Ethereum (ETH) is exhibiting indicators of a possible restoration as market analysts predict a worth vary between $4,000 and $8,000 within the coming months. Technical patterns, on-chain knowledge, and institutional curiosity additional reinforce this outlook, indicating the token could also be making ready for a robust upward transfer.

Ethereum (ETH) Holds Above Key Assist as Analysts Predict Breakout

Ethereum has maintained a long-term ascending trendline regardless of current market volatility. In keeping with Crypto Common, the cryptocurrency has been respecting this trendline with no intentions of breaking under it anytime quickly, suggesting that the asset remains to be in a bullish construction.

But the token’s worth has been consolidating, however analysts consider it might quickly try to interrupt previous key resistance ranges. In the meantime, a chart shared by market analyst Ted exhibits that the ETH cryptocurrency has not too long ago damaged out of a symmetrical triangle sample, which traditionally alerts the beginning of an uptrend.

$ETH worst appears to be over.

Huge community upgrades are coming subsequent month together with the approval of staking options for Ethereum ETFs.

We’re only one god candle away from $4K.🚀 pic.twitter.com/sKcSsrXyqh

— Ted (@TedPillows) February 14, 2025

The analyst additionally identified that main community upgrades and the attainable approval of staking options for Ethereum ETFs might function catalysts for worth development. Because of this, Ted acknowledged that Ethereum is simply “one god candle away” from reaching $4K.

Key Resistance Ranges That Might Drive ETH Larger

The ETH token presently trades above $2,600, and analysts have outlined key resistance zones that might decide its subsequent transfer. As an illustration, the chart by Crypto Common marks $4,104, $4,110, $4,817, and $6,082 as important worth ranges. If Ethereum surpasses these resistance zones, the worth might speed up towards the upper vary of $6,000 to $8,000.

The cryptocurrency’s breakout from a long-term consolidation part strengthens the argument for an upward transfer. Analysts emphasize that the market construction stays bullish so long as ETH respects the trendline and holds key assist ranges.

On-Chain Information Reveals Rising Accumulation by Giant Holders

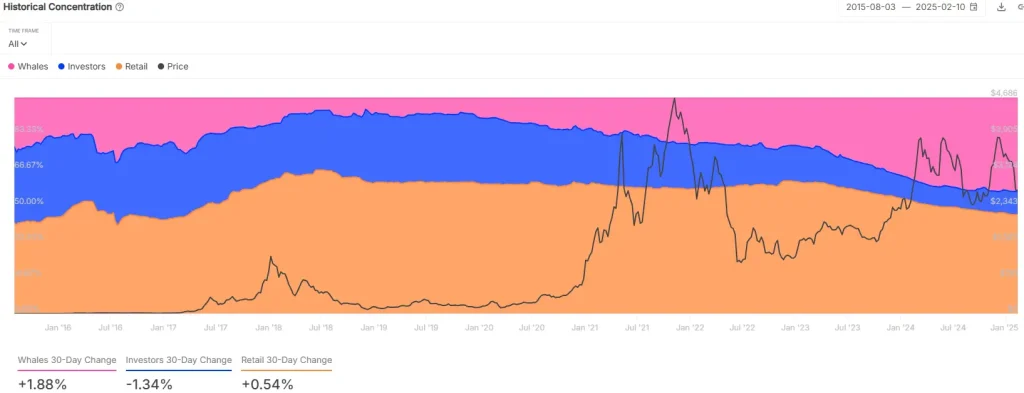

Ethereum’s Historic Focus knowledge exhibits that whales and retail buyers have elevated their holdings. As of February, whales management 43.61% of the ETH token provide, whereas retail buyers maintain 45.8%. Over the previous month, whale holdings have risen by 1.88%, whereas retail buyers added 0.54% to their holdings.

The International In/Out of the Cash metric signifies that 74.64% of ETH cryptocurrency holders are in revenue at present costs. The biggest accumulation zone is between $2,257 and $2,578, which suggests this vary is a robust assist space.