Ethereum (ETH) stays beneath the $2,700 degree regardless of Bitcoin’s resilience, because the broader crypto market and prime altcoins rebound. Merchants seem like shrugging off considerations over China’s DeepSeek synthetic intelligence advances and U.S. President Donald Trump’s tariffs.

The biggest altcoin’s value efficiency stays underwhelming, nonetheless this might change as sentiment amongst merchants turned optimistic, in accordance with information supplier Cryptoeq.

Desk of Contents

Ethereum value struggles at the same time as on-chain metrics flip bullish

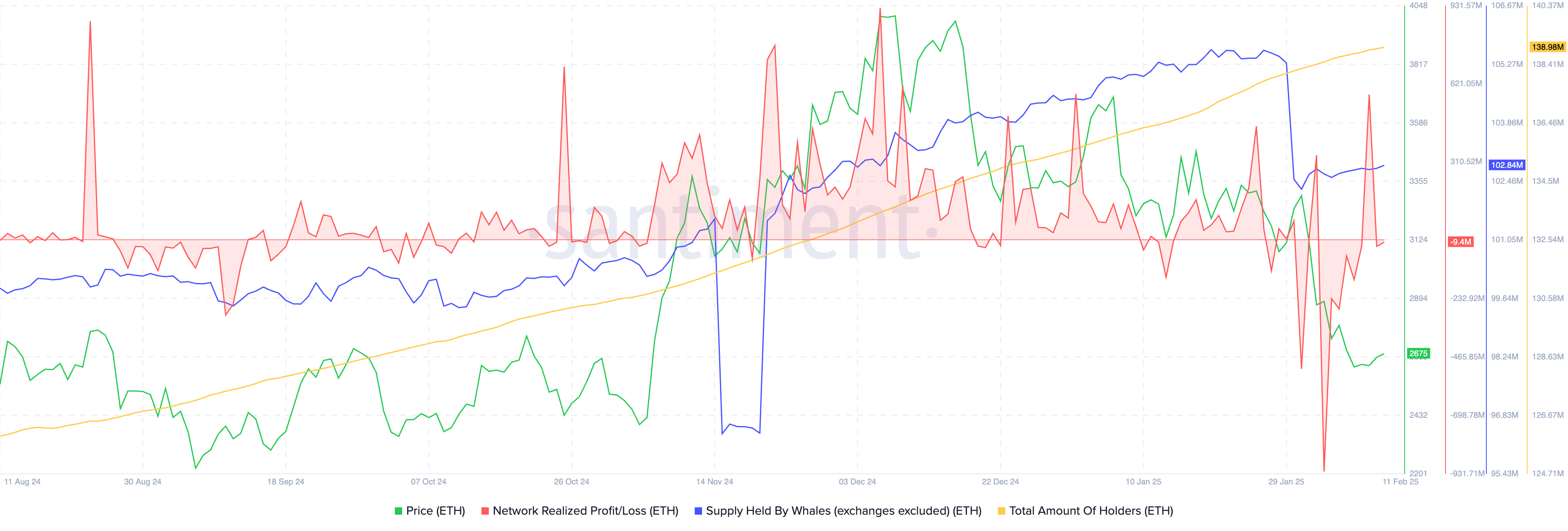

Ethereum’s holder rely has continued to rise steadily, in accordance with on-chain information from intelligence tracker Santiment. On Tuesday, the variety of Ethereum holders climbed to 138.98 million, marking a rise of almost 500,000 new Ether holders holders previously week. This helps a bullish thesis for the altcoin.

The Community realized revenue/loss metric, which measures the web revenue or lack of Ether tokens moved each day, confirmed massive damaging spikes between Jan. 30 and Feb. 8.

A lot of merchants promoting ETH at a loss is usually thought of an indication of capitulation. Ethereum merchants could also be exchanging their ETH for stablecoins or different cryptocurrencies, which might sign a possible value restoration within the close to future.

Ethereum provide held by whales or massive pockets buyers, excluding trade wallets has climbed by almost half one million ETH tokens in February 2025.

