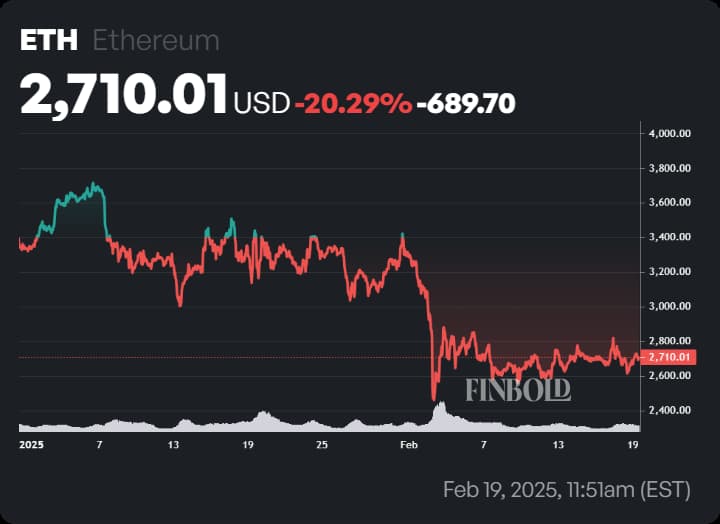

Ethereum (ETH) has confronted a difficult 12 months, rising because the worst-performing cryptocurrency among the many prime 5, with a year-to-date decline of 20%.

Presently buying and selling at $2,710 the asset has struggled to achieve momentum even throughout broader market recoveries.

Nevertheless, key community indicators counsel potential indicators of a turnaround, with Ethereum transaction charges dropping to $0.41 per switch, their lowest stage since August 2024.

This sharp decline alerts diminished congestion and a attainable accumulation section, traditionally seen earlier than worth rebounds.

But, uncertainty surrounding Ethereum’s near-term trajectory stays, leaving buyers divided on its subsequent transfer.

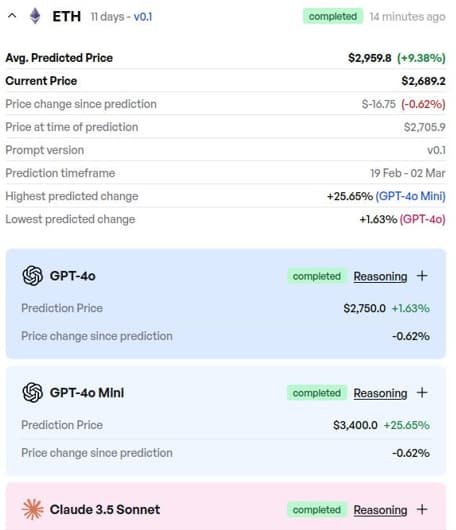

Finbold AI predicts Ethereum worth goal for March 1

Finbold’s AI-powered prediction device has supplied an up to date forecast for Ethereum’s worth trajectory main as much as March 1, 2025. Factoring in technical indicators and market information, the mannequin predicts a mean ETH worth of $2,959.8 for early subsequent month, representing a 9.38% improve from the extent of $2,689.2 on the time of the forecast.

Regardless of this reasonably bullish projection, AI fashions stay sharply divided on Ethereum’s subsequent transfer. Probably the most optimistic outlook, generated by GPT-4o Mini, foresees a 25.65% rally, suggesting ETH may climb to $3,400 within the coming weeks.

Conversely, GPT-4o presents a extra cautious view, predicting a 1.63% improve to $2,750, indicating that ETH might wrestle to achieve momentum.

Is Ethereum gearing up for a serious comeback?

Ethereum’s regulatory panorama and upcoming community upgrades may play a key function in figuring out its subsequent market shift.

A latest U.S. Securities and Alternate Fee (SEC) submitting has invited public feedback on a proposal from Cboe Alternate, Inc. to listing and commerce choices on Ethereum ETFs, together with the Grayscale Ethereum Belief ETF, Grayscale Ethereum Mini Belief ETF, and Bitwise Ethereum ETF. If permitted, this might improve institutional participation and introduce larger liquidity into the market.

On the identical time, Ethereum’s Pectra improve, scheduled for April 2025, goals to boost scalability, transaction speeds, and value effectivity.

Testing phases are already in progress, with the Holesky community set for February 24 and Sepolia scheduled for March 5. If profitable, the improve may enhance developer exercise and adoption, additional driving demand for ETH.

Including to Ethereum’s potential institutional enchantment, Cboe and 21Shares have submitted a proposal to combine staking into their Ethereum ETF. If permitted, ETF buyers would be capable to earn staking rewards, making Ethereum’s funding autos extra enticing to long-term buyers.

With these components in play, Ethereum may very well be getting ready to a serious market shift, although its near-term trajectory stays depending on regulatory outcomes, the profitable rollout of community upgrades, and broader market restoration.

Featured picture by way of Shutterstock