Crypto by no means sleeps, however you do. And that’s an issue if you wish to experience each market wave efficiently. One second, you’re making espresso; the following, the market flips, and also you miss the proper commerce. Guide buying and selling could be worrying, emotional, and exhausting. That’s the place AI buying and selling bots are available. They watch the market, execute sensible strikes, and keep on with the plan, so that you don’t should. It’s time to be taught extra about them. This information particulars the completely different AI buying and selling bot providing on Bitget, a prime centralized trade. Right here’s what to know.

On this information:

- What are AI buying and selling bots?

- How do AI buying and selling bots work?

- Forms of AI buying and selling bots on Bitget

- Bitget’s fundamental buying and selling bots: When to make use of them and the way

- Bitget’s superior buying and selling bots: When to make use of them and the way

- Why use AI buying and selling bots?

- AI buying and selling bot dangers

- Are Bitget’s AI buying and selling bots value it?

- Continuously requested questions

What are AI buying and selling bots?

AI buying and selling bots are automated applications that analyze market developments, execute trades, and optimize methods — all with out human intervention. On Bitget, these bots assist merchants capitalize on alternatives 24/7 with out feelings, hesitation, or burnout.

How do AI buying and selling bots work?

Consider AI buying and selling bots as algorithmic merchants that observe predefined guidelines, reacting to the market sooner than any human may. Relying on the kind of bot, they use technical indicators, market developments, or predefined methods to make calculated strikes.

So how do these bots get entry?

AI buying and selling bots, together with these on Bitget, function immediately inside the platform. This implies you don’t must grant exterior entry or arrange API keys. While you activate a bot, it reserves funds out of your Spot or Futures Pockets, utilizing these funds to position orders (purchase or promote) primarily based in your strategic preferences.

Forms of AI buying and selling bots on Bitget

- Spot Grid bots – Purchase low, promote excessive inside a set value vary. Splendid for sideways markets.

- Futures Grid bots – Similar as Spot Grid, however for futures buying and selling with leverage. Greater danger, increased reward.

- Martingale bots – Improve funding after a loss to get well faster when the market turns. Excessive danger however efficient in trending markets.

- Sensible portfolio bots – Automate portfolio rebalancing to optimize asset allocation primarily based in your technique.

- CTA (Commodity Buying and selling Advisor) bots – Comply with trend-based methods to experience market momentum.

- Sign bots – Execute trades primarily based on real-time buying and selling alerts from skilled analysts and algorithms.

These are just a few bots that take the guesswork out of buying and selling and execute sooner, smarter, and extra effectively than human merchants can. We will describe every intimately later within the information.

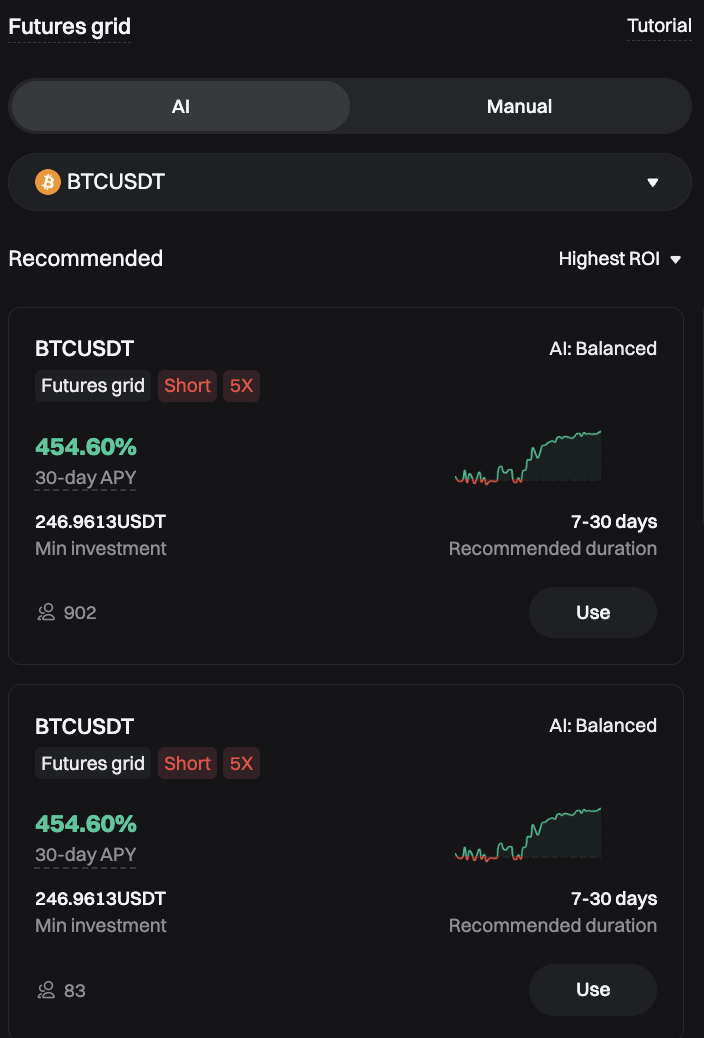

Futures grid: Bitget

Bitget’s fundamental buying and selling bots: When to make use of them and the way

Bitget’s fundamental buying and selling bots are constructed for merchants who need automation with out complexity. Listed below are just a few that you simply may think about.

Spot Grid Bot

What it does: Buys low and sells excessive inside a set value vary, maximizing revenue from sideways markets.

When to make use of: Use the Spot Grid Bot in ranging markets, the place costs transfer up and down inside a predictable zone. It thrives when there’s no clear pattern — not too bullish or bearish — serving to you revenue from frequent value fluctuations.

Methods to use:

- Go to Bitget Buying and selling Bots and choose Spot Grid Bot.

- Select a buying and selling pair, say, BTC/USDT.

- Set your value vary; the bot will purchase and promote accordingly.

- Outline the variety of grids (extra grids = smaller, frequent trades).

- Allocate funding funds out of your Spot Pockets. (could be finished beforehand)

- Click on Begin and let the bot deal with the trades robotically.

