Bitcoin continues to point out indicators of value consolidation, with its worth hovering just under the $87,000 mark. As of at present, BTC is buying and selling at roughly $86,990, reflecting a 0.8% decline over the previous 24 hours.

Regardless of the slight dip, the broader image reveals that Bitcoin has stabilized above $85,000 for a number of consecutive periods, signaling a pause within the sturdy upward or downward momentum noticed in earlier weeks.

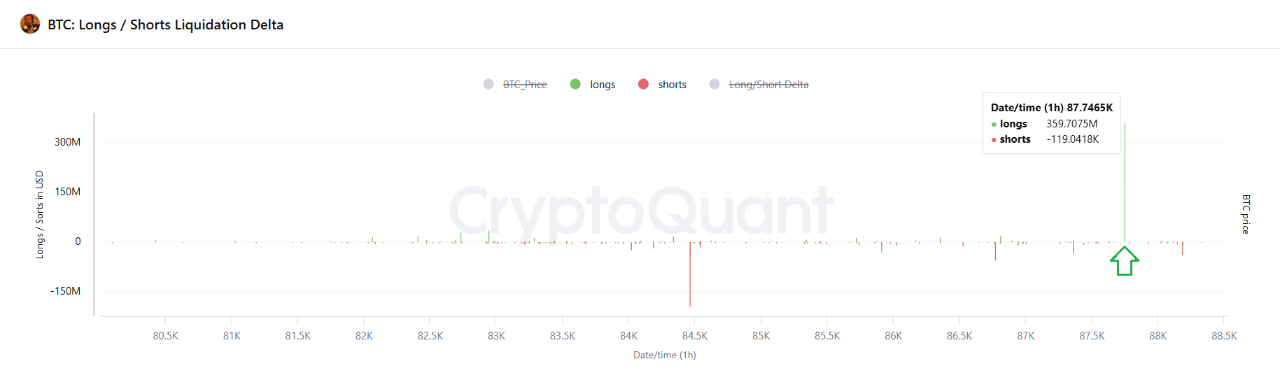

Lengthy Liquidation Indication For The Market

Whereas volatility seems subdued, market dynamics stay lively behind the scenes. CryptoQuant contributor Amr Taha just lately offered insights into Bitcoin’s newest market construction, highlighting a key improvement: the liquidation of $359.7 million value of lengthy positions.

This occasion has drawn consideration to potential shifts in sentiment and essential technical ranges that will act as assist or resistance within the brief time period.

In accordance with Taha, a protracted liquidation happens when merchants holding leveraged lengthy positions are pressured to shut their trades after the worth drops under their margin thresholds. When this occurs at scale, as seen just lately, it displays a sudden change in sentiment and sometimes forces short-term sell-offs.

Nonetheless, Taha factors out that such occasions also can set the stage for a possible market rebound, as many overleveraged positions are cleared, giving house for brand new demand to emerge.

Liquidation occasion of $359.7M in lengthy positions

“If BTC holds above the short-term realized value, it suggests energy in demand. A breakdown under these ranges may point out a possible reversal or correction.” – By Amr Taha

Full submit ⤵️https://t.co/SW9e16kofW pic.twitter.com/0YR9rfreGa

— CryptoQuant.com (@cryptoquant_com) March 27, 2025

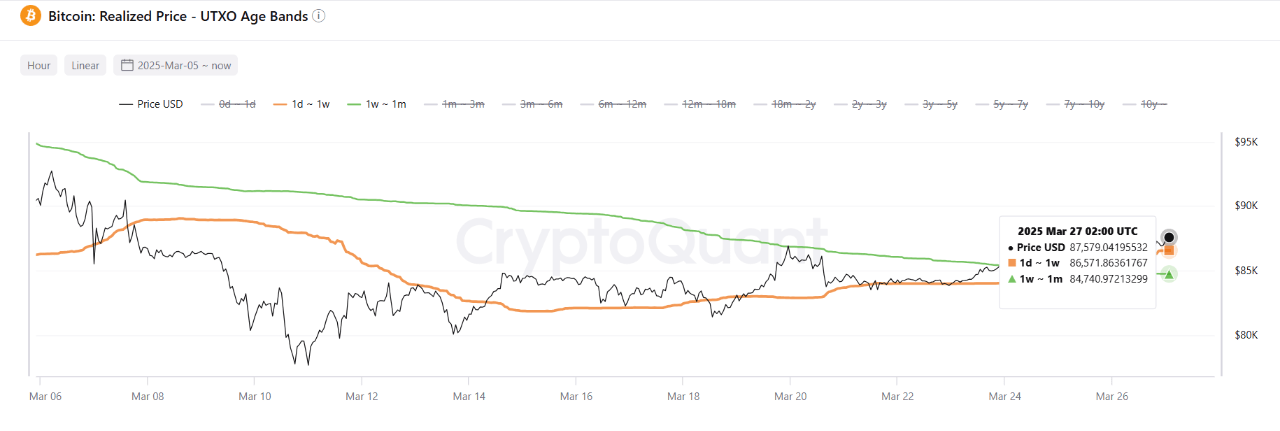

Bitcoin UTXO Metrics Paint a Combined Image

Complementing this statement is Bitcoin’s realized value distribution by UTXO age bands. Taha notes that Bitcoin’s present market value stays above the realized value for UTXOs aged 1 day to 1 week, indicating that current patrons are holding unrealized earnings.

In the meantime, UTXOs within the 1-week to 1-month vary have their realized value close to $84,740—a stage that might act as technical assist if Bitcoin dips within the close to time period. This confluence of short-term holder profitability and assist close to $84K might function an essential sign.

If Bitcoin maintains its place above these realized value zones, it suggests continued energy from current patrons. Nonetheless, if the worth begins to fall under these thresholds, it might level to elevated promoting stress or a broader correction part.

Whereas the liquidation of lengthy positions and UTXO age metrics provide some perception into market sentiment, Taha’s conclusion of a chance for the worth to both fall or proceed rising provides extra purpose to stay cautious.

Featured picture created with DALL-E, Chart from TraingView