In a newly printed chart, Elliott Wave specialist and crypto analyst Large Mike (@Michael_EWpro) outlines a exact roadmap for Bitcoin’s value motion, indicating {that a} break above $95,000—or a bounce from decrease assist close to $72,895—might propel BTC towards the $130,000–$140,000 area. His evaluation builds on detailed wave counts, a number of Fibonacci extension targets, and important shifting averages, providing a granular take a look at the BTC’s near- and mid-term prospects.

What’s Subsequent For Bitcoin?

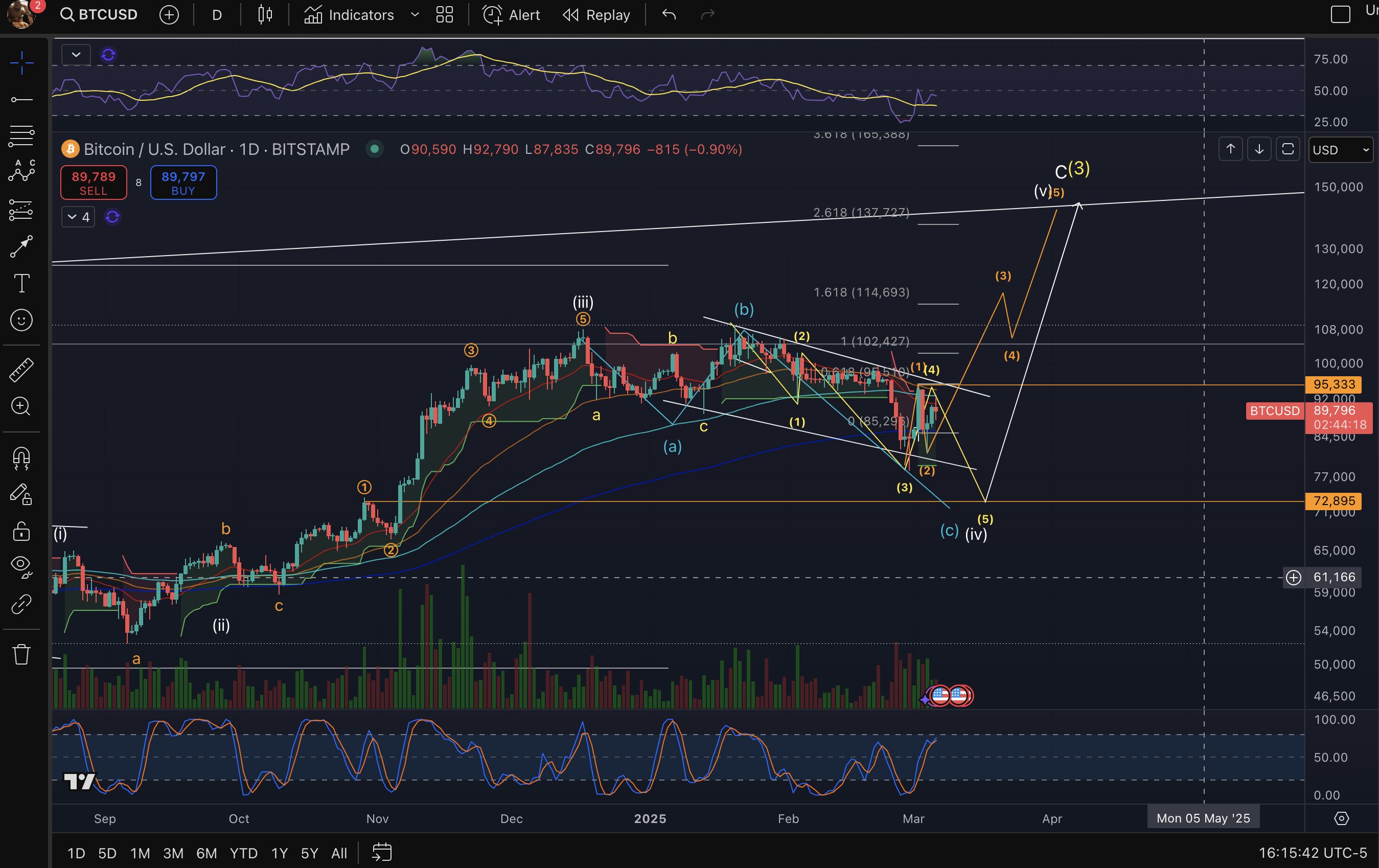

Large Mike’s chart shows a fancy Elliott Wave construction consisting of 5 primary impulse waves and interspersed corrective sub-waves. A key space labeled close to $72,895 corresponds to wave (c)(iv), representing a significant potential backside if the market breaks under $78,000 and continues decrease.

Notable corrective waves round $85,000 to $95,000 seem to have shaped a bigger consolidation section, which he regards as a precursor to the subsequent directional transfer. The chart additionally pinpoints an upside pathway from roughly $95,000, projecting impulse waves (3), (4), and (5) that reach into the $100,000–$140,000 zone.

Fibonacci extension targets seem at roughly $114,693 (1.618 extension) which may very well be the goal for wave (3), adopted by a corrective transfer to $102,000 earlier than beginning wave 5 which goals for $137,727 (2.618 extension), or perhaps a closing leg close to $150,000 aligns with wave c(3).

Transferring averages within the $72,000–$90,000 vary underscore the importance of assist close to $78,000–$72,895, whereas an higher band round $90,000–$95,000 represents an important resistance hall. The analyst observes a descending wedge formation from mid-February to early March, spanning $95,000 right down to $85,000, and notes that an upside breakout might herald a renewed push into six-figure territory.

Quantity profiles point out subdued participation throughout latest corrective phases, alongside a impartial Stochastic RSI studying that implies momentum might shift decisively relying on which value threshold provides approach first.

Large Mike emphasizes two important traces within the sand: “BTC above $95k will set off the transfer shortly in the direction of my goal of $130-$140k. Under $78k and we check $72k, then run to $140k.” From his perspective, each a direct break above $95,000 and a deeper dip to $72,895 in the end converge on the identical upside goal close to $130,000–$140,000.

At press time, BTC traded at $90,053.

Featured picture created with DALL.E, chart from TradingView.com