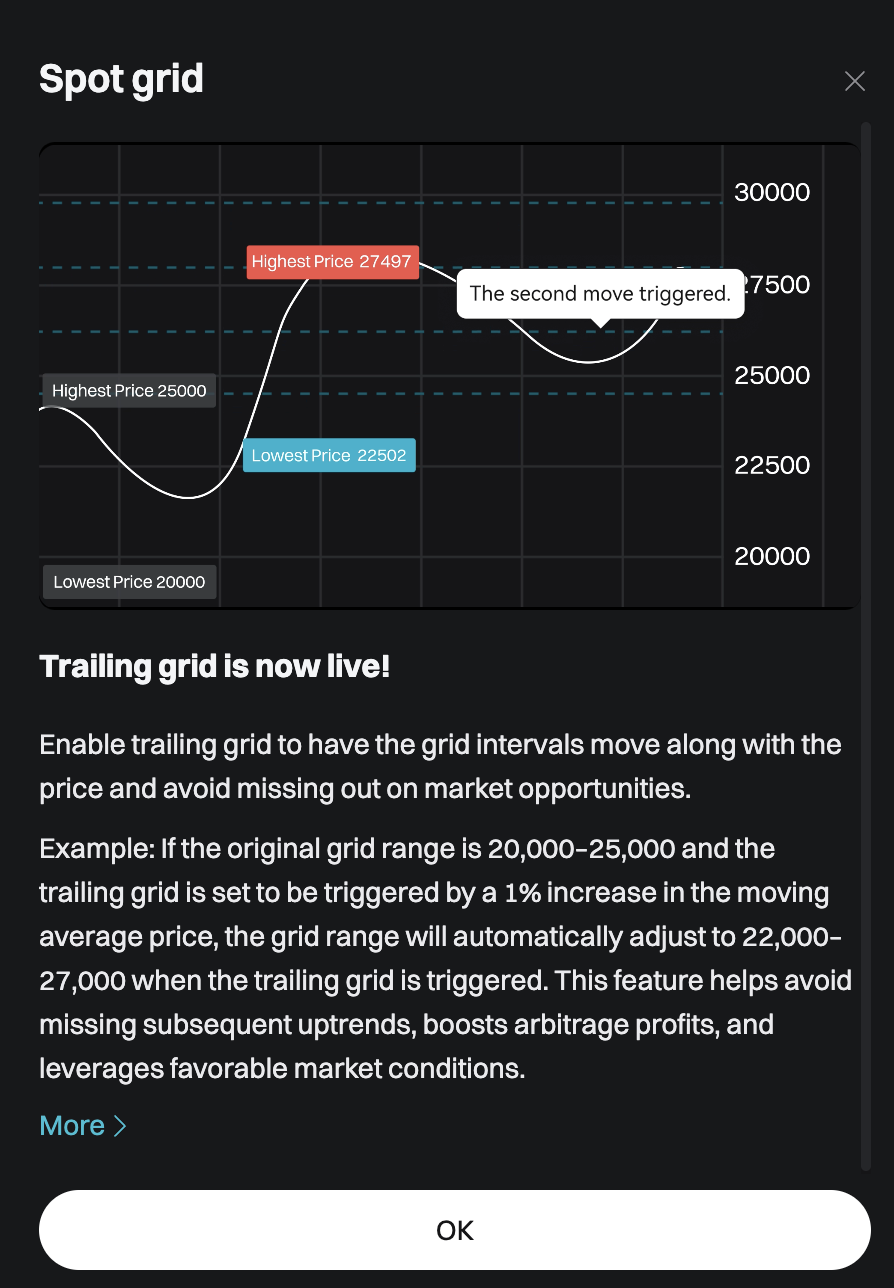

You may as well activate trailing grids to make higher use of market alternatives.

