Bitcoin (BTC) worth’s latest journey has been a bumpy one, with its worth seeing a pullback to round $93.5K. This brings into focus the vital $91K degree, which serves as the common price foundation for short-term holders.

BTC Value Takes a Hit

Presently, Bitcoin‘s capacity to maintain above this worth is essential for sustaining the bullish sentiment that pervades the market. Ought to this degree maintain, it would restore confidence amongst traders, doubtlessly setting the stage for a restoration.

Nevertheless, those that purchased in at or above $100K at the moment are going through unrealized losses. The choice of this group to carry or promote might be pivotal. In the event that they select to dump their holdings, we might see elevated promoting strain, which could drive costs down even additional.

Conversely, their resolution to carry might assist stabilize the market, permitting Bitcoin to consolidate and maybe climb again. The resilience of the $91K help degree is below scrutiny. If this help holds, it might reinforce investor confidence, probably initiating a restoration part.

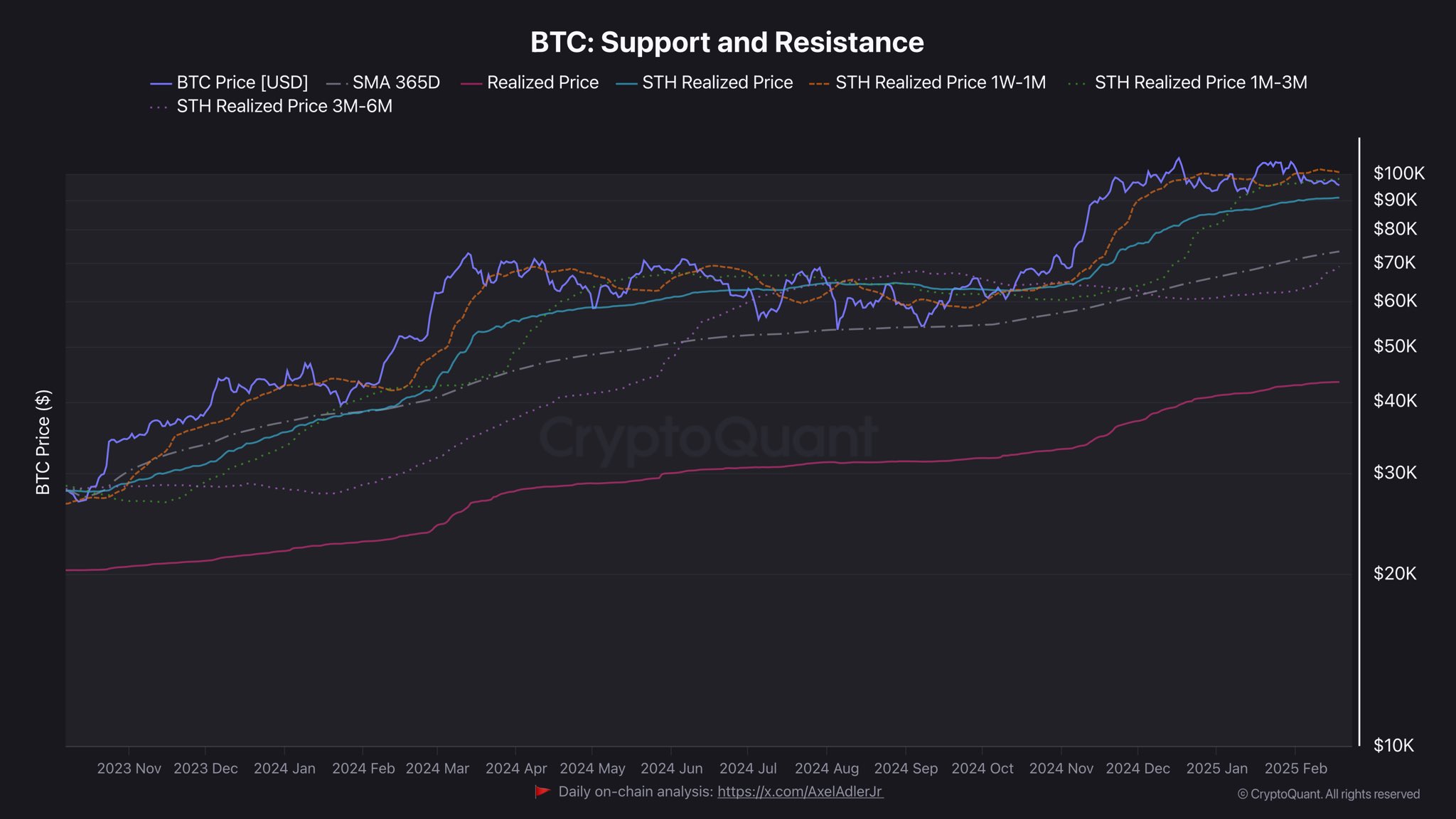

BTC worth help and resistance | Supply: CryptoQuant

Presently, BTC continues to vary because it trades above $96K following that fall. But when it fails, BTC might discover itself testing the subsequent vital help on the Realized Value degree, which is progressively decrease, indicating potential spots for renewed shopping for exercise primarily based on historic conduct.

