In style stablecoin fee app Wirex has lately expanded to the US market. The app will enable US residents to make use of their stablecoins for every day transactions through Visa Playing cards.

Like Wirex, many different Web3 platforms are more and more seeking to enter the American market as lawmakers are pushing for regulatory readability for stablecoins.

Utilizing Stablecoins For Everday Purchases Throughout 80 Million Retailers

Wirex’s entry into the US market is supported by its collaboration with Bridge, a number one stablecoin fee infrastructure supplier.

Via this partnership, Wirex Pay permits customers to transact immediately from non-custodial wallets utilizing playing cards and financial institution transfers whereas sustaining full management of their belongings.

“Whereas regulatory readability is at all times useful for innovation, our growth into the US market is primarily pushed by rising shopper demand for stablecoin funds and the growing adoption of digital belongings for on a regular basis transactions,” Wirex co-founders Pavel Matveev and Dmitry Lazarichev advised BeInCrypto.

Earlier in 2024, US fee large Stripe acquired Bridge in a landmark $1.1 billion deal. With Wirex’s growth, US shoppers can now use stablecoins at over 80 million Visa-accepting retailers throughout 200 nations.

Wirex Pay’s co-founder highlighted the US as a key market on account of its massive base of energetic crypto customers. They anticipate robust adoption in 2025 as stablecoins achieve wider acceptance.

This transfer is predicted to drive greater transaction volumes and contribute considerably to income progress.

“Whereas it’s too early to offer actual projections, we’re assured that Wirex Pay’s US launch will likely be a key progress driver for our firm within the coming years,” the Co-Founders mentioned.

Regulatory Developments Shaping the US Stablecoin Market

US lawmakers are more and more targeted on stablecoin rules, which may speed up market progress.

In February, CFTC Commissioner Caroline Pham introduced a CEO Discussion board to develop crypto rules, strongly emphasizing stablecoins.

Main trade gamers, together with Circle, Coinbase, and Ripple, are collaborating in discussions to assist form insurance policies via a regulatory framework.

In the meantime, Financial institution of America can also be monitoring developments intently. CEO Brian Moynihan acknowledged that the financial institution may introduce a stablecoin if favorable rules are enacted.

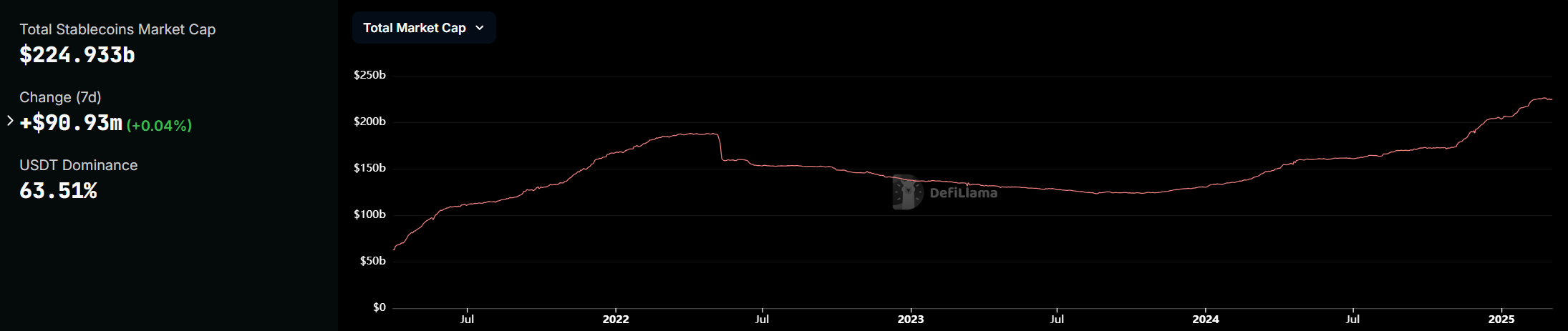

Additionally, the stablecoin market lately surpassed a document $225 billion market cap. Regulatory readability may push adoption additional.

Stablecoin Market Cap. Supply: DefilLama

Finally, this might assist combine stablecoins extra deeply into mainstream finance. Extra web3 companies will seemingly look to develop into the US market as regulatory developments proceed to unfold.