Trailing grids: Bitget

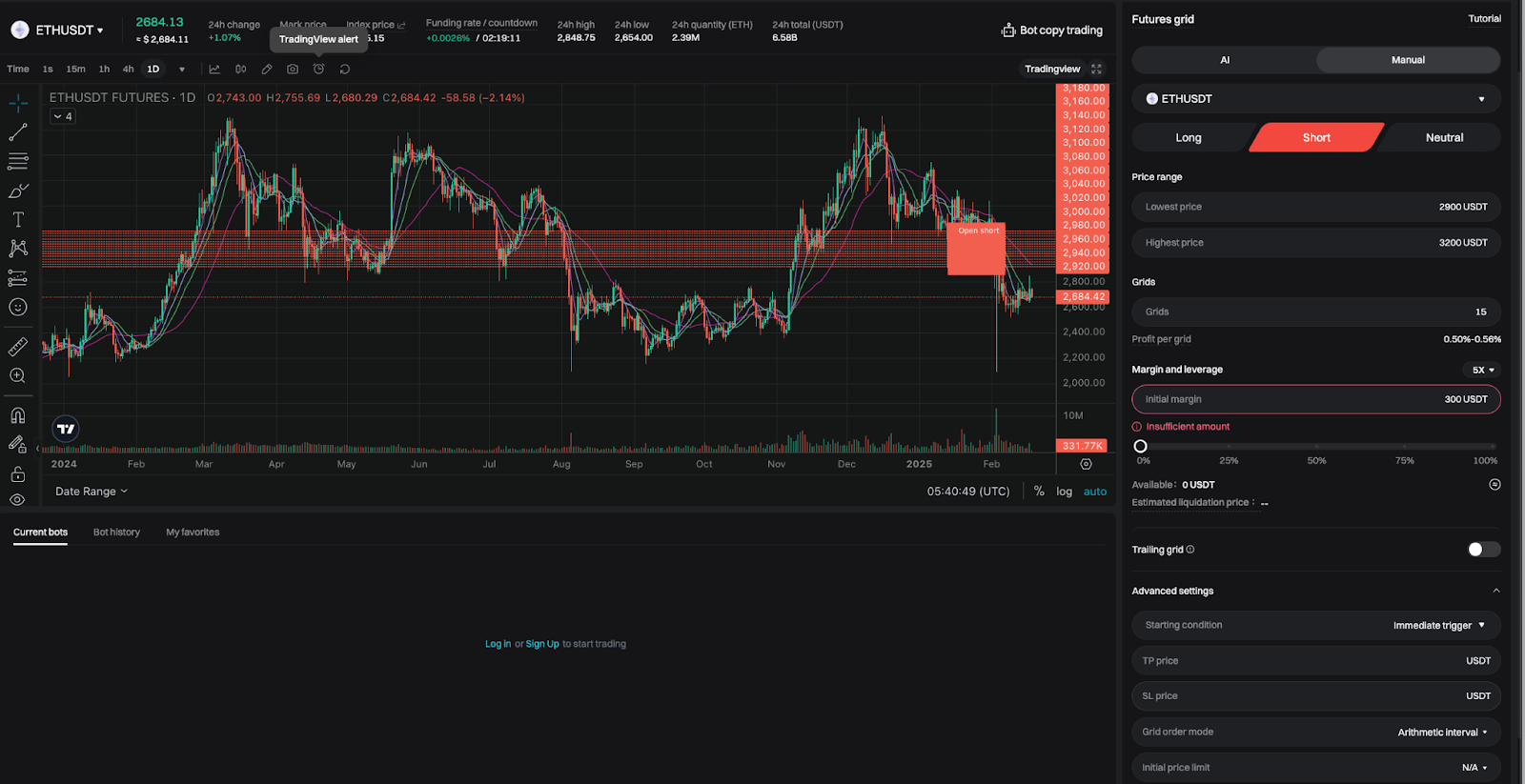

Futures Grid Bot

What it does: Works just like the Spot Grid Bot however within the futures market, with the added possibility of leverage for increased potential returns.

When to make use of: Use the Futures Grid Bot whenever you wish to make use of value fluctuations to amp up your trades, exactly to amplify earnings (and dangers). Greatest for skilled merchants who can handle futures volatility.

Methods to use:

- Choose Futures Grid Bot within the Buying and selling Bots part.

- Choose a futures buying and selling pair (e.g., ETH/USDT).

- Set your value vary and grid ranges.

- Select leverage (1x, 5x, 10x, and so on.). This could decide your asset liquidation value.

- Allocate funds out of your Futures Pockets.

- Click on Begin, and the bot will execute purchase/promote orders primarily based on value actions.

How the Futures grid interface takes care of the inputs: Bitget

Martingale Bot

What it does: Doubles commerce dimension after a loss, aiming to get well losses with a much bigger win when the market reverses.

When to make use of: Use the Martingale Bot in trending markets with anticipated corrections. It really works greatest when value actions are considerably predictable, permitting the bot to get well losses by way of bigger, strategically positioned trades.

Methods to use: Select Martingale Bot within the Bitget Buying and selling Bots part.

- Choose a buying and selling pair (e.g., BTC/USDT). (You may select Spot or Futures Martingale, primarily based in your necessities)

- Set base order dimension; your preliminary commerce quantity.

- Outline the multiplier (value motion down tab): how a lot the bot will increase commerce dimension after a loss.

- You may as well set the variety of security orders; the variety of instances you need the bot to repeat commerce after the loss.

- Set take-profit ranges to lock in good points.

- Click on Begin, and the bot will regulate commerce sizes primarily based on market strikes.

