The crypto trade skilled a transformative 12 months in 2024, marked by fast person acquisition and shifting ecosystem dynamics.

A brand new report from Flipside highlights important progress in person engagement, significantly on Base and Ethereum, whereas decentralized exchanges (DEXs) and new blockchain initiatives reshaped the aggressive market.

On-Chain Progress and Rising Market Dynamics

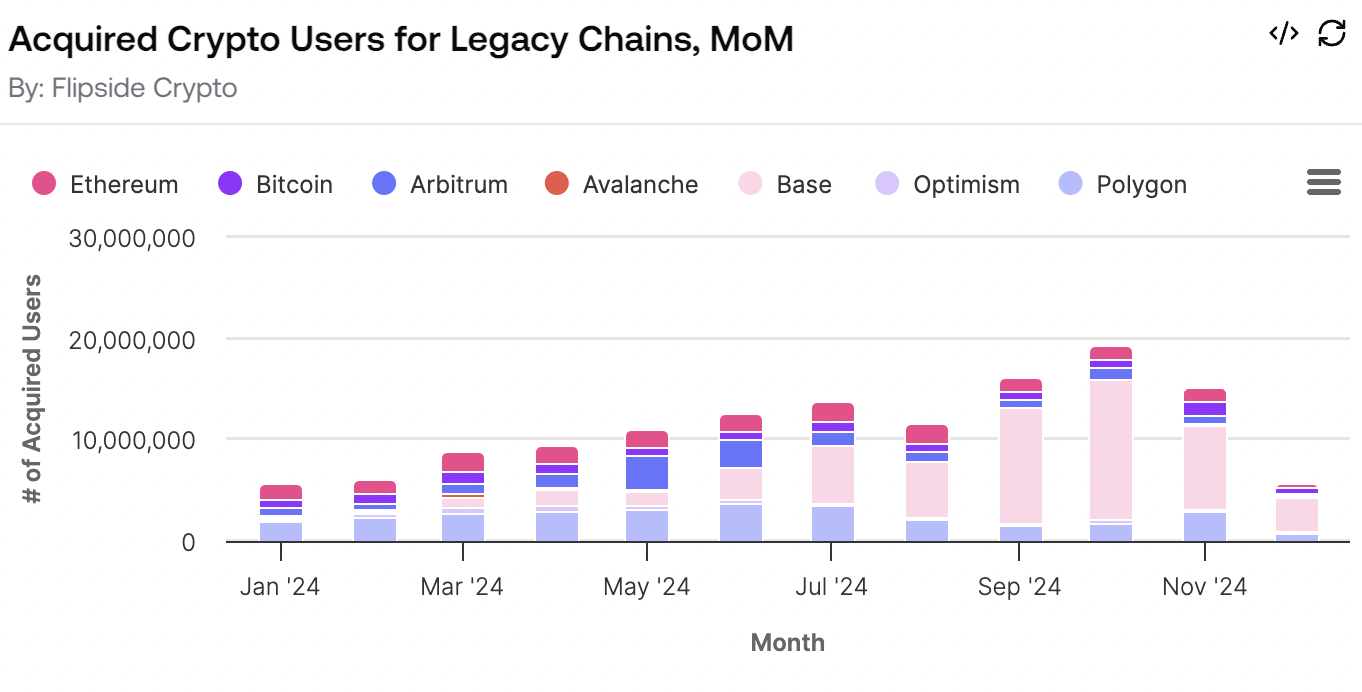

Base, a blockchain platform developed by Coinbase, led the market in 2024 with 13.7 million new customers in October alone. This surge positioned Base because the fastest-growing chain, outpacing Ethereum’s regular common of 1.56 million new customers monthly. Compared, Bitcoin’s progress lagged regardless of its worth reaching $100,000, signaling speculative curiosity reasonably than new person onboarding.

Ethereum’s consistency as a person acquisition chief helps its established place, however Base’s fast progress demonstrates the potential for newer chains to disrupt the ecosystem. Polygon additionally noticed engagement, leveraging non-DeFi actions to broaden its person base.

Acquired Crypto Customers for Legacy Chains, MoM. Supply: Flipside.

Base attracted 15.1 million tremendous customers—these with over 100 transactions—surpassing even Ethereum and Polygon. This milestone displays Base’s skill to maintain lively engagement, positioning it as a standout platform. Polygon, in distinction, excelled by diversifying its actions and sustaining excessive transaction volumes throughout gaming and non-financial use instances.

Flipside Report Reveals How DEXs Evolve

Uniswap solidified its dominance within the decentralized change sector, capturing 91.3% of acquired person exercise on Base. On Ethereum, Uniswap’s share additionally grew, reinforcing its place because the market chief. Dealer Joe maintained its lead on Avalanche, supported by options like Auto-Swimming pools and multi-chain capabilities.