Ethereum on-chain metrics | Supply: Santiment

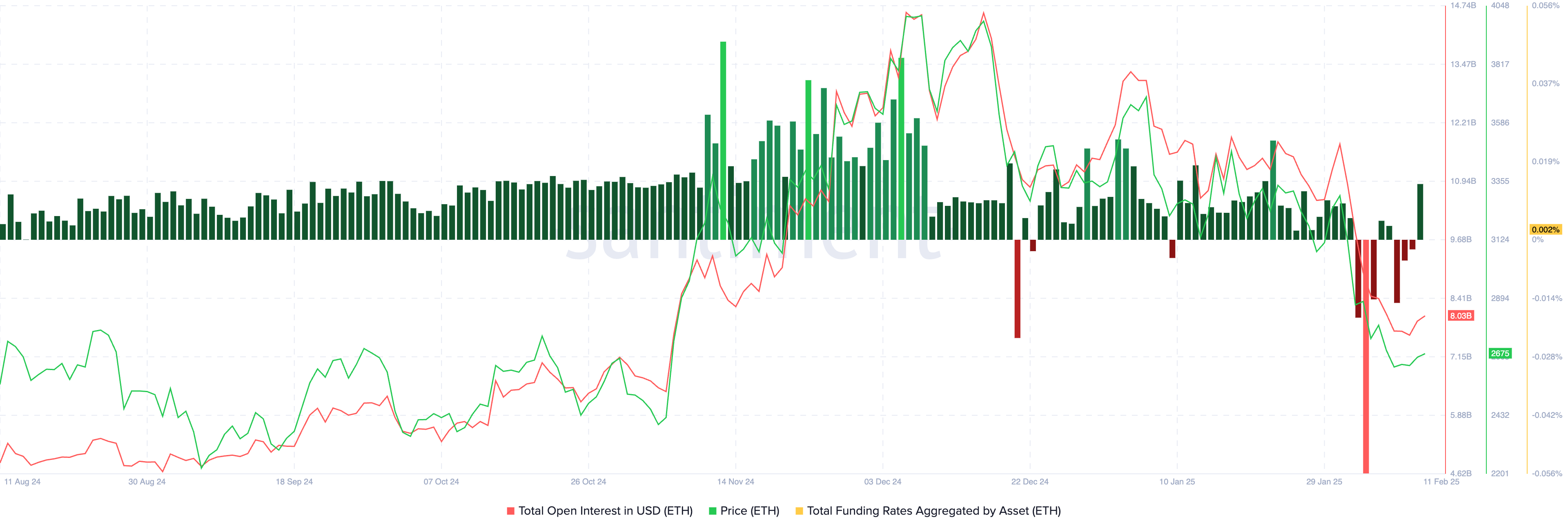

Metrics from derivatives merchants present the sentiment shifting in direction of “bullish.” The funding fee aggregated throughout derivatives exchanges turned optimistic, after a number of damaging spikes within the chart. The full open curiosity or worth of all open derivatives contracts in Ether climbed to $8.03 billion, in accordance with Santiment information.

Derivatives merchants anticipate a restoration in Ethereum value.

Ethereum on-chain metrics | Supply: Santiment

Whales accumulate Ether whereas establishments are indecisive: Bull case

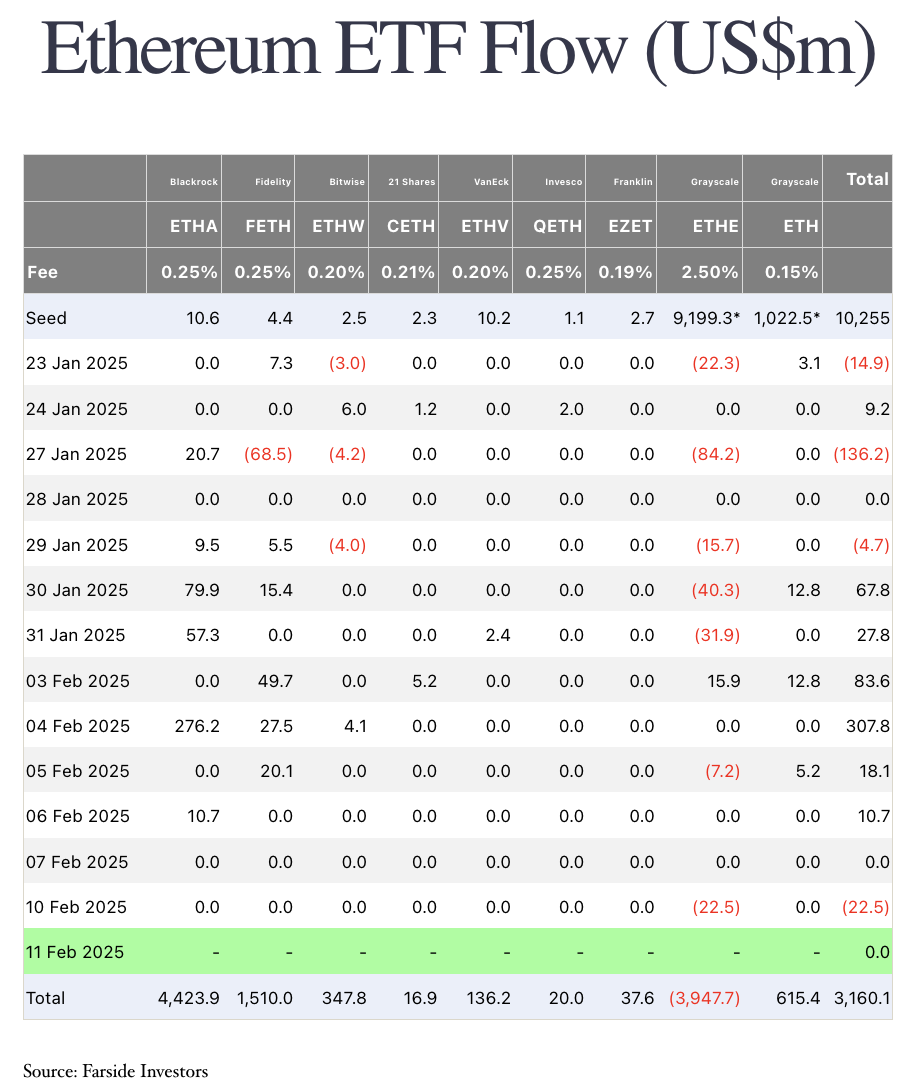

U.S. Spot Alternate Traded Fund flows from Farside Buyers exhibits no vital inflows or netflows to Ether ETFs previously 4 enterprise days. On Feb. 10, Ethereum ETFs recorded $22.5 million in outflows, as seen within the desk beneath.

