The worth of bitcoin (BTC) plunged to $82,618 per coin as of 9 p.m. Jap Time on Monday, marking a major downturn within the broader cryptocurrency market. The overall crypto financial system has contracted by greater than 12% towards the U.S. greenback, now valued at $2.72 trillion.

Bitcoin, Ethereum, and Solana Endure Heavy Losses as Promote Stress Mounts

Bitcoin and its digital asset counterparts endured a turbulent session, with world commerce quantity reaching $175.84 billion—over 4% decrease than the day prior to this, with a predominant share pushed by sell-offs. BTC’s worth bottomed out at $82,618 in the course of the previous 24 hours, and by 9 p.m. ET, it had edged up barely to $83,634. Of in the present day’s complete world buying and selling exercise, $72.86 billion will be attributed to BTC quantity alone.

BTC/USD by way of Bitstamp on March 3, 2025.

BTC has declined by 10.5%, whereas ethereum (ETH) has taken a steeper fall of 16.5%. Shut behind, XRP has depreciated by 18.7% towards the U.S. greenback. BNB has slipped by 10.2%, whereas solana (SOL) has suffered a good sharper decline at 21.3%.

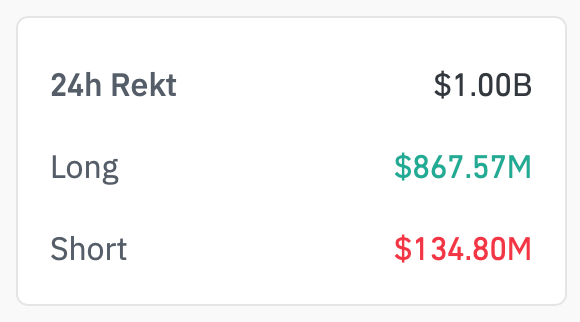

Supply: Coinglass on March 3, 2025, at 9 p.m. ET.

Nonetheless, the losses for cardano (ADA) have been much more pronounced, with a 27.4% drop, whereas meme coin dogecoin (DOGE) shed 17.5%. Among the hardest-hit property have been additionally meme cash, with SNEK, MOG, and AI16Z plummeting by 29.29%, 28.24%, and 27.59%, respectively.

POPCAT, TRUMP, and PNUT additionally recorded double-digit losses exceeding 20%. The sell-off was so intense that crypto derivatives platforms noticed $1 billion in liquidations. Of this, $867.87 million got here from lengthy positions, with BTC derivatives alone accounting for $310.55 million in liquidations over the past day. Vital liquidations additionally occurred in ETH, SOL, XRP, and ADA positions.