Ethereum’s value motion has been risky in current weeks, however the asset encountered a big resistance zone.

With robust promoting stress doubtless at this stage, a rejection adopted by a short-term decline seems possible.

Technical Evaluation

By Shayan

The Each day Chart

ETH lately discovered assist on the vital $2.5K stage and has since jumped towards the $3K area, revisiting the beforehand damaged trendline of the descending wedge. Nonetheless, this upward motion seems to lack momentum, resembling a pullback reasonably than a sustained restoration.

Notably, the $3K area coincides with the 200-day transferring common, reinforcing it as a robust resistance stage the place important promoting stress could emerge. Given this confluence, the chance of rejection is excessive, probably main to a different bearish transfer. If sellers regain management, Ethereum might decline additional, with the $2.5K stage remaining the first draw back goal within the mid-term.

The 4-Hour Chart

On the 4-hour timeframe, ETH’s current bullish retracement is clear as the value inches nearer to a key resistance zone. This space consists of the decrease boundary of the beforehand damaged wedge and aligns with the 0.5 ($2.7K) and 0.618 ($2.9K) Fibonacci retracement ranges—each of which traditionally act as robust resistance zones.

With promoting stress doubtless concentrated inside this vary and bullish momentum showing weak, Ethereum could wrestle to interrupt greater. If rejection happens, the value might reverse towards the $2.5K assist stage, the place a vital provide zone awaits.

Onchain Evaluation

By Shayan

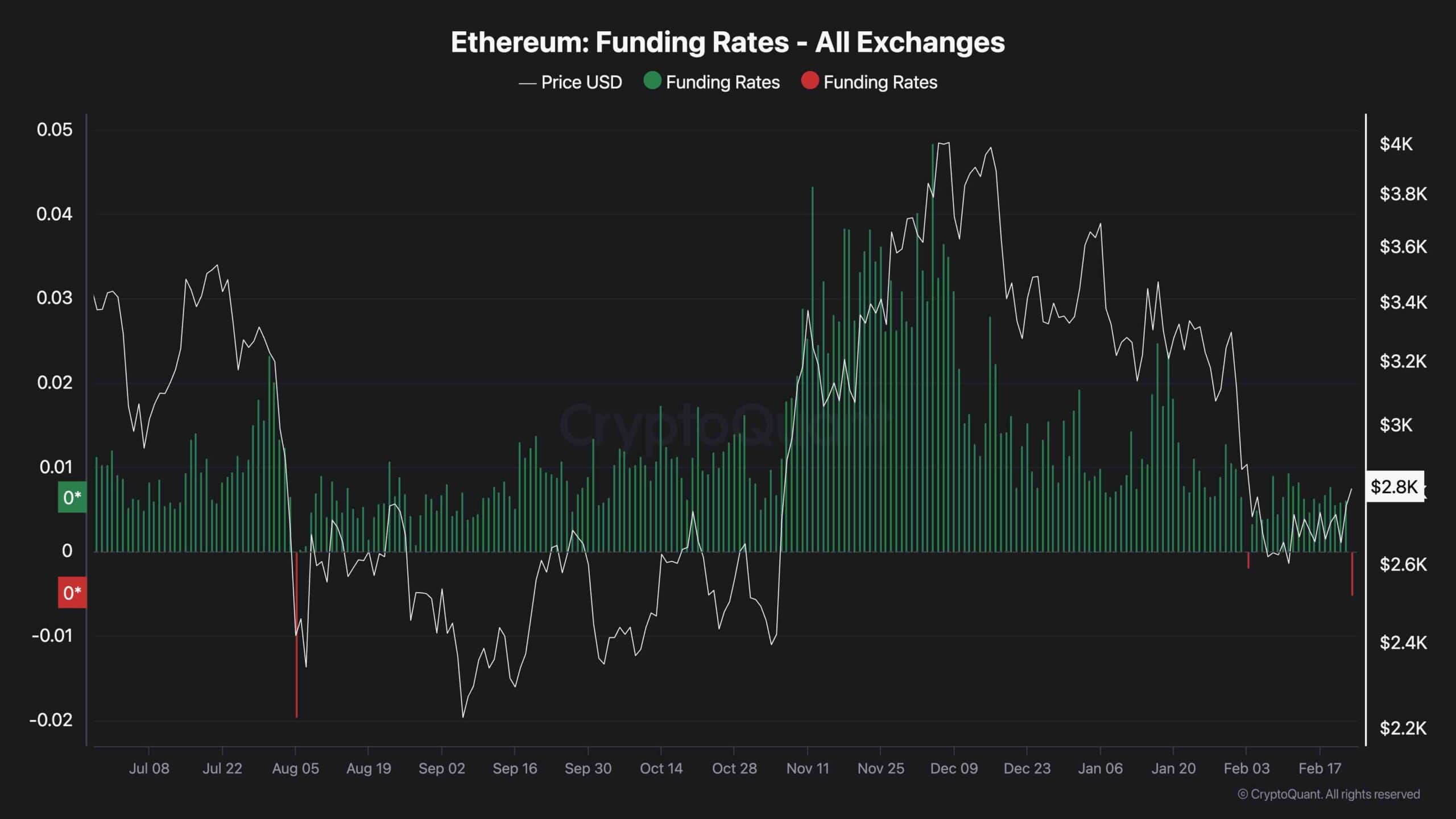

The current Bybit hack has raised issues amongst market members about its potential impression on value tendencies. An important metric to observe on this context is the funding price, which displays the urgency of patrons and sellers in executing trades.

As illustrated within the chart, funding charges have skilled a pointy decline through the newest market turbulence, even turning destructive. This drop suggests heightened promoting stress and fear-driven exercise in response to the hack. If this development persists, notably with continued resistance on the $3K stage, additional declines might observe, with sellers eyeing $2.5K as the following main assist.

Traditionally, such steep drops in funding charges typically result in a section of sideways consolidation with elevated volatility. On this case, the $2.5K–$3K vary might act as the first buying and selling zone till market sentiment stabilizes.