Ethereum (ETH) value has struggled to regain momentum after shedding the $3,000 threshold on February 2, remaining under that degree ever since. Over the previous 30 days, ETH has dropped greater than 20%, reflecting ongoing market weak point and uncertainty about its subsequent transfer.

Technical indicators just like the DMI recommend an absence of a transparent pattern, with each bullish and bearish pressures weakening in latest days. In the meantime, the availability of ETH on exchanges has fallen to its lowest degree in six months, which might sign accumulation and lowered promoting stress, doubtlessly setting the stage for a restoration try.

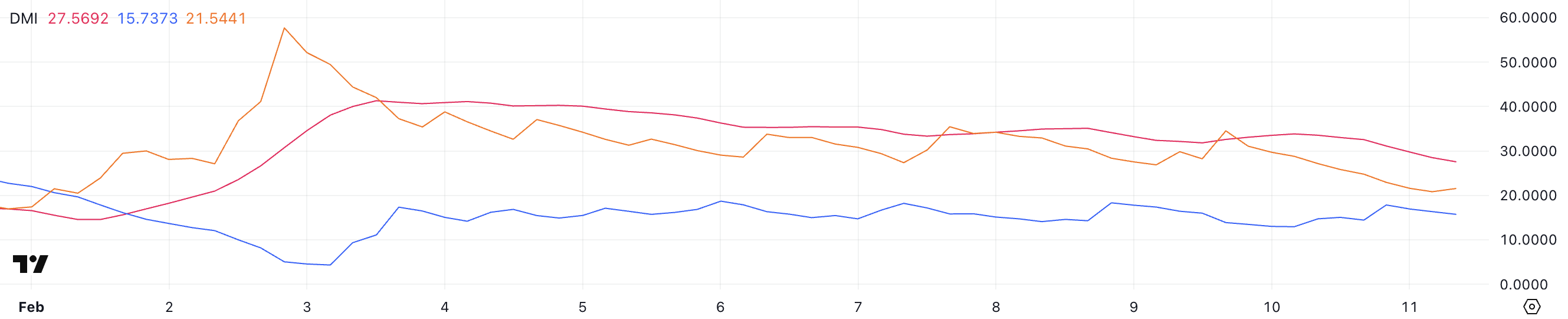

Ethereum DMI Exhibits the Lack of a Clear Development

Ethereum’s DMI chart reveals a weakening pattern, because the ADX has declined to 27.5 from 33.8 prior to now day. The ADX, or Common Directional Index, is a key indicator used to measure pattern energy. Readings above 25 sometimes sign a powerful pattern, whereas values under 20 point out a weak or nonexistent pattern.

The downward motion of the ADX means that Ethereum latest pattern is shedding momentum reasonably than gaining energy, which might point out market indecision.

ETH DMI. Supply: TradingView.

Wanting on the directional indicators, +DI has dropped from 17.8 to fifteen.7, whereas -DI has additionally declined from 22.9 to 21.5. This implies that each shopping for and promoting stress have weakened, leaving Ethereum with out a clear directional bias.

With -DI nonetheless above +DI, bears preserve a slight edge, however the declining ADX signifies the pattern is just not gaining traction.

This setup factors to a part of consolidation or potential pattern reversal reasonably than a continuation of robust bearish momentum. Till there’s a clear divergence within the directional indicators or an increase in ADX, Ethereum’s subsequent transfer stays unsure.

