Within the final day, Bitcoin’s value has made a great restoration, rising from round $100,000 to presently buying and selling at $102,448, a rise of over 3.1%. It even briefly peaked at $102,622 however couldn’t sustain that degree. The buying and selling quantity of Bitcoin over the previous 24 hours has gone up by 5.5% to $61.2 billion.

Zooming out, Bitcoin fell under $100,000 on January 7 and has been principally declining since then. It reached a low level of about $89,397 on January 13 however has began to bounce again from that drop. Consequently, its complete market worth has elevated by 3.12% to $2.02 trillion in sooner or later.

Potential Bitcoin Reserve May Create New ATH

A number of analysts have seen that Bitcoin’s value and the probabilities of organising a Bitcoin reserve usually enhance collectively. Each time Bitcoin’s value goes up, it appears extra seemingly {that a} Bitcoin reserve shall be created.

Bitcoin’s value went up by 8.2% this week however declined 2% within the final 30 days. Yesterday, Bitcoin’s value shortly went over $102,000 earlier than falling a bit. That is the primary time it has reached this value since final Tuesday, January 7.

A number of causes brought on this value leap. One major cause is the upcoming U.S. presidential inauguration on January 20, which has introduced plenty of curiosity to Bitcoin and different cryptocurrencies with the potential of organising a Bitcoin reserve.

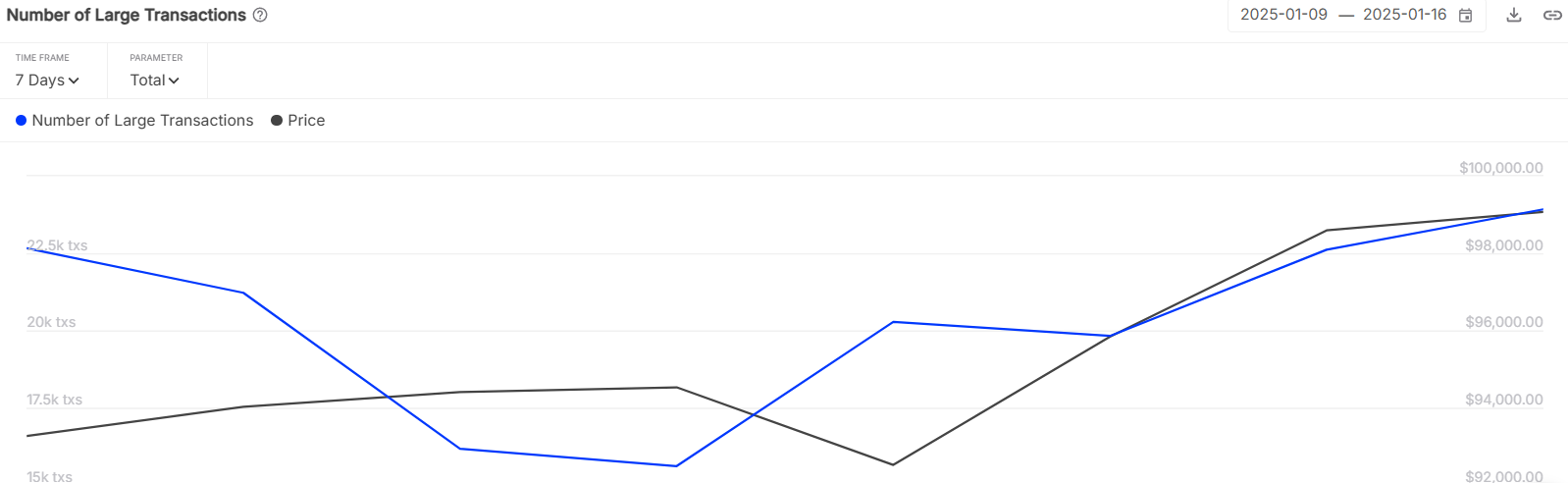

As Bitcoin’s value retains going up, there’s extra exercise from massive buyers, usually known as “whales.” In keeping with information from IntoTheBlock, the variety of giant Bitcoin transactions has jumped from 15,620 to 23,920. This enhance means that these massive buyers are enjoying a big function within the rising value of Bitcoin.

Bitcoin Worth Prediction: Technical Evaluation

Bitcoin value easily surged from its $100K degree and broke the $102,000 degree. Although it’s dealing with minor promoting strain across the quick Fib channel, BTC may quickly overcome the extent. As of writing, BTC value trades at $102,666, surging over 3.8% within the final 24 hours.

The BTC/USDT buying and selling pair continues to hover round $102K, which might be a serious impediment. If the worth falls under the EMA20 development line on the 1-hour chart, the sellers will seemingly attempt to push it again all the way down to $95,000.

Nonetheless, if the worth manages to carry above $102K, it could favor the patrons. The buying and selling pair may then enhance to $108,256, and presumably attain $111K afterward. If it surpasses this degree, the subsequent goal might be above $125,000. We anticipate a minor upward correction because the RSI degree is at 73, suggesting an overbought situation.

Bitcoin Worth Prediction: What to Anticipate Subsequent?

Quick-term: In keeping with BlockchainReporter, BTC value may proceed to battle round $102K. Nonetheless, the strain may quickly weaken, leading to a consolidation under $105K.

Lengthy-term: In keeping with Coincodex’s newest Bitcoin value prediction, Bitcoin’s value is anticipated to extend by 24.37% and attain $126,849 by February 16, 2025. Coincodex’s technical indicators counsel a bullish sentiment, whereas the Concern & Greed Index signifies a degree of 75, categorized as Greed. Over the previous 30 days, Bitcoin has had 14 out of 30 inexperienced days, displaying a value volatility of two.59%. Based mostly on this forecast, it’s presently a great time to purchase Bitcoin.

How a lot is Bitcoin value at present?

Bitcoin value is buying and selling at $102,666 on the time of writing. The BTC value has elevated by over 3.8% within the final 24 hours.

What’s the BTC value prediction for January 17?

All through the day, Bitcoin value may consolidate round $102K-$104K. If it breaks above, we would see $108K at present. On the draw back, $97K is the decrease vary.

Is Bitcoin a Good Purchase Now?

In keeping with long-term forecasts, Bitcoin value may attain $126,849 by February 16. This makes BTC value a great funding contemplating its month-to-month yield.

Funding Dangers for Bitcoin

Investing in Bitcoin could be dangerous as a result of market volatility. Traders ought to:

- Conduct technical and on-chain evaluation.

- Assess their monetary scenario and danger tolerance.

- Seek the advice of with monetary advisors if needed.