The spot martingale interface put up inputs: Bitget

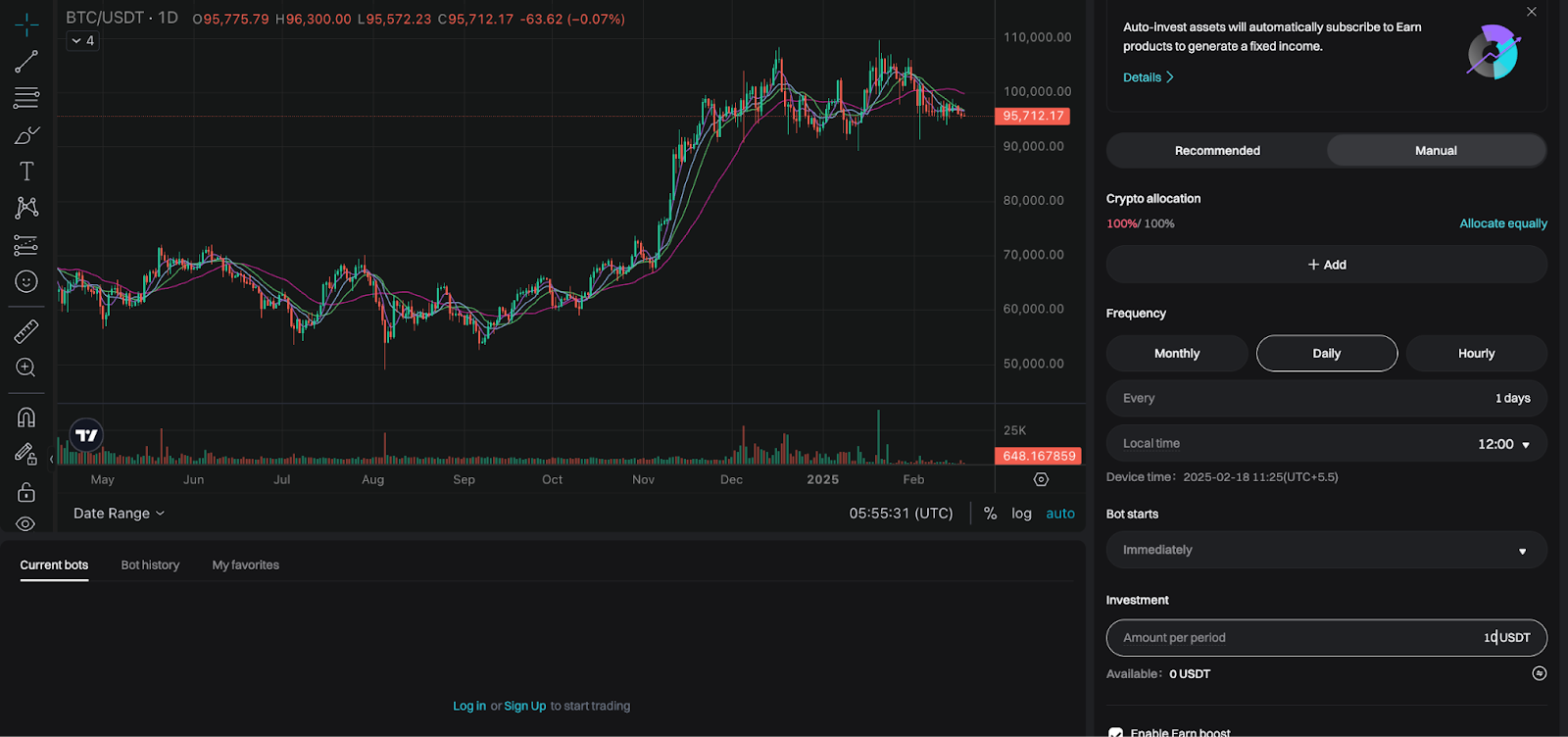

Spot Auto-Make investments Bot

What it does: Automates dollar-cost averaging (DCA) by frequently shopping for crypto at set intervals to scale back market timing danger.

When to make use of: Use the Spot Auto-Make investments Bot whenever you wish to accumulate crypto over time with out worrying about short-term value swings. It’s splendid for long-term traders trying to construct a portfolio persistently.

Methods to use:

- Choose Spot Auto-Make investments Bot within the Buying and selling Bots part.

- Choose a buying and selling pair (e.g., ETH/USDT).

- Set funding quantity per cycle (e.g., $10 per day).

- Select a shopping for frequency (day by day, weekly, or hourly.)

- Click on Begin, and the bot will robotically buy crypto on the set intervals.

Spot Auto-Make investments Bot: Bitget

Sensible Portfolio Bot

What it does: This bot rebalances (auto) your crypto portfolio primarily based in your goal asset allocation technique.

When to make use of: Use the Sensible Portfolio Bot whenever you maintain a number of cryptocurrencies and wish to preserve a balanced allocation with out manually adjusting holdings. It’s helpful for long-term traders managing a diversified portfolio.

Methods to use:

- Choose Sensible Portfolio Bot from Bitget’s Buying and selling Bots menu.

- Select your belongings (e.g., BTC, ETH, USDT).

- Set allocation percentages (e.g., 50% BTC, 30% ETH, 20% USDT).

- Select rebalancing frequency (day by day, weekly, month-to-month). You may even select to rebalance proportionally, primarily based on asset efficiency, if timed rebalancing isn’t your factor.

- Click on Begin, and the bot will regulate your portfolio robotically. All the time allow the asset auto switch possibility if you do not need to overlook out on the buying and selling or rebalancing alternatives.

Sensible Portfolio Bot: Bitget

The Portfolio bot is a dependable software for swing merchants and even HODLers. Plus, there are a number of bot presets you could merely copy and use primarily based in your investment-specific aggressiveness.

Sensible Portfolio: Bitget

Choose the suitable bot to your technique, set it up, and let automation deal with the remaining.

Bitget’s superior buying and selling bots: When to make use of them and the way

For merchants in search of extra complicated methods, deeper market evaluation, and better customization, Bitget’s superior buying and selling bots supply highly effective automation instruments.

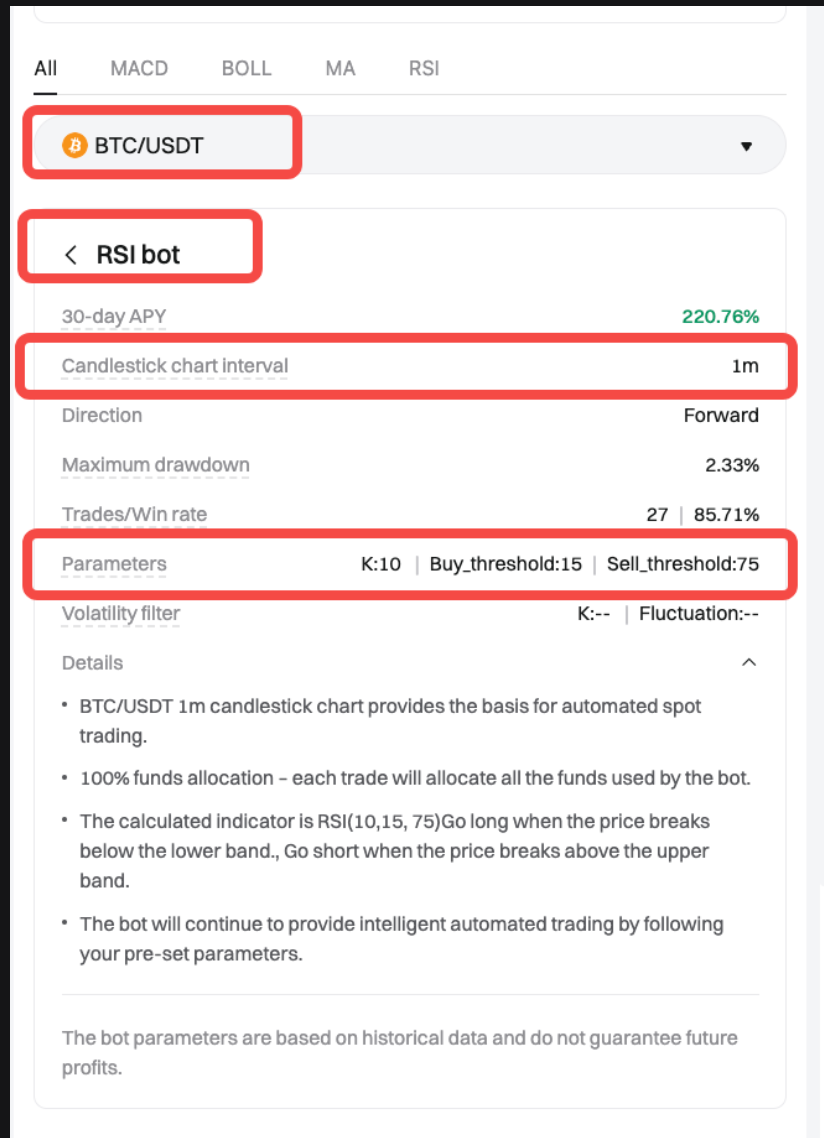

CTA (Commodity Buying and selling Advisor) bot

What it does: Makes use of trend-following methods to enter and exit trades primarily based on market momentum.

