BTC continues to commerce inside a good vary as buyers monitor the macroeconomic panorama and gauge conflicting market indicators.

Conflicting Market Pressures See BTC Stabilizing at $96.5K

Bitcoin (BTC) is sustaining a cautious upward trajectory, buying and selling at $96,540.34 on the time of reporting. This marks a modest 0.25% improve over the previous 24 hours and a 1.75% achieve over the previous week. Regardless of current fluctuations, BTC stays inside a comparatively slim vary, with a 24-hour value span of $93,388.83 to $96,695.38, signaling ongoing consolidation available in the market.

(BTC value / Buying and selling View)

Buying and selling Quantity Surges as Market Exercise Picks Up

Bitcoin’s 24-hour buying and selling quantity has seen a notable spike, rising 38.59% to $37.05 billion. This improve suggests rising participation from merchants, but the value stays constrained, reflecting a tug-of-war between bullish and bearish sentiment. In the meantime, bitcoin’s whole market capitalization stands at $1.91 trillion, up barely by 0.22% from yesterday.

“Bitcoin’s swift rebound after hitting a two-week low is consistent with the value inertia we’ve seen since December,” mentioned Neil Roarty, cryptocurrency analyst at Click on Out Media. “Each bulls and bears stay hesitant, and in consequence, bitcoin continues to commerce inside a comparatively tight band.”

Bitcoin Dominance Barely Slips as Altcoins Regain Floor

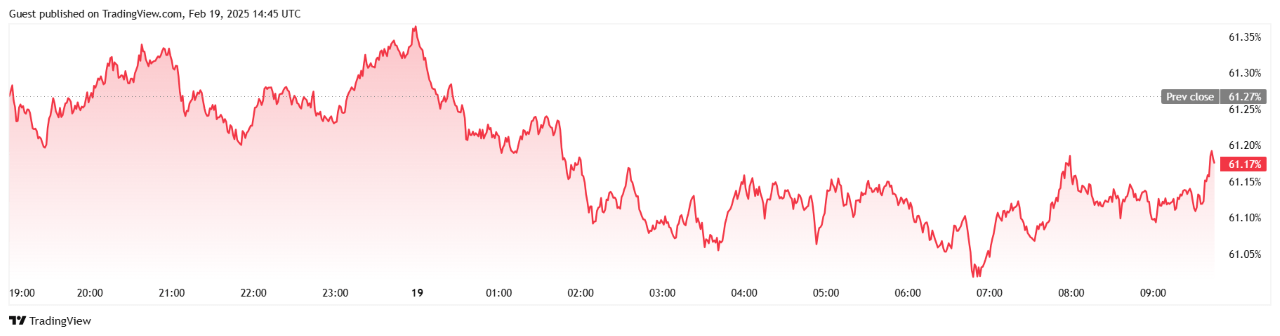

BTC’s market dominance has declined barely by 0.22% over the previous 24 hours, now standing at 61.12%, in keeping with Buying and selling View. This shift means that some capital is rotating into different cryptocurrencies, regardless of lingering detrimental sentiment within the broader market within the wake of the ever-deepening Libra memecoin debacle.

(Bitcoin dominance / Tradingview)

Futures Open Curiosity Rises, However Liquidations Spotlight Threat

Within the derivatives market, BTC futures open curiosity has climbed by 0.37% to $61.93 billion, in keeping with Coinglass, indicating a reasonable improve in speculative positioning. Nevertheless, liquidation information highlights continued volatility. Over the previous 24 hours, whole bitcoin liquidations reached $93.48 million, with lengthy positions accounting for $74.22 million and brief liquidations totaling $19.26 million. The imbalance means that overleveraged bullish merchants have confronted setbacks amid BTC’s uneven value motion.

Institutional Strikes Add to Market Uncertainty

Including to the market’s blended indicators, Technique introduced a proposed $2 billion personal providing of convertible senior notes yesterday, with proceeds probably earmarked for bitcoin acquisitions. As the most important company holder of BTC, Technique’s deliberate funding may inject additional shopping for stress into the market, counteracting current bearish sentiment.

“Detrimental sentiment in the direction of crypto following Milei’s questionable endorsement of the Libra memecoin has been balanced by information that bitcoin’s largest bull, Michael Saylor of the world’s largest company crypto holder Technique, is eyeing up additional purchases,” Roarty remarked.

Bitcoin Market Outlook

Bitcoin’s current value motion means that the market stays in a holding sample, with neither bulls nor bears capable of assert dominance. Regardless of elevated buying and selling exercise and institutional curiosity, BTC has but to interrupt decisively out of its multi-month vary.

“What’s it going to take to interrupt us out of this three-month holding sample?” Roarty requested. “In all probability a extra decisive dedication to rate of interest cuts from the Federal Reserve. Till then, anticipate bitcoin value motion to proceed ebbing and flowing,” he added.