A breach under $91K would possible result in additional corrections, testing decrease helps at round $70K as proven by historic realized costs. This might take a look at the market’s energy and the resolve of long-term holders, probably resulting in a bearish part.

BTC worth’s future actions hinged considerably on its capacity to carry on the $91K degree. A profitable maintain might result in market stabilization and a gradual restoration in direction of ranges above $100K.

Nevertheless, failing this take a look at might set off a sharper decline, difficult the conviction of long-term holders and setting a bearish tone for the market.

Bitcoin Coinbase Premium Index

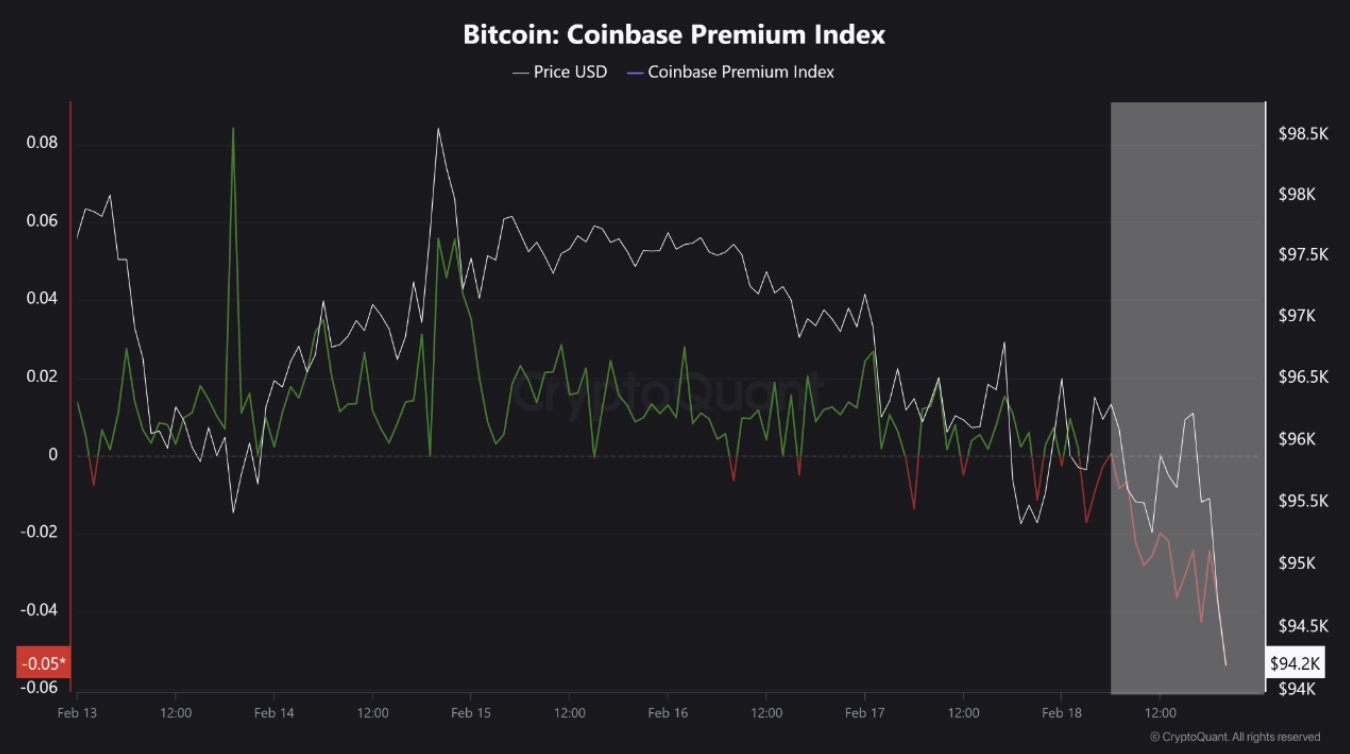

Additional evaluation of the Coinbase Premium Index, which gauges the worth distinction between Bitcoin on Coinbase and its worth on Binance, took a nosedive proper after U.S. markets opened, a sign of volatility.

This sudden drop, from a near-zero to -0.05, mirrored a shift in buying and selling conduct, suggesting that merchants on Coinbase have been offloading Bitcoin at decrease costs in comparison with Binance.

Because the index fell, so did BTC worth, tumbling from $96,000 to about $94,200. This instructed that demand for BTC and different cryptos was low doubtlessly as a result of fall in costs within the broader market.

Bitcoin Coinbase Value Index | Supply: CryptoQuant

This adverse premium is a purple flag, hinting that investor sentiment on Coinbase has turned bearish, possible influencing the broader market. If this development persists, Bitcoin might face additional declines as confidence wanes.

Nevertheless, if the premium swings again to constructive, it would point out easing promoting strain, doubtlessly stabilizing and even boosting Bitcoin’s worth.

This index might provide key insights into market sentiment and upcoming BTC worth actions. It might make it a vital indicator for merchants monitoring inter-exchange dynamics.