Bitcoin (BTC) has undergone a pointy correction, falling as a lot as 23% from its current peak, elevating considerations about whether or not the market is getting into a chronic bearish section.

Cryptocurrency analytics agency CryptoQuant has launched the Bullish Rating Index to evaluate whether or not this decline is a part of a brief correction inside a broader bull cycle or the beginning of a deeper decline.

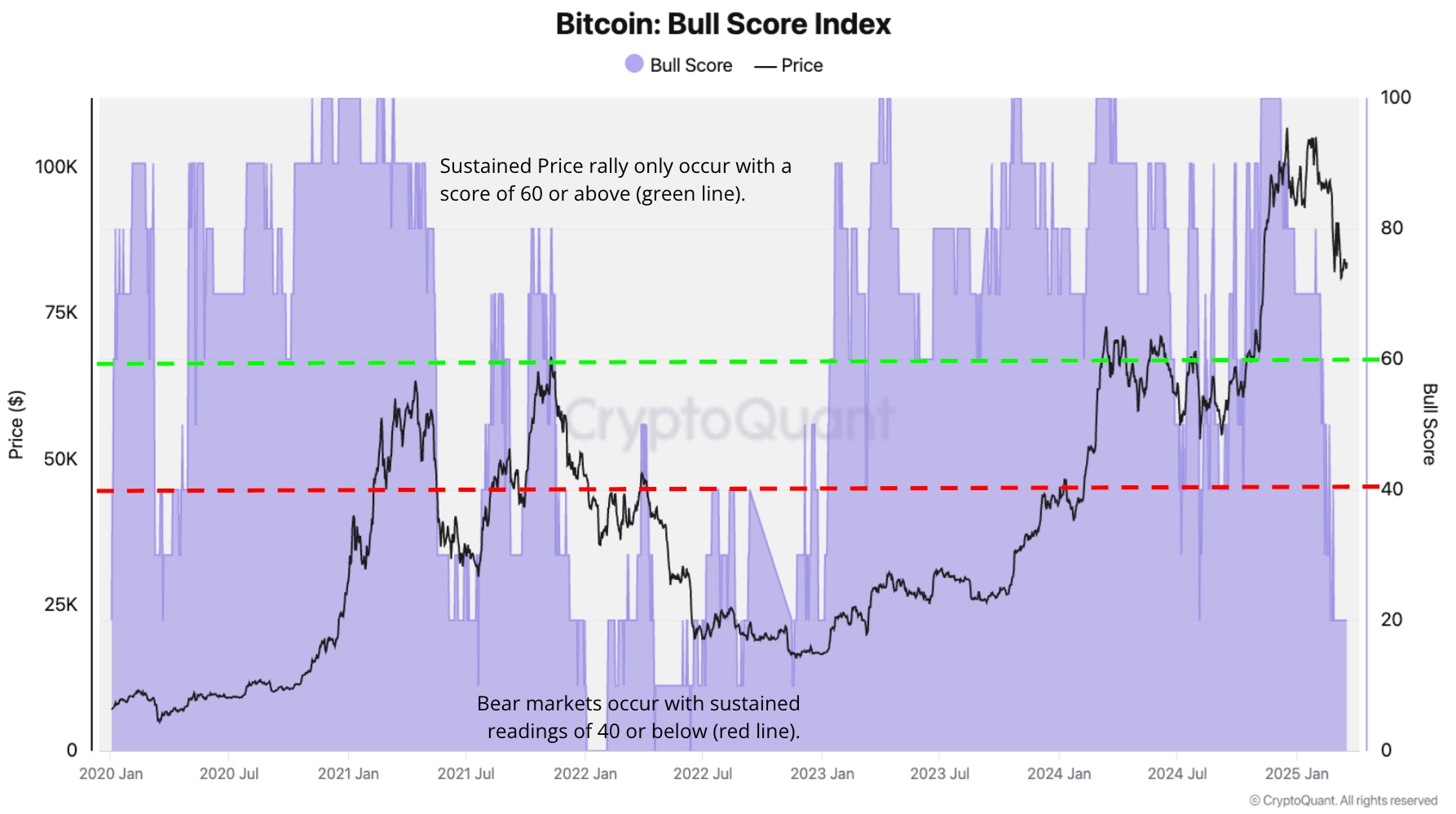

CryptoQuant’s Bull Rating Index, which evaluates ten key indicators of community exercise, investor profitability, Bitcoin demand, and market liquidity, at present sits at 20, the bottom stage since January 2023. Starting from 0-100, the index is designed to measure the proportion of bullish metrics out there, with larger values indicating a powerful funding local weather, whereas decrease values point out a bearish outlook.

Traditionally, Bitcoin has solely sustained main value rallies when the Bullish Rating Index was above 60, whereas extended readings under 40 have equated to bear markets. On condition that the index stays properly under this threshold, CryptoQuant analysts warn that present market circumstances are weak and will sign additional draw back threat.

If the Bull Rating Index stays under 40 for an prolonged time frame, it may affirm the continuation of bearish circumstances just like earlier downtrends. Whereas Bitcoin has seen comparable corrections in previous bull cycles, the present weak market setting may make a fast restoration tough except elementary metrics enhance, analysts notice.

Chart displaying the bullish index, shared by CryptoQuant.

*This isn’t funding recommendation.