When to make use of: Use the CTA Bot in a strongly trending market — whether or not bullish or bearish. It’s splendid for merchants who wish to automate entries and exits primarily based on pattern alerts, eradicating emotional bias from buying and selling selections.

Methods to use:

- Go to Bitget Buying and selling Bots and choose CTA Bot.

- Choose a buying and selling pair (e.g., BTC/USDT).

- Select your trend-following technique (long-only, short-only, or each). Relevant to Futures CTA.

- Outline entry circumstances (e.g., shifting common crossovers, RSI triggers).

CTA Bot: Bitget

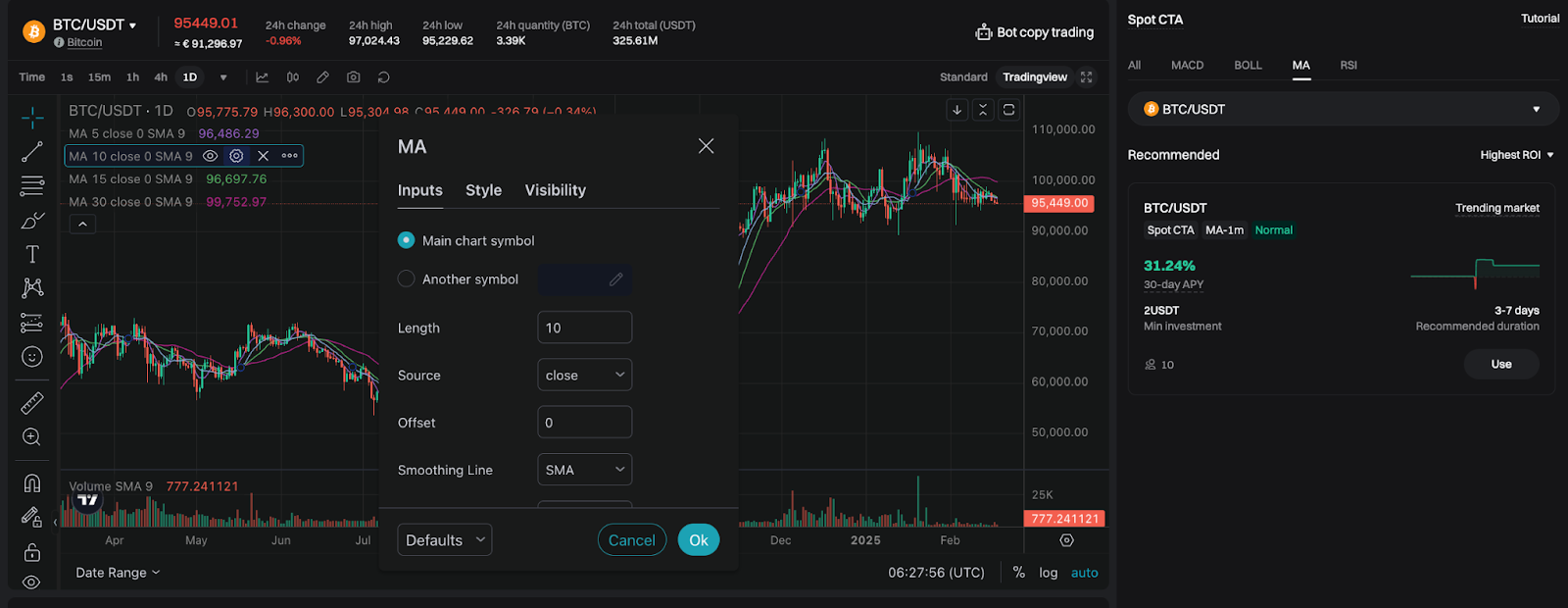

- Some customers may solely see pre-existing bots, which can be utilized primarily based on buying and selling preferences. Nonetheless, to optimize settings, you may head over to Bitget’s TradingView interface and tweak parameters accordingly.

- Set danger administration parameters (stop-loss, take-profit ranges).

- Click on Begin, and the bot will execute trades primarily based on predefined alerts.

