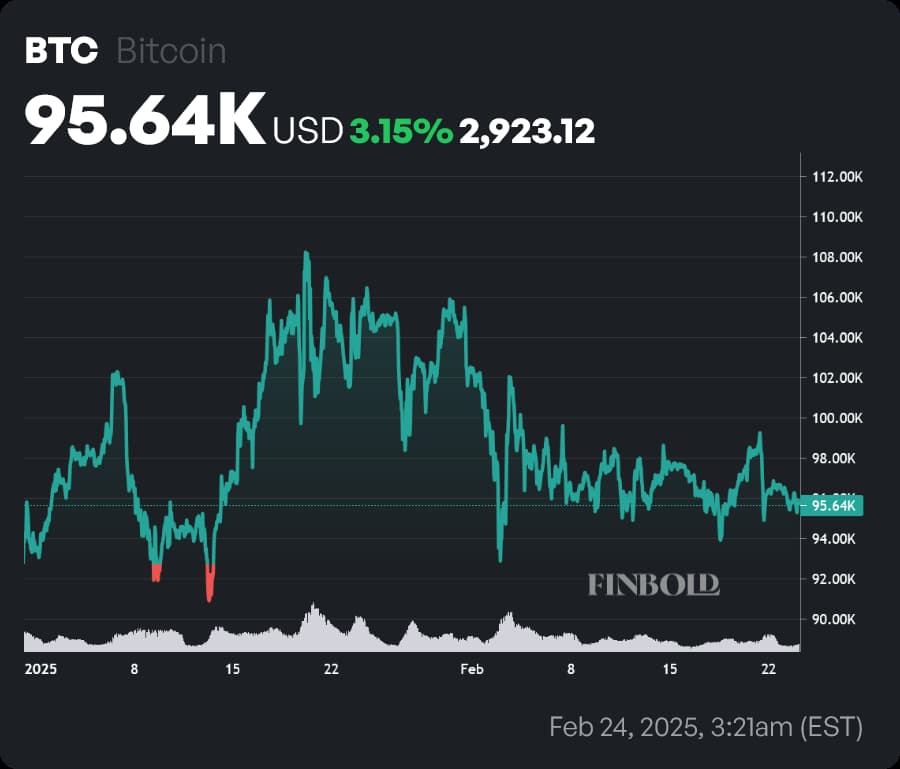

After the market-wide cryptocurrency bull run kicked off in November 2024, the upward trajectory of Bitcoin (BTC) stalled out in late December.

Though a renewed rally noticed a brand new all-time excessive (ATH) of $108,786 reached on January 20, costs managed to carry above the $100,000 mark simply till the tip of the month — when President Trump’s implementation of tariffs induced a market-wide selloff of danger property.

The main cryptocurrency has been buying and selling sideways since; though this time round, the extent of help has solidified larger than earlier than, at $96,500.

Investing $1,000 in Bitcoin at first of the yr would have netted buyers a comparatively modest return by February 24. On January 1, BTC was altering palms at a value of $92,880. Regardless of the standard uptick seen, that value level nonetheless represents fairly a gorgeous entry level when taking a look at the long run.

$1,000 invested in Bitcoin on January 1 would now be value 3% extra

On the entire, because the begin of the yr, the value of Bitcoin has elevated by 3.15%, as much as $95,640 at press time.

Accordingly, a $1,000 funding made at first of the yr can be value $1,031.5 on the time of publication — in different phrases, it might have made a $31.5 revenue.

Nevertheless, because the main digital asset started exhibiting important volatility as early as late December, discovering a extra enticing entry level wouldn’t have been notably laborious.

For the reason that starting of 2025, BTC has seen two important dips in value. The 2 troughs noticed costs attain low factors of $91,910 and $90,900 on January 9 and January 13, respectively.

Making a $1,000 funding at these value factors would have netted a 4.05% or 5.21% return — this could translate to an funding value $1,040.5 and $1,052.1 on the time of publication — or, in different phrases, a $40.5 and $52.1 revenue, respectively.

Readers ought to notice, nevertheless, that these are finally short-term snapshots of the premier cryptocurrency’s value motion. Whereas you will need to notice dissenting voices, analysts typically stay fairly bullish amid a backdrop of accelerating institutional adoption and a U.S. administration that’s largely seen as pro-crypto. As well as, as coated by Finbold, technical analysts have not too long ago outlined a case for a renewed surge to $107,000 — though it might more than likely entail one other dip to $91,000 earlier than bullish momentum resumes.

Featured picture through Shutterstock