Ethereum ETF Flows | Supply: Farside Buyers

Whereas whales off exchanges accumulate extra Ether, institutional curiosity in Spot Ether ETFs doesn’t present indicators of progress. This helps a bearish thesis for the altcoin and Ethereum probably faces an uphill battle in terms of institutional adoption, when in comparison with the most important cryptocurrency, Bitcoin (BTC).

Lookonchain information exhibits that institutional curiosity is slowly shifting with $514,000 in web inflows on the time of writing on February 11, Tuesday.

Feb 11 Replace:

10 #Bitcoin ETFs

NetFlow: +468 $BTC(+$45.49M)🟢#ARK21Shares inflows 614 $BTC($59.65M) and presently holds 51,867 $BTC($5.04B).9 #Ethereum ETFs

NetFlow: +193 $ETH(+$514K)🟢#InvescoGalaxy inflows 471 $ETH($1.25M) and presently holds 7,844 $ETH($20.9M).… pic.twitter.com/CSGOwE69H5— Lookonchain (@lookonchain) February 11, 2025

You may also like: Lido eyes new period for ETH staking with v3 improve

Specialists says Ethereum worth proposition is robust

Marcin Kazmierczak, Co-founder & COO of blockchain startup RedStone instructed Crypto.information in an unique interview:

“Whereas ETH’s value might fluctuate with broader market sentiment, its basic worth proposition stays remarkably robust. The community has advanced into a classy monetary ecosystem, processing over $30 billion in each day transactions throughout its Layer 2 networks like Arbitrum, Base, and zkSync.

Quick-term value actions usually overshadow the community’s rising adoption – from institutional participation in liquid staking to the scaling options dealing with tens of millions of each day transactions. This strong infrastructure and confirmed utility counsel Ethereum’s long-term trajectory is extra about ecosystem progress than momentary market reactions. Whereas a dip of ETH beneath $2k is feasible, it is dependent upon the broader crypto market’s volatility and the place negotiations land at this time.”

Staked Ether plateaus as institutional consideration is concentrated on Bitcoin: Bear case

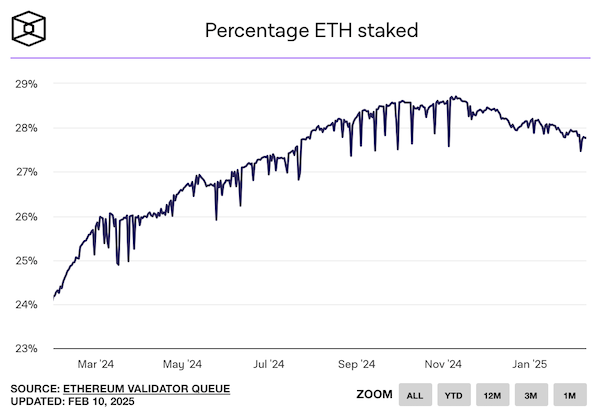

Knowledge from The Block exhibits that the proportion of ETH staked Ethereum’s staking contract has declined to 27%, returning to ranges final seen in July 2024. That is the primary notable drop since ETH staking peaked at 29%, reached in late 2024.

At the moment, 33.5 million ETH stays staked, making certain that the Ethereum community stays safe regardless of this decline.

Share Ether staked | Supply: Beaconcha.in

Ethereum is vital to the DeFi and NFT community it helps, even whereas establishments shift their focus to Layer 2 protocols or Bitcoin. The rising alternatives for incomes a yield and airdrops from Layer 2 chains throughout the ecosystem has probably resulted in merchants taking a measured method to Ether staking.

The shifting panorama of Ether staking due to this fact presents each alternatives and challenges for the community. The Ether ecosystem continues to evolve and the dynamics between staking charges, protocol dominance, and community safety probably affect each protocol growth and ETH holders’ habits.

You may also like: Crypto market could also be shifting past boom-bust cycles, Pantera Capital says

Ethereum long-term outlook is bullish

Ruslan Lienkha, Chief of Markets at YouHodler instructed Crypto.information in an unique interview:

“Whereas the short-term outlook for Ethereum seems bearish, a broader perspective reveals that its value is approaching a robust long-term help degree. This means that, regardless of present market weak spot, institutional buyers see a lovely entry level for long-term accumulation.

Traditionally, such accumulation by institutional gamers usually precedes a market restoration, as these buyers are inclined to take positions based mostly on long-term fundamentals slightly than short-term value fluctuations. Moreover, with different main cryptocurrencies having reached new all-time highs a number of occasions in current months, ETH could also be positioned for a major upward transfer as soon as market sentiment shifts.”