Set parameters Spot CTA: Bitget

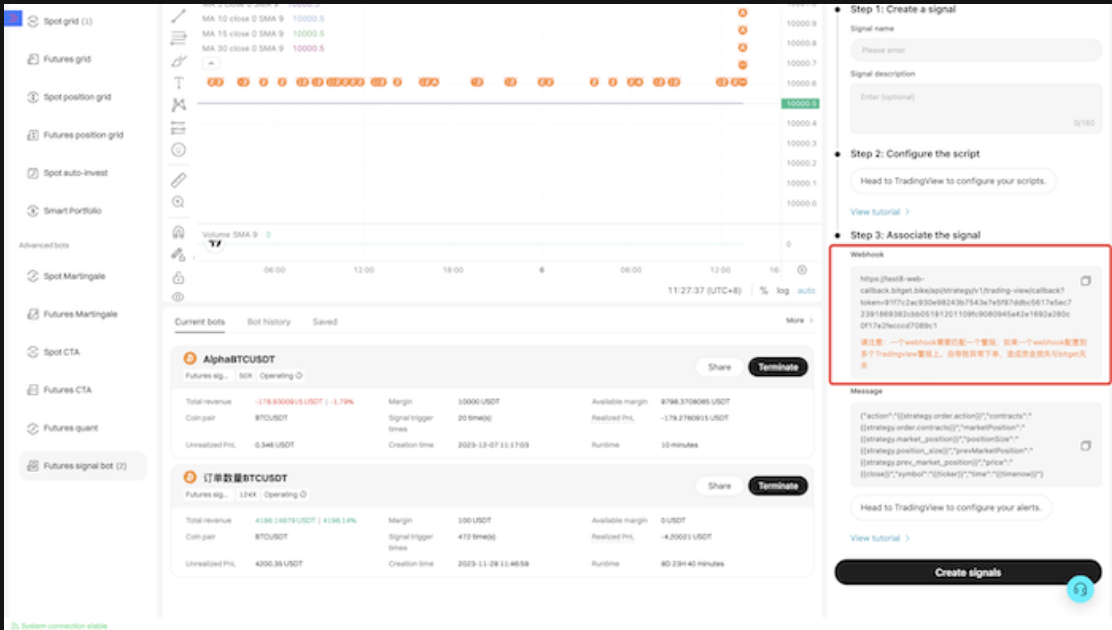

Futures Sign bot

What it does: Executes trades primarily based on exterior buying and selling alerts from skilled merchants, algorithms, or analytics instruments. At current, Futures Sign bot is the one current, which automates trades within the futures market by executing orders primarily based on customized buying and selling alerts from TradingView scripts, skilled merchants, or algorithmic methods.

When to make use of: Use the Sign Bot whenever you wish to copy high-quality buying and selling methods with out actively making selections. Greatest for merchants who belief exterior alerts or wish to observe consultants.

Methods to use: (This bot requires a number of steps and subsequently wants your full consideration)

Create a brand new sign on Bitget

- Go to Bitget Buying and selling Bots and choose Futures Sign Bot.

- Click on on Create New Sign and enter the next particulars: (hypothetical instance)

- Sign title: ETH Scalper 5-Minute

- Sign description: A high-frequency scalping technique that opens trades primarily based on five-minute candle breakouts.

Futures Sign Bot: Bitget

- Click on Verify to create the sign.

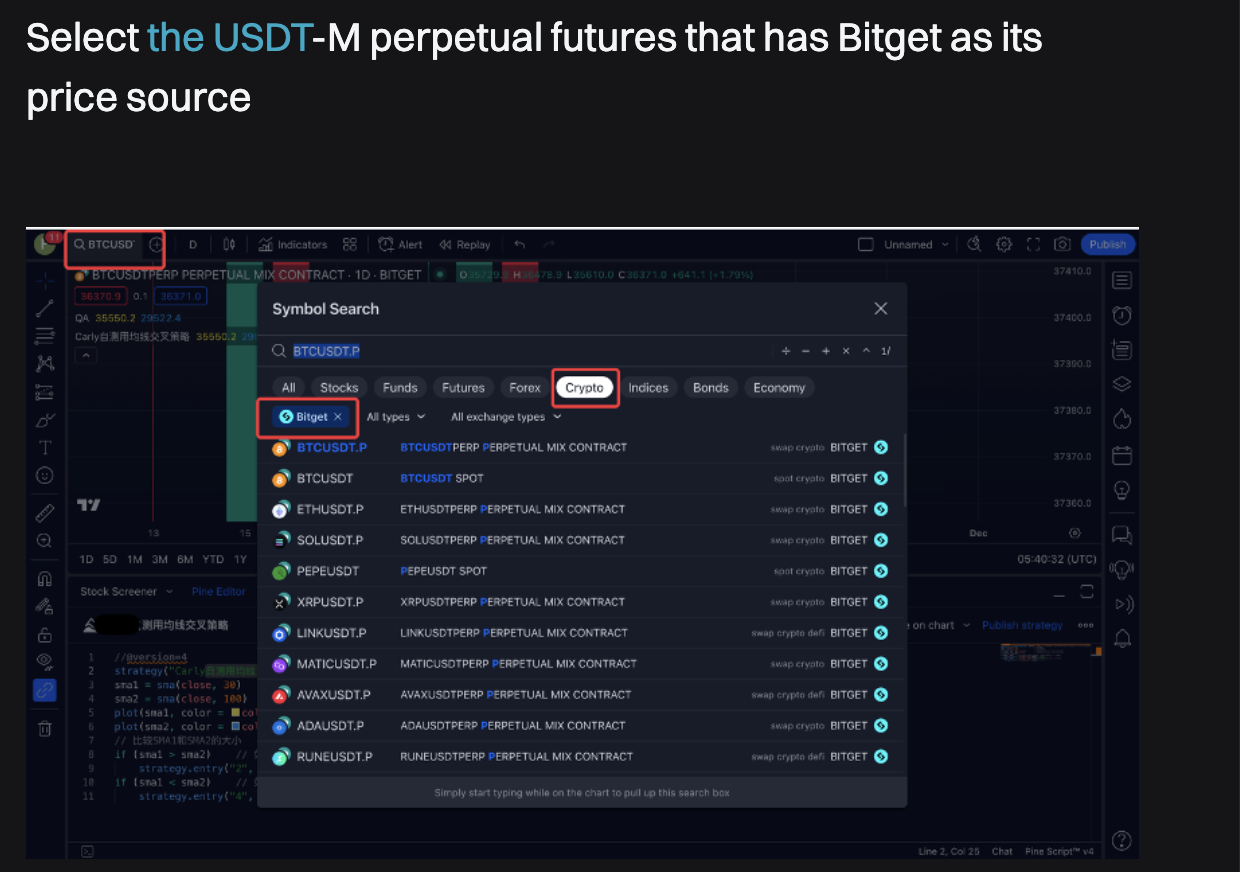

Configure the buying and selling technique on TradingView

Choose the worth supply first: Bitget

- Open TradingView and go to the Pine Editor.

Pine Editor: TradingView

- Create or modify a script utilizing the next technique parameters:

- Indicator 1: Bollinger Bands (Value touching the higher/decrease band triggers a commerce).