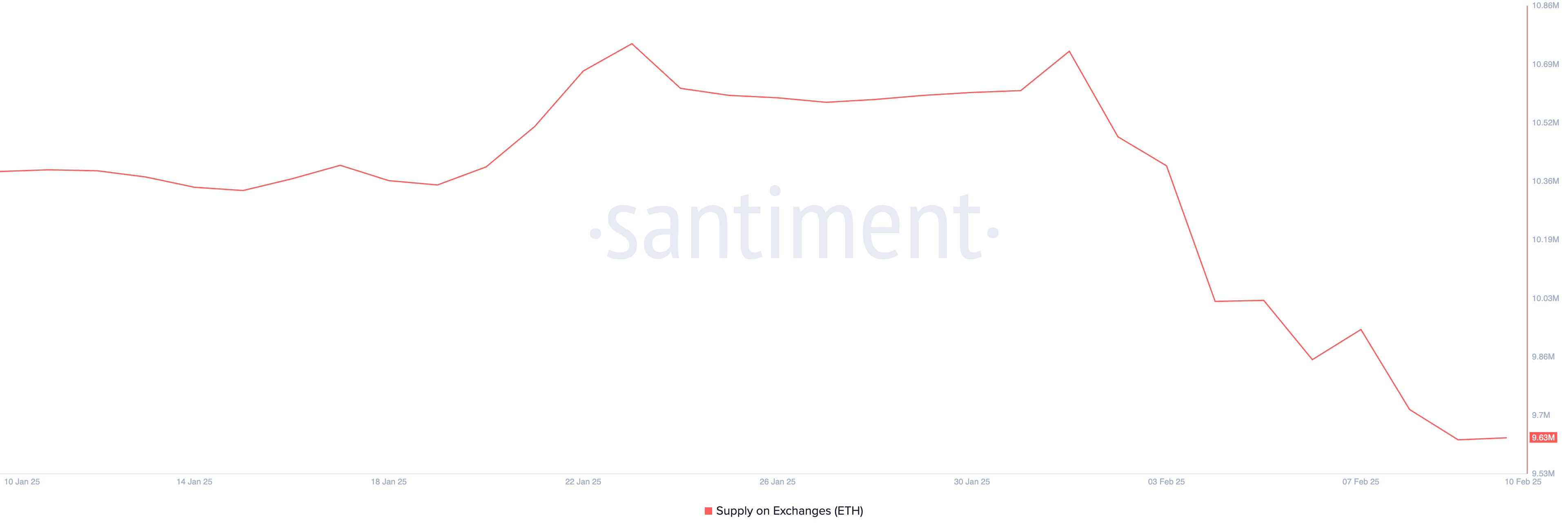

ETH Provide on Exchanges Reached Its Lowest Stage In Six Months

The provision of ETH on exchanges noticed a notable shift over the previous few weeks. After rising from 10.35 million on January 19 to 10.73 million on February 1, alternate balances have since declined sharply, falling consecutively to 9.63 million – the bottom degree in six months, courting again to August 2024.

This regular lower in ETH held on exchanges indicators a big shift in investor conduct, doubtlessly impacting value motion within the close to time period.

ETH Provide on Exchanges. Supply: Santiment.

The provision of ETH on exchanges is a key metric in understanding market sentiment. When alternate balances rise, it usually means that buyers are making ready to promote, as extra ETH is available for buying and selling. This may create promoting stress, resulting in bearish situations.

Conversely, when Ethereum provide on exchanges declines, it implies that buyers are shifting their holdings to non-public wallets, decreasing the fast sell-side liquidity.

This pattern is usually thought of bullish, because it suggests confidence in holding reasonably than promoting. With ETH alternate provide now at its lowest degree in six months, it might point out robust accumulation, decreasing promoting stress and doubtlessly setting the stage for upward value momentum.

ETH Worth Prediction: Can Ethereum Rise Again to $3,000?

Ethereum value chart reveals that its EMA strains nonetheless point out a bearish construction, with short-term shifting averages positioned under long-term ones.

This implies that ETH value has not but established a confirmed uptrend. Nevertheless, if shopping for momentum strengthens and ETH can get well a sustained upward motion, it could first problem the resistance at $2,798.

A profitable breakout above this degree might open the door for additional beneficial properties towards $3,024. If bullish momentum persists, ETH might ultimately goal the following main resistance at $3,442, signaling a full pattern reversal to the upside.

ETH Worth Evaluation. Supply: TradingView.

Then again, failure to determine an uptrend might depart ETH value weak to a retest of its key assist at $2,524.

A breakdown under this degree, particularly with rising promoting stress, would verify a bearish continuation, doubtlessly driving ETH additional right down to $2,163.