In response to the newest knowledge, Bitcoin’s hashrate has dipped beneath the 800 exahash per second (EH/s) threshold, coinciding with a 30-day low in mining income, generally known as hashprice. As of Friday, the hashprice is hovering just under $50 per petahash per second (PH/s), marking a notable decline in miner profitability.

Bitcoin Miners Really feel the Pinch

Bitcoin’s descent beneath the $80,000 threshold on Thursday proved lower than superb for miners, as their earnings took a big hit. As of now, with bitcoin (BTC) climbing again above $83,000, the hashprice—or the estimated worth of 1 PH/s—has seen a slight restoration however stays at its lowest stage since Jan. 28.

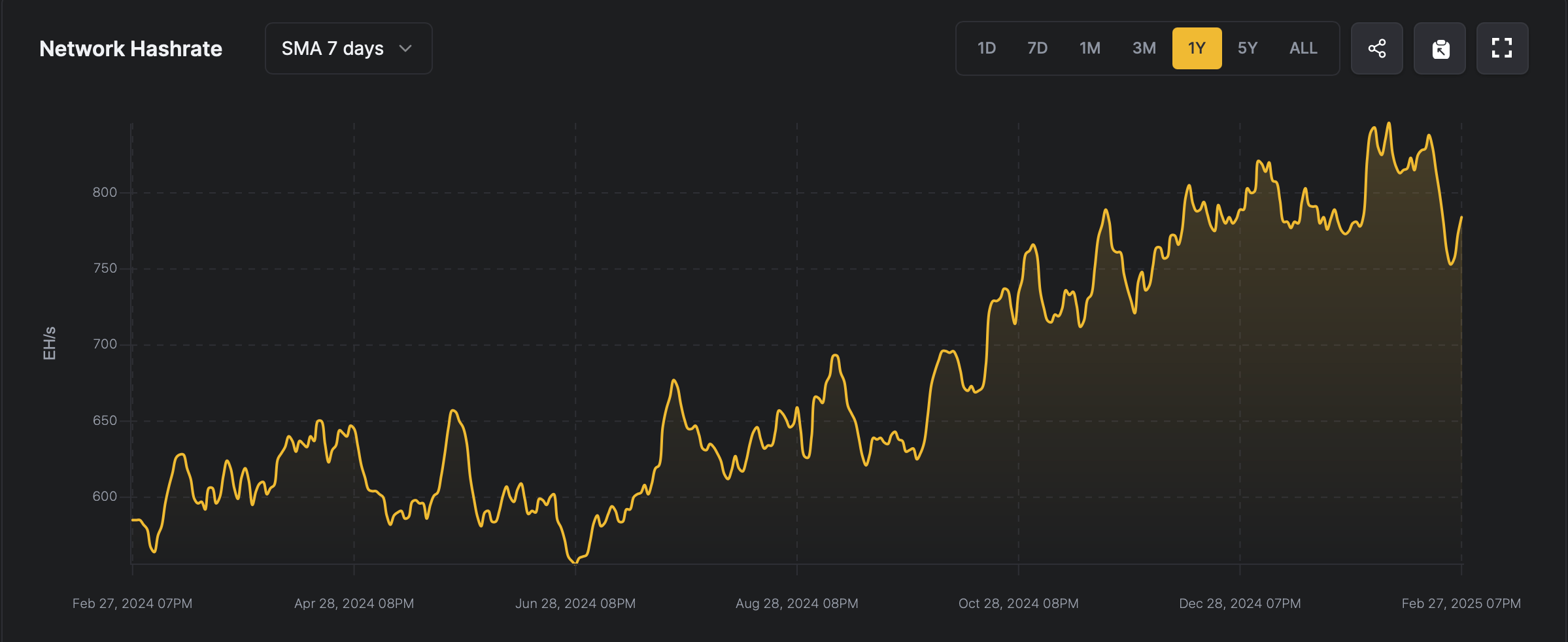

Bitcoin hashrate by way of hashrateindex.com

On Thursday, the hashprice dipped to $45.41 per petahash, and as of three:30 p.m. Jap Time on Friday, it has inched as much as $48.65 per petahash. Simply 30 days in the past, the hashprice was a extra favorable $60.19 per PH/s, highlighting the current challenges confronted by BTC miners. Bitcoin’s hashrate additionally skilled a big peak in February, climbing to 852 EH/s on Feb. 7, 2025.

Nevertheless, with the present price at 799 EH/s, the community has shed over 50 EH/s of its computational power, marking a noticeable shift in processing capability. The discount in hashpower coincides with a 3.15% decline in Bitcoin’s issue, which occurred 5 days in the past on Feb. 23 at block top 885,024. Presently, the community issue rests at 110.57 trillion, with the subsequent adjustment anticipated to happen on March 9.

Whereas official metrics stay incomplete as Feb. 28 has not but concluded, it seems bitcoin miners have extracted much less worth this month in comparison with January. In response to knowledge gathered from theblock.co, miners generated $1.4 billion from block subsidies and charges final month. Nevertheless, this month’s tally stands at $1.21 billion, with simply three hours and 20 minutes left earlier than February attracts to a detailed.