Bitcoin is again below $96,000 because the crypto market begins the week on a bearish be aware. Is a downfall to $90k imminent this week?

Final week, Bitcoin confronted huge fluctuations, with a 7-day low at $93,340 and a excessive at $99,508. Regardless of the large fluctuation, BTC concluded the week at $96,262, with a surge of 0.14%.

In the meantime, the uncertainty within the BTC worth development takes a bearish shift in the beginning of this week. With an intraday fall of 0.57%, Bitcoin trades at a market worth of $95,714.

Moreover, final week’s cumulative weekly circulation within the Bitcoin ETF remained damaging. Amid such situations, will Bitcoin maintain above its essential help close to the $94,000 mark, or is a downfall imminent?

Bearish Stress Intensifies on Every day Chart

Within the day by day chart, the BTC worth development reveals a major bearish affect that dominates the worth development. At the moment, Bitcoin is above the $95,000 mark after rejection from the overhead development line.

Bitcoin Value Chart

Together with the overhead development line, the essential provide zone close to the $98,500 and the 50% Fibonacci degree influences the short turnaround. With short-term sustenance close to the $95,000 mark, the BTC worth development hints at a possible comeback.

Supporting bullish probabilities, the cash circulation index reveals a surge in influx because it takes a bounce again from the oversold area. At the moment, BTC costs present a 0.26% surge up to now 4 hours, with a number of low-price rejections close to the $95,000 mark.

BTC is more likely to rechallenge the 38.20% Fibonacci degree at $96,703. If a bullish breakout happens, the uptrend will first rechallenge the overhead development line, leading to 4 bearish reversals.

A profitable breakout may push BTC towards the $98,500 provide zone close to the 50% Fibonacci degree.

Conversely, a breakdown of native help on the $95,000 mark will take a look at the 23.60% Fibonacci degree at $94,393. Additional, it is going to enhance the probabilities of a fast revisit to the $90k psychological help.

Bitcoin ETFs Witness Large Outflows

In line with a current tweet by SpotOnChain, U.S. spot Bitcoin ETFs noticed an enormous outflow of $552.5 million final week. There have been outflows on all 4 buying and selling days, throughout which BTC costs dropped by almost 8%.

This decline resulted in a weekly Doji candle, indicating market uncertainty.

Will March Set off a Bullish Comeback for Bitcoin?

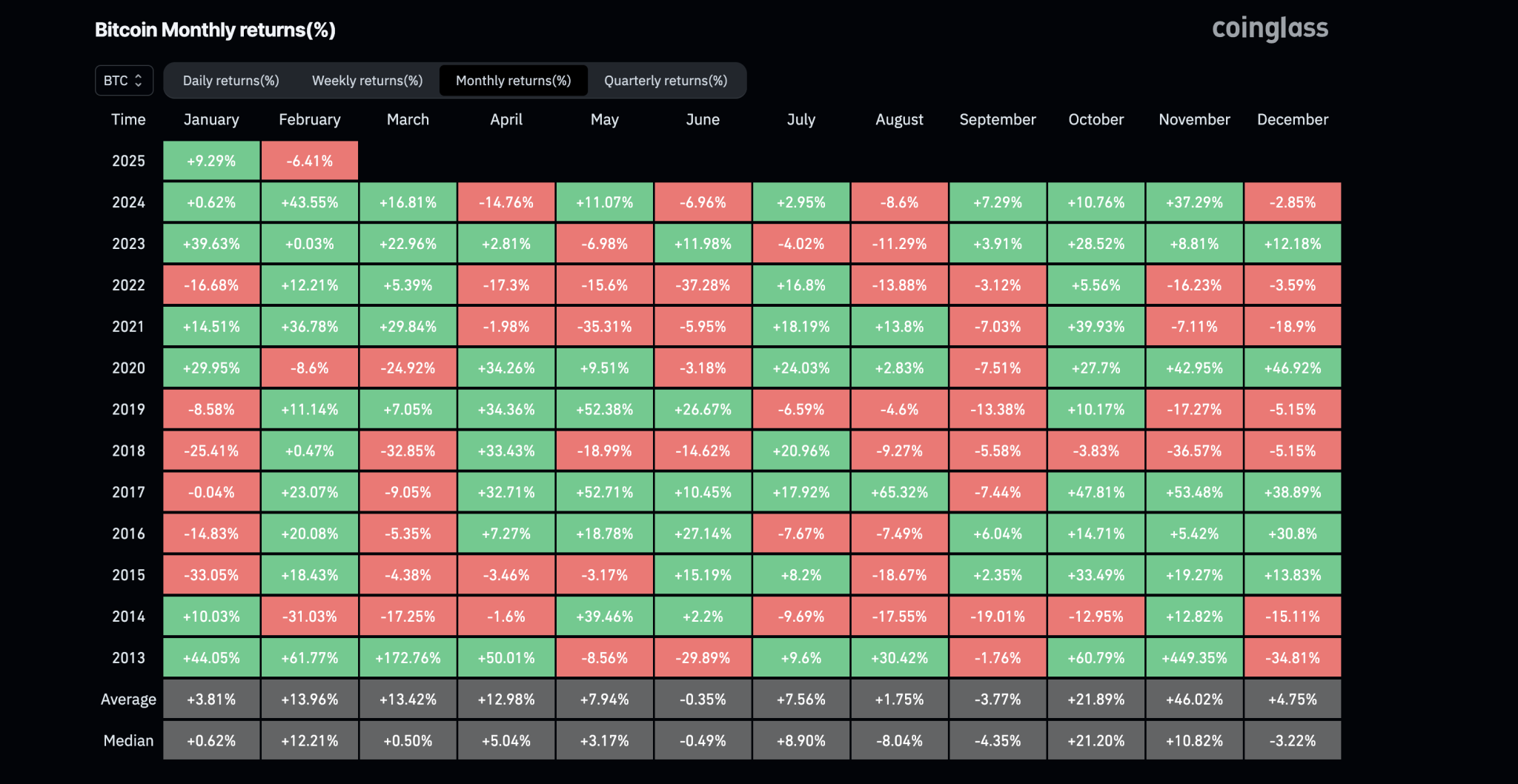

Regardless of the continued downfall, Bitcoin’s worth will seemingly make a bullish comeback subsequent month. As per Coinglass, over the previous 4 years, Bitcoin recorded vital returns in March.

Bitcoin Month-to-month Returns

If the bullish development continues, the upcoming month may witness a bullish spree with a breakout of the 50% Fibonacci degree. A breakout above the 50% Fibonacci degree may open doorways for additional good points, focusing on the 78.60% Fibonacci degree at $103,393 and the provision zone close to the $108,000 mark.