Bitcoin (BTC) is pushing to regain its six-figure valuation following a interval the place it risked falling beneath $90,000 help zone. Nonetheless, on-chain information suggests a brand new file excessive might be on the horizon amid the latest volatility.

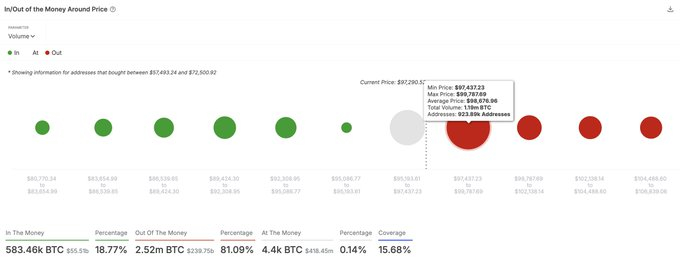

Particularly, information signifies that Bitcoin is presently hovering close to a essential worth vary between $97,500 and $99,800, the place over 924,000 addresses beforehand bought greater than 1.19 million BTC.

To this finish, outstanding on-chain cryptocurrency analyst Ali Martinez recognized this zone as a ‘brick wall’ because of the magnitude of Bitcoin collected at these ranges, he stated in an X publish on December 21.

“Bitcoin faces a brick wall between $97,500 and $99,800. <…> If BTC can handle to interrupt above this stage, we may see new all-time highs quickly,” Santana famous.

A breakdown of the information exhibits that wallets holding roughly 583,460 BTC are presently worthwhile, representing 18.77% of the market. Alternatively, 2.52 million BTC, or 81.09%, is held at larger ranges, awaiting worth restoration, whereas a minimal 4,400 BTC is sitting at breakeven.

Usually, a break above the $97,500-$99,800 vary would sign robust bullish momentum and presumably set off ‘Concern of Lacking Out’ (FOMO) from buyers on the sidelines.