These shifts illustrate the growing consolidation of DEX exercise round main gamers, highlighting a maturing market. Nevertheless, newer chains face the problem of balancing innovation with person retention.

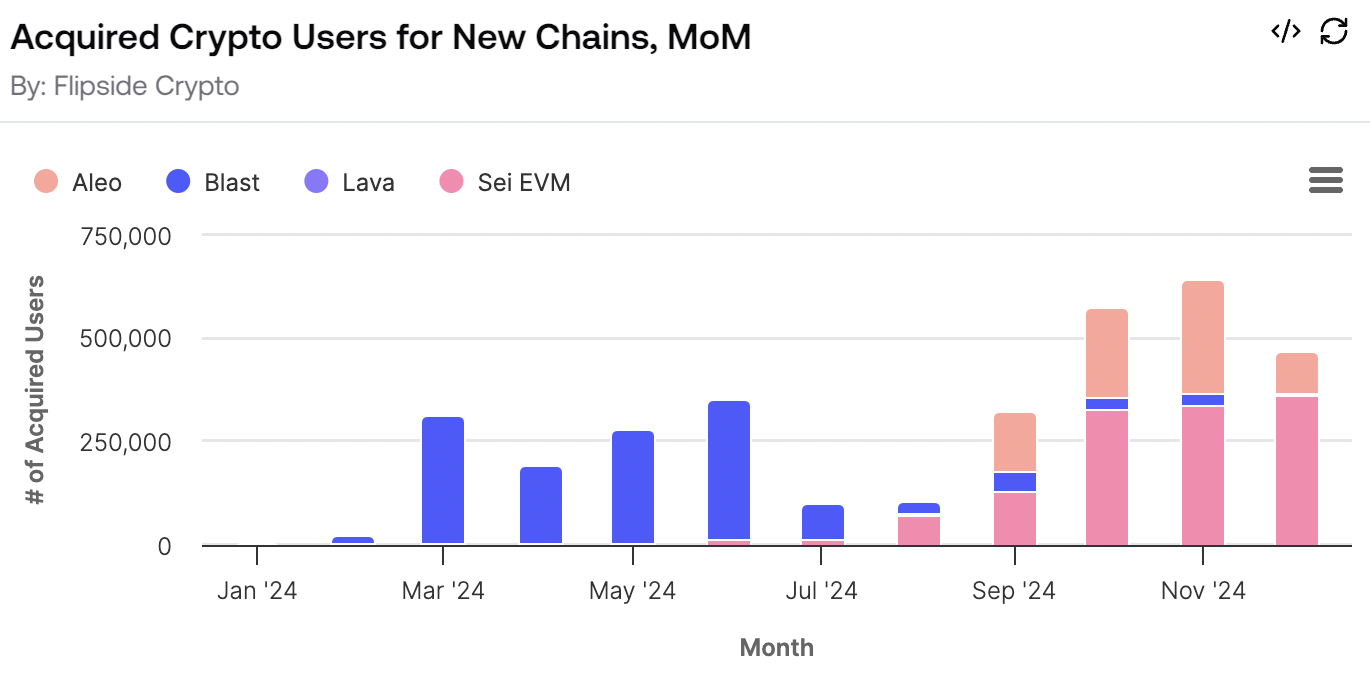

Acquired Crypto Customers for New Chains, MoM. Supply: Flipside.

New blockchain networks like Aleo demonstrated promising progress however face hurdles in sustaining person engagement. Base, by comparability, emerged as a mannequin for scaling engagement by way of options and partnerships. These new ecosystems should increase past buying and selling to compete successfully within the broader crypto house.

Macro Traits Drive Institutional Confidence

In response to the Flipside report, regulatory readability performed a vital position in shaping the 2024 crypto house. The EU’s Markets in Crypto-assets Regulation (MiCA) bolstered institutional confidence, encouraging ETF launches and better adoption. These developments supported constant person progress throughout main chains.

Ethereum stays a crucial basis for innovation, significantly for Layer 2 options. Whereas Ethereum continues to develop its person base, fostering deeper engagement and new use instances stays a problem.

Because the crypto market matures, new traits like GameFi and synthetic intelligence integration are anticipated to drive adoption. These improvements might deal with scalability and knowledge administration challenges, unlocking alternatives for broader person engagement.

“Behind the headlines of document person progress lies a deeper problem: constructing ecosystems that create significant, lasting engagement, not simply fleeting hypothesis. Briefly, most blockchains are nonetheless scratching the floor in terms of turning informal customers into high-value contributors,” the report said.

Flipside’s report highlights a pivotal 12 months for crypto, the place established platforms competed with rising ecosystems. The long run will rely upon how chains steadiness innovation, person retention, and regulatory adaptation to maintain momentum in 2025.

With platforms like Base main the best way and Ethereum cementing its dominance, the competitors for person exercise and engagement is way from over.