- The value of Bitcoin continues to develop its vary earlier than probably exceeding $108K because it goals in the direction of $150K.

- A worth rise to $150K would most likely draw extra institutional funding to facilitate higher market development.

- The value motion of Bitcoin will proceed primarily based on macroeconomic components together with resistance obstacles to find out its long-term development prospects.

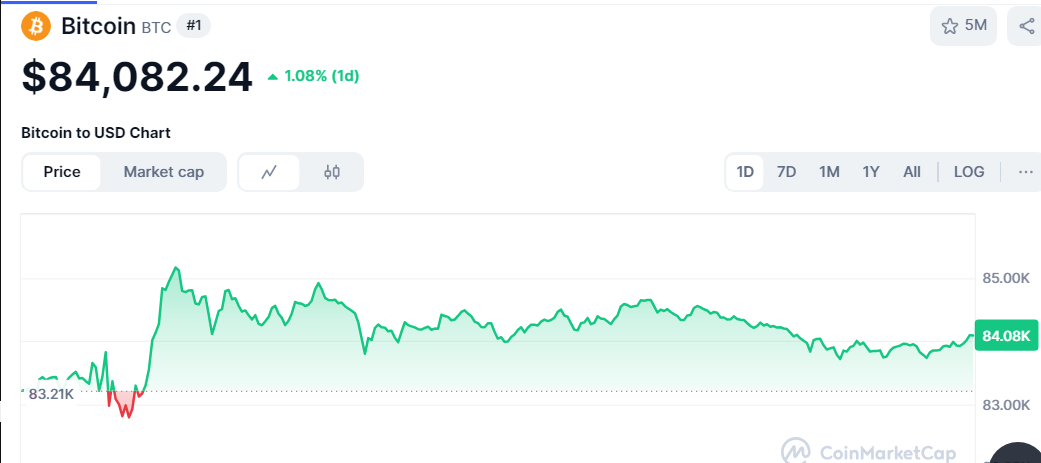

Bitcoin’s worth has been consolidating inside a broadening wedge sample, hinting at a possible breakout. The most recent market information signifies Bitcoin buying and selling at $84,082.24, marking a 1.08% enhance over the previous 24 hours. With the worth fluctuating between $82,705.87 and $85,139.55 in the identical interval, analysts intently watch resistance and help ranges to foretell the subsequent transfer.

Supply:Coinmarketcap

The value of Bitcoin reveals repeated exams towards help and resistance boundaries whereas the buying and selling boundaries have widened.If Bitcoin exceeds the necessary resistance zone at $108,000 it could expertise a serious worth surge based on chart evaluation.

Market Tendencies and Key Indicators

In response to CryptoGoos,with the Bitcoin broadening wedge, BTC will possible transfer previous $150,000. Current worth exercise reveals a descending development that discovered help round $78,500 earlier than rebounding. Bitcoin has been forming larger lows, signaling elevated purchaser confidence. If shopping for strain continues, a breakout above $108,000 might result in a sustained rally.

BITCOIN BROADENING WEDGE! 🚨

The value goal is $150,000🚀 pic.twitter.com/1crVCyxNtf

— CryptoGoos (@crypto_goos) March 15, 2025

Nevertheless, failure to interrupt this degree could end in worth consolidation or retracement. BTC present buying and selling quantity is $27.77B, a 4.9% decline. A surge in buying and selling quantity and a rise in bullish momentum might validate the projected worth motion.

Institutional Surge & Market Affect Forward

A rise of Bitcoin to $150,000 would drive further institutional capital alongside broader market acceptance. The robust worth rise will have an effect on all the cryptocurrency market alongside altcoins and decentralized finance (DeFi) initiatives.The crypto trade could witness heightened regulatory consideration if volatility will increase considerably.

Quick-term market corrections will possible happen if momentum loss occurs as a result of costs will check help areas. Buyers ought to monitor macroeconomic indicators together with inflation charges together with financial insurance policies and worldwide financial tendencies affecting Bitcoin’s evolution.

Bitcoin reveals worth alerts which point out potential breakout potential as analysts predict the worth will attain $150,000. By observing each market indicators and resistance ranges will permit merchants to foretell the upcoming vital market motion.