Ethereum Information: Can ETH Value Surge Previous $3K Subsequent?

1- NYSE Proposes Rule Change for Grayscale’s Spot Ether ETF Staking

The New York Inventory Trade (NYSE) has filed a proposal with america Securities and Trade Fee (SEC) to permit Ethereum staking in Grayscale’s upcoming Spot Ether ETF. This transfer might considerably affect Ethereum’s market dynamics by enabling the ETF to take part in Ethereum’s proof-of-stake community, probably producing staking rewards for buyers.

The proposal outlines the operational mechanics of the staking course of, emphasizing that rewards can be accrued however circuitously distributed as dividends. As an alternative, these rewards can be mirrored within the web asset worth (NAV) of the ETF shares. If authorised, this improvement might enhance institutional curiosity in Ethereum, additional solidifying its position within the decentralized finance (DeFi) ecosystem.

Key Factors:

→ Staking Proposal: NYSE requests permission to permit staking in Grayscale’s Spot Ether ETF.

→ Reward Allocation: Rewards mirrored in NAV with out direct payouts.

→ Market Influence: Elevated institutional participation anticipated if authorised.

2- Pectra Set to Launch on Ethereum Sepolia Testnet in March 2025

Ethereum’s ecosystem continues to broaden with the upcoming launch of Pectra on the Sepolia testnet, scheduled for March 5, 2025. Pectra goals to reinforce Ethereum’s scalability and person expertise, aligning with ongoing community upgrades like Ethereum 2.0.

The Sepolia testnet serves as a vital surroundings for testing new options earlier than mainnet deployment. Pectra’s integration is predicted to optimize transaction processing and assist broader adoption of Ethereum-based functions.

Launch Highlights:

◆ Date: March 5, 2025.

◆ Community: Sepolia Testnet.

◆ Focus: Scalability and efficiency enhancements.

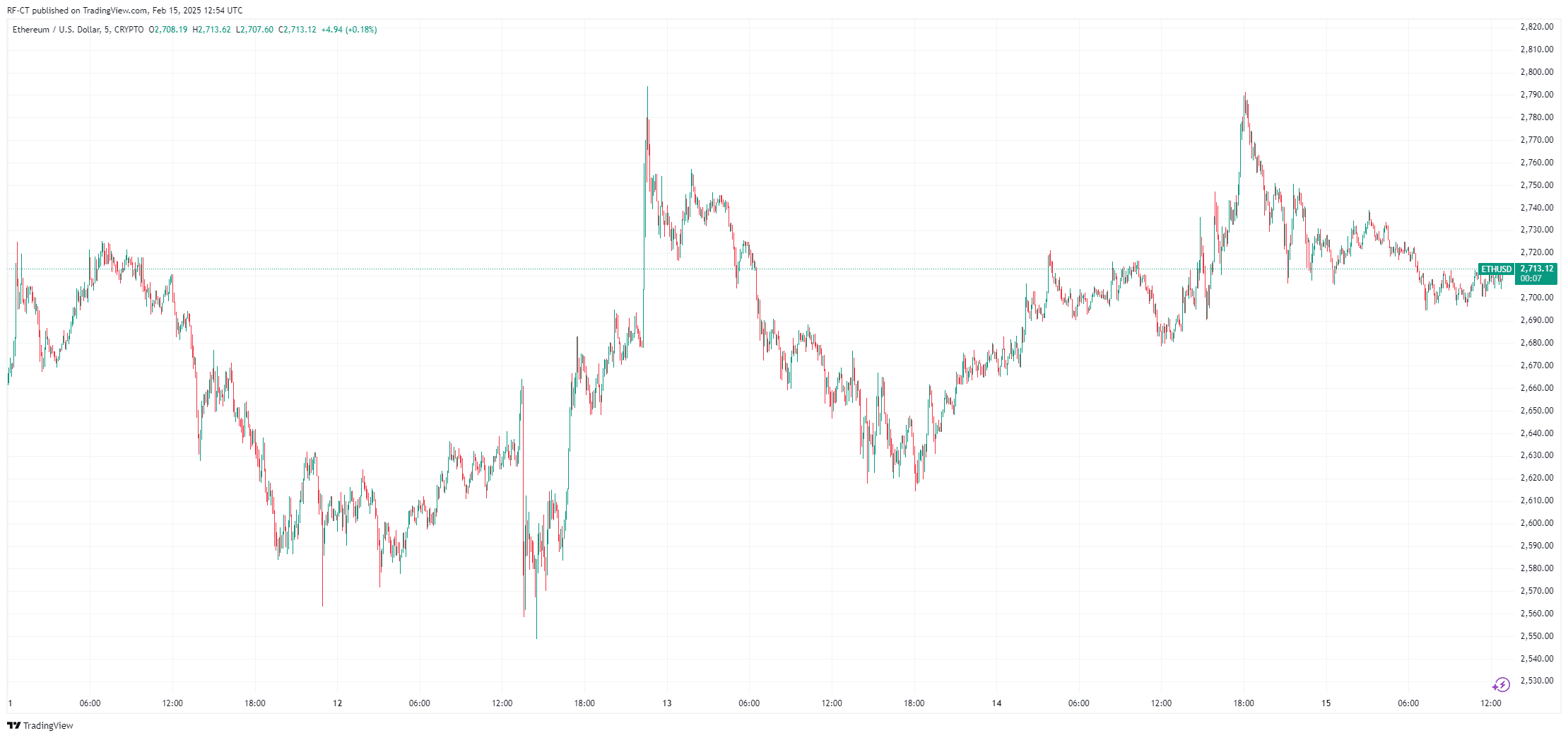

3- Ethereum Defends Vital Demand Zone Amid Market Uncertainty

Ethereum lately examined a crucial assist zone close to $2,200 however demonstrated resilience, sustaining its place above this degree. Technical evaluation signifies sturdy shopping for stress round this demand zone, suggesting bullish sentiment regardless of broader market volatility.

Analysts are eyeing a possible rally towards the $3,000 mark if Ethereum maintains its present momentum. On-chain metrics reveal a gentle influx of ETH into wallets, indicating accumulation by long-term holders.

Market Insights:

- Assist Zone: Robust protection on the $2,200 degree.

- Potential Rally: Eyes on $3,000 if momentum persists.

- Investor Conduct: Elevated accumulation by long-term holders.

By TradingView – ETHUSD_2025-02-15 (5D)

Ethereum’s Future Appears to be like Promising

Ethereum stays on the forefront of blockchain innovation, with regulatory developments, sturdy value assist, and ongoing technological upgrades driving its progress. The NYSE’s staking proposal might open new avenues for institutional buyers, whereas the upcoming Pectra launch alerts Ethereum’s continued dedication to scalability.

All whereas the ETH value defends its key zone, all appears promising, but the market volatility is taking its toll on all main cryptos regardless of final month’s highs. The quick time period could seem extremely unsure, however the lengthy one appeals extra promising.