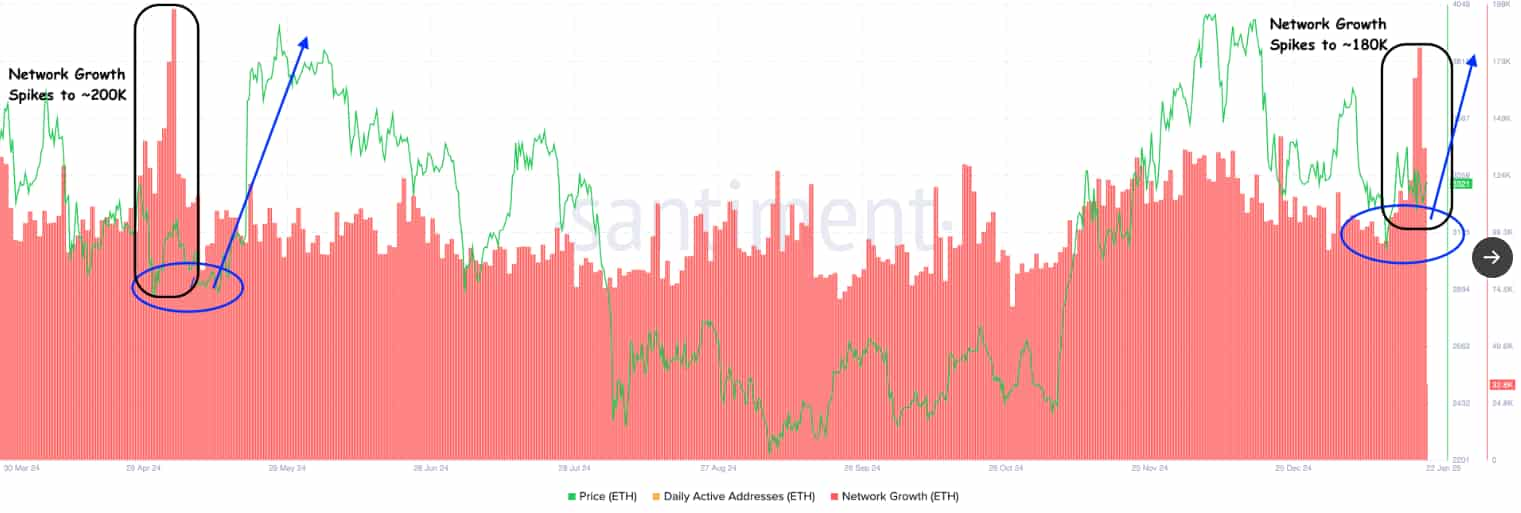

An analogous surge in April 2024 was adopted by a value rally from $2,800 to $4,000, highlighting the sturdy correlation between community progress and value efficiency.

Wanting forward, synthetic intelligence (AI) fashions forecast a near-term goal for Ethereum at $3,750 by the tip of Q1 2025, assuming continued market exercise and powerful demand.

Conversely, in a bearish state of affairs pushed by macroeconomic pressures or lowered liquidity, Ethereum’s value may retrace to $3,000 exhibiting the affect of exterior elements on its efficiency.

In the meantime, investor sentiment has more and more shifted towards altcoins and meme cash, which have posted notable good points in current weeks, with Ethereum lagging behind in capturing the broader market’s enthusiasm.

Featured picture through Shutterstock