Binance Pockets, one of many extensively used Web3 providers, reached peak volumes on Wednesday. The pockets took over visitors after OKX suspended its DEX aggregator service.

Binance Pockets grew to become the most well-liked Web3 interplay instrument, with every day volumes surpassing $90M. The pockets took over Web3 visitors and DEX exercise after the OKX pockets suspended its DEX aggregator service.

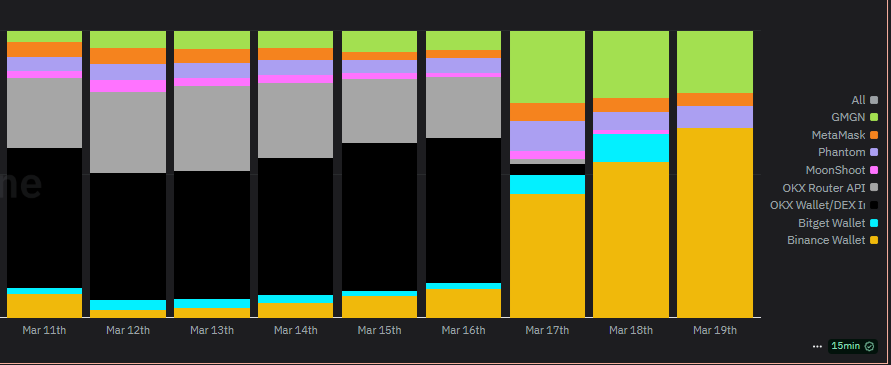

Up to now two days, Binance Pockets expanded its share of general every day customers. Proper after the announcement by OKX, the pockets took over 54% of the market. A day later, the share already expanded to 66%.

Binance Pockets expanded its affect amongst different Web3 wallets after including new liquidity options. | Supply: Dune Analytics

Binance Pockets utilization additionally coincided with a basic improve in BNB Good Chain utilization and DEX exercise on PancakeSwap. The shift could also be momentary, as OKX has solely suspended its DEX aggregator to realize improved compliance. The opposite short-term motive for the elevated pockets utilization was the launch of the Bubblemaps (BMT) token on Binance. The asset was among the many day’s trending tokens, additional boosting the pockets’s exercise.

The opposite motive for the growth of Binance Pockets utilization is the particular bonus interval with zero further buying and selling charges. The power to commerce the latest memes with out further bills drove the pockets to the main place. The pockets additionally retains the benefit of getting a local chain, which different Web3 wallets lack, counting on multi-chain entry.

🚀 Get pleasure from zero buying and selling charges on all swaps in #Binance Pockets for the following 6 months!

Begin buying and selling now! 🔥

— Binance Pockets (@BinanceWallet) March 17, 2025

Binance’s ecosystem is attempting to develop extra aggressively after Ethereum and Solana are displaying indicators of person outflows. The pockets has additionally added new options, together with unique entry to TGE launches, token filtering and choice options.

OKX loses visitors after turning into a instrument for Lazarus hackers to launder funds

OKX Web3 pockets beforehand carried as much as 50% of visitors, on account of multi-chain entry and excessive demand for the out there DEX. After eradicating the aggregator, the pockets’s share fell to three.6% of all exercise.

As a Web3 pockets, OKX was used anonymously and carried among the visitors from the current Bybit hack. For that motive, OKX will improve its compliance mechanism. The OKX Web3 pockets used THORChain, which managed to obscure among the swaps. OKX is attempting to safe its position in DeFi house, because it turned out protocols weren’t prepared to trace down and freeze funds from hacking actions.

OKX claimed its Web3 platform was open to anybody, however the current exercise confirmed protocols might select to trace down funds and doubtless had been complicit with the losses. There is no such thing as a unified customary on freezing funds, however OKX will change its entry to filtering and aggregating transactions.

Binance shifts the stability of Web3 wallets

The sudden exercise spike can also be linked to a brand new function that additional consolidates the ecosystem. The house owners of Binance balances on the centralized alternate can now instantly bid on decentralized tokens.

Binance Alpha 2.0 launched for the Chinese language-speaking areas, explaining the speedy spike in Web3 exercise throughout Asian buying and selling hours. Binance’s method to increasing token choice with out itemizing is just like the Coinbase verified swimming pools, providing curated entry to comparatively safer liquidity pairs.

The BNB Good Chain additionally produced $1.63M in charges for the previous 24 hours, surpassing TRON (TRX) to turn into the sixth-largest payment generator for the previous day. BNB Good Chain additionally raised extra charges in comparison with Ethereum and Solana put collectively. The shift to new meme tokens exhibits there’s nonetheless a seek for extremely lively crypto belongings. Regardless of the sluggish altcoin season, liquidity hubs and accessible infrastructure stay the important thing to retaining on-chain exercise.

At present, Binance and Coinbase are the one centralized exchanges with a extremely lively native chain. This has allowed the crossover between centralized exercise and Web3. Up to now months, liquidity was largely break up between CEX and DEX, however Binance unleashed its peak person base and belongings to circulation again into DEX exercise.

Following the height pockets utilization, the native token BNB took a step again, to commerce at $618.84. Up to now few days, BNB maintained its worth above $600, largely pushed by new demand for meme tokens.

Binance has the extra benefit of integrating 4.meme tokens, along with the hand-picked every day Alpha choices. Different exchanges lack the built-in ecosystem to supply prolonged lists of tokens and protected DEX aggregation.