Blockchain and Crypto have a sophisticated standing in China: Beijing says no to crypto however sure to blockchain. It bans buying and selling but builds infrastructure.

Now, with Hong Kong providing regulated crypto markets, insiders say a loophole is rising.

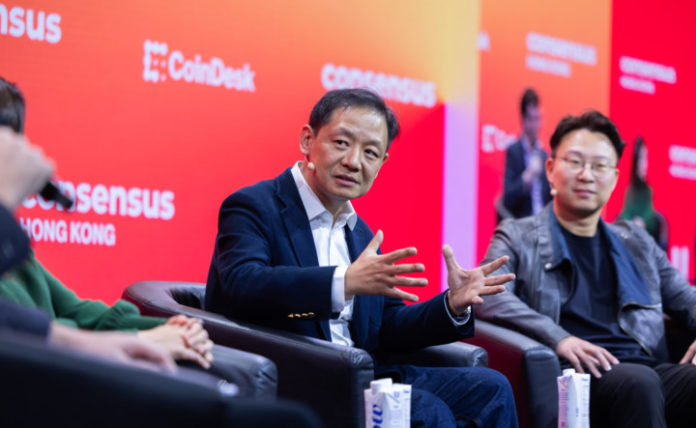

If China already permits traders to purchase U.S. shares by its Certified Home Institutional Investor (QDII) program, why not bitcoin? The important thing, one knowledgeable argued on stage at Consensus Hong Kong, is management, and Beijing might have simply discovered a method to preserve it.

In China, there are two programs for mainland traders to purchase and promote inventory exterior China. First, there’s QDII, which permits choose traders to purchase U.S. ETFs utilizing RMB.

Then there’s additionally the Shanghai-Hong Kong Join and Shenzhen-Hong Kong Join, which let Chinese language traders purchase and promote Hong Kong shares by mainland securities companies, with all trades settled in RMB.

“The important thing [with these systems] is that capital by no means flows freely out of China, and if you happen to apply this identical logic to crypto, there’s no purpose it couldn’t work the identical means,” Yifan He, CEO of Purple Date expertise, mentioned on stage at Consensus Hong Kong.

He emphasised that the largest regulatory hurdle isn’t crypto itself, however capital controls, guaranteeing that funds don’t transfer freely out and in of China.

These capital controls are in place as they stop extreme foreign money fluctuations and capital flight, to be able to keep the steadiness and worth of the RMB. They’re additionally one of many the explanation why Hong Kong’s crypto ETFs, with their in-kind redemptions, weren’t allowed on the mainland.

“What’s the distinction between a Hong Kong-regulated inventory and a Hong Kong-regulated crypto asset?” He continued. “If they’ve a system so that you can purchase and promote in RMB, however by no means transfer cash exterior China, then it is simply one other regulated funding product.”

This technique wouldn’t permit Chinese language traders to self-custody their crypto. As an alternative, purchases can be held by an middleman, equivalent to a licensed securities agency.

“They purchase crypto straight, however it’s not like they’re holding it themselves,” He mentioned. “The safety firm within the center really holds it for you.”

This mannequin aligns with China’s method to inventory and ETF investments.

Simply as mainland traders can commerce U.S. ETFs by QDII however by no means take direct custody, they might acquire publicity to crypto with out proudly owning the underlying belongings – no cash strikes throughout borders.

For a nation with 200 million retail traders and an financial system in want of stimulus, regulated crypto entry by Hong Kong’s sandbox may provide Beijing a calculated compromise

Blockchain vs. Crypto

China has lengthy been a proponent of blockchain expertise, whereas taking a chilly method to crypto.

“We do not permit weapons in China, however we are able to nonetheless make metal,” He defined as an analogy. “The expertise shouldn’t be regulated to be able to construct all types of purposes. However when some utility triggers rules, that’s totally different.”

However based mostly on his conversations with monetary regulators, this might be altering.

“I see some sign from monetary regulators,” He mentioned. “They’re starting to speak about Bitcoin, saying we have to pay extra consideration and do extra analysis on digital belongings.”

Might this result in broader adoption? Two years in the past, He would have mentioned ‘zero probability.’

“Now, I’d say there’s greater than a 50% probability in three years,” He concluded.

And you’ll take these odds to Polymarket.