- Indicator 2: MACD Crossovers (Purchase when MACD crosses above the sign line, promote when it crosses beneath).

- Timeframe: 5-minute chart.

- Backtest the technique utilizing the Technique Tester to make sure it performs effectively traditionally.

- As soon as glad, apply the technique to your ETH/USDT chart.

Arrange alerts and webhooks on TradingView

- Click on on the Alert icon on TradingView.

- Within the Situation subject, choose your ETH Scalper 5-Minute technique.

- Scroll right down to Webhook URL and allow it.

- Copy the Bitget webhook URL and paste it into the webhook subject.

Allow webhooks: TradingView

- Within the Message subject, enter the next JSON format (supplied by Bitget): (solely occurs whenever you login along with your account)

{

“image”: “ETHUSDT”,

“aspect”: “purchase”,

“orderType”: “market”,

“amount”: “0.1”,

“leverage”: “5”,

“takeProfit”: “2%”,

“stopLoss”: “1%”

}

This code can range primarily based on what parameters you add.

- Click on Create Alert to start out sending alerts from TradingView to Bitget.

Hyperlink the sign to the Futures Sign bot on Bitget

- Return to Bitget, discover your newly created ETH Scalper 5-Minute sign.

- Click on Hyperlink Sign and choose the ETH/USDT buying and selling pair.

- Configure the bot’s danger parameters: (these can change primarily based in your preferences)

- Leverage: 5x

- Commerce Measurement: 0.1 ETH

- Take Revenue: 2%

- Cease Loss: 1%

- Click on Begin, and the bot will now execute trades robotically at any time when the TradingView alert is triggered.

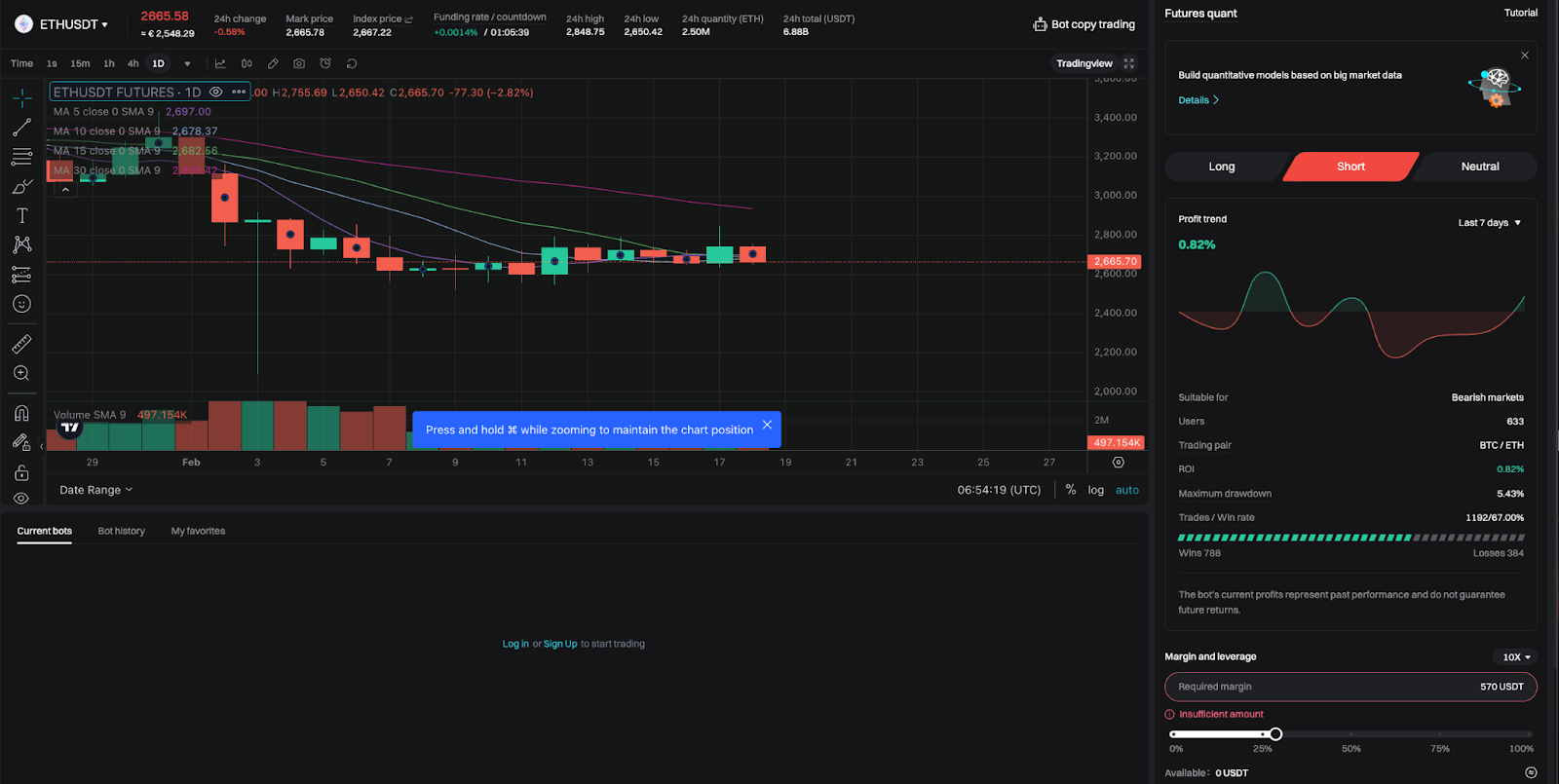

Futures Quant Buying and selling bot

What it does: This bot precept relies on quantitative buying and selling methods. These methods are meant for high-frequency buying and selling within the futures market that includes executing a number of trades quickly to capitalize on value inefficiencies.

When to make use of: Use the Futures Quant Buying and selling Bot when buying and selling in a unstable futures market, the place fast fluctuations permit for scalping and arbitrage alternatives. Greatest for merchants comfy with leverage and fast commerce execution.

