Analysts reported that the crypto group is witnessing a decline within the shopping for strain for Bitcoin, pushing the firstborn cryptocurrency into adverse territory.

Nonetheless, some market observers famous that not all is misplaced within the current slide of Bitcoin, saying what appears to be an unfavorable situation affords alternatives for long-term traders.

Downward Development

Analysts mentioned {that a} weakening shopping for strain on Bitcoin is likely to be a cue that the crypto is getting into a downward pattern part with some observers saying that BTC is already inside the adverse strain zone.

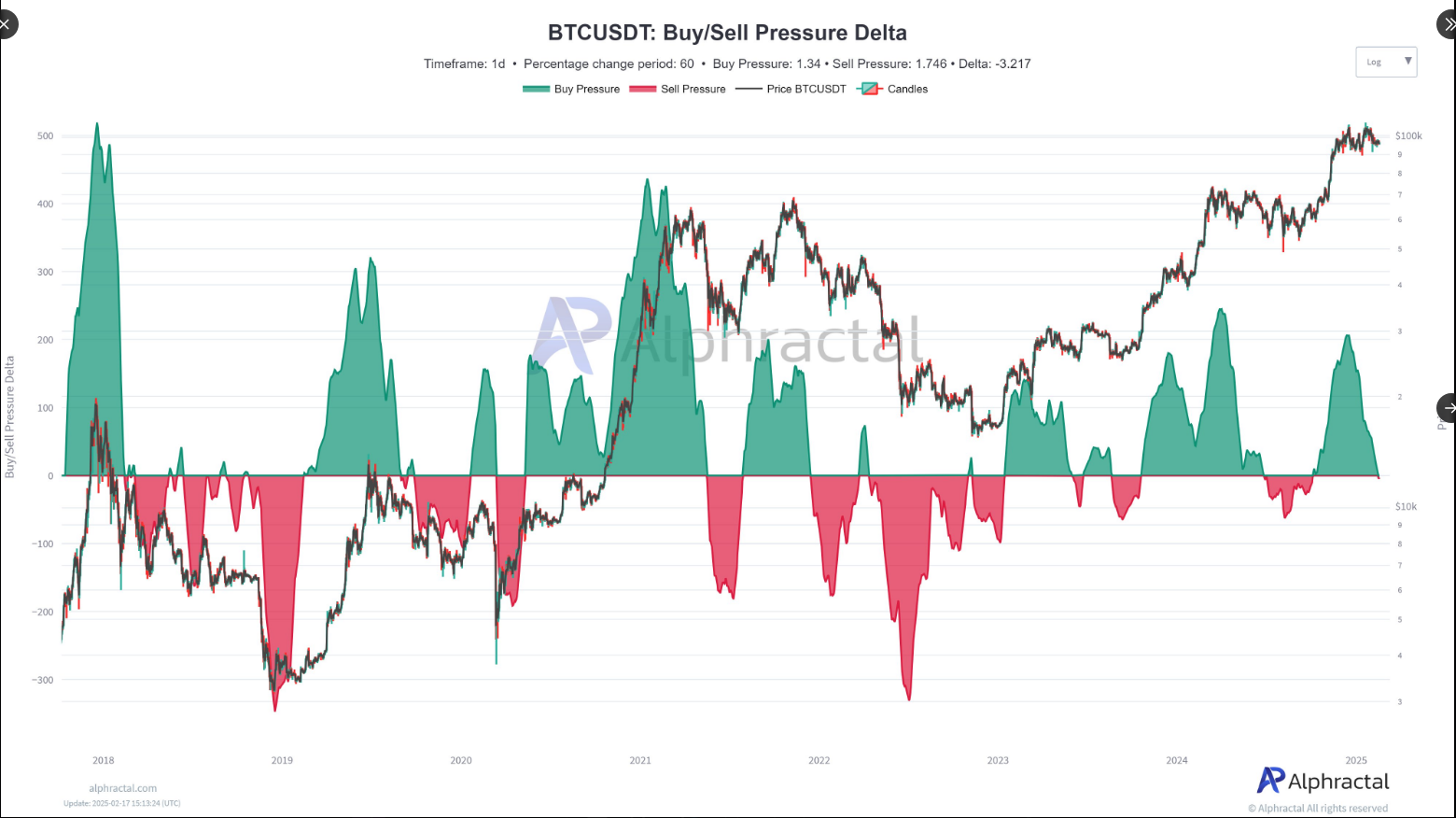

“Bitcoin’s shopping for strain has decreased over the past 60 days, permitting room for promoting strain,” Joao Wedson, Founder & CEO of Alphractal, mentioned in a put up.

Bitcoin’s shopping for strain has decreased over the past 60 days, permitting room for promoting strain. Unfavorable areas current two alternatives:

🔸Favoring quick positions

🔸They sign that the downtrend might proceed or has occurred, creating a chance to build up BTC. pic.twitter.com/dApRsS9Ihf— Joao Wedson (@joao_wedson) February 17, 2025

Crypto analysts famous that this situation may result in a decline in value which could possibly be each good and dangerous for digital property merchants.

Knowledge reveals that Bitcoin is having a tough time sustaining a bullish momentum as its value hovers round $95,912 per coin.

Two Alternatives

Wedson mentioned that BTC has been experiencing a decline in shopping for strain within the final two months, noting that the market shift may supply one thing optimistic to its traders.

“Unfavorable areas current two alternatives,” the CEO famous.

He enumerated that among the many alternatives is “favoring quick positions” which could possibly be a great signal for merchants. One other vibrant spot is the weakened shopping for strain that signifies the “downtrend might proceed or has occurred, creating a chance to build up BTC.”

In different phrases, the present situation of Bitcoin may give traders an opportunity to construct their BTC portfolio by shopping for extra cash.

The Purchase/Promote Strain Delta Chart

In a put up, Wedson offered two charts of the Purchase/Promote Strain Delta as an example the shifting dynamics between shopping for and promoting exercise in Bitcoin, which has been occurring previously 60 days.

Wedson defined that if the market is dominated by promote strain, traders can make the most of the downward momentum by getting into quick positions.

In accordance with historic knowledge, adverse strain zones normally align with a continued lower in value, a doubtlessly worthwhile alternative for merchants betting on additional value declines.

In the meantime, the Alphractal government confirmed within the graph {that a} excessive promote strain generally signifies a bearish sentiment, including that this can be a nice alternative for long-term merchants to extend their BTC holdings.

Analysts defined accumulating extra Bitcoin throughout this era permits long-term traders to place themselves for a future restoration.

“The lower in shopping for strain is a major issue to contemplate. Whereas quick positions might sound enticing in a downtrend, the potential for accumulation additionally presents a compelling long-term technique,” a crypto investor commented on Wedson’s put up.

Bitcoin may proceed to be susceptible to additional decline if the shopping for strain stays weak.

Featured picture from The Unbiased, chart from TradingView