Methods to use:

- Choose Futures Quant Buying and selling Bot in Bitget Buying and selling Bots.

- Select a futures pair (e.g., ETH/USDT).

- Set your buying and selling technique (e.g., Lengthy, Quick, or Impartial).

- Outline leverage ranges (increased leverage will increase revenue potential but in addition danger).

- Regulate danger administration settings (stop-loss, liquidation buffer) utilizing the buying and selling view interface.

- Click on Begin, and the AI buying and selling bot will start executing trades with out you having to do something.

Futures Quant Buying and selling Bot: Bitget

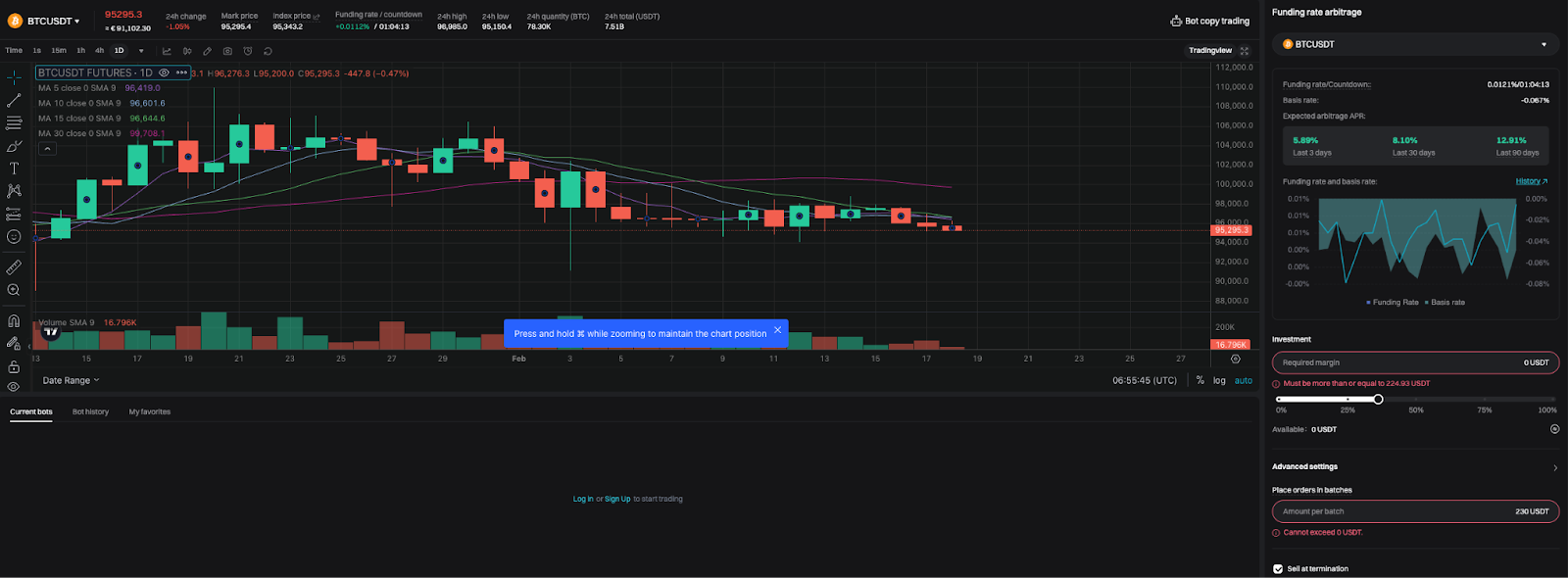

Funding Charge Arbitrage Bot

What it does: This comparatively new bot capitalizes on funding price variations between spot and futures markets. By concurrently holding opposing positions, lengthy within the spot and brief within the futures area, the bot goals to earn earnings from the funding charges.

When to make use of: Deploy the Funding Charge Arbitrage Bot when there’s a big distinction in funding charges between spot and futures markets, permitting you to earn constant returns with minimal market publicity.

Methods to use:

- Navigate to the Funding Charge Arbitrage Bot within the Bitget Buying and selling Bots part.

- Choose a cryptocurrency pair (e.g., BTC/USDT).

- Decide the capital to allocate for the technique, which additionally determines the margin.

- Regulate settings like leverage and place sizes (quantity per batch) primarily based in your danger tolerance.

- Activate the bot to start automated arbitrage buying and selling.

Funding Charge Arbitrage Bot: Bitget

Why use AI buying and selling bots?

AI buying and selling bots aren’t nearly automation — they offer merchants a aggressive edge by eliminating human errors, optimizing methods, and reacting sooner than any human ever may. Right here’s why they’re value utilizing:

- 24/7 buying and selling

- Emotion-free buying and selling

- Lightning-fast execution

- Optimized methods

- Arms-free comfort

- Backtested and>AI buying and selling bot dangers

Quite a lot of dangers exist. Listed below are just a few which may want some consideration:

- Market volatility: Bots observe the foundations, not instinct; a sudden value crash can nonetheless result in losses.

- Unsuitable technique = mistaken trades: If you happen to arrange a bot poorly, it is going to execute trades precisely as programmed, even when they’re unhealthy ones.

- Over-reliance on automation: No bot is foolproof; market circumstances can change unpredictably.

- Leverage dangers: Futures buying and selling bots use leverage, which amplifies each good points and losses, and liquidation is an actual hazard.

- Alternate downtime: If Bitget experiences downtime, buying and selling bots may malfunction or get caught in open positions.

- Safety dangers: Although Bitget bots run on the platform itself (no API wanted), at all times use sturdy safety measures to guard your account.

Are Bitget’s AI buying and selling bots value it?

AI buying and selling bots could be priceless if you’re conscious of how the bots work and the extra complicated points of parameter dealing with capabilities. If not, all will not be misplaced as you’re at all times free to select from the preset bots, which have tried and examined revenue ranges to their title. Whatever the bots you utilize, it is very important observe Bitget tutorials regarding AI buying and selling bots earlier than continuing. All the time do your personal analysis and by no means make investments greater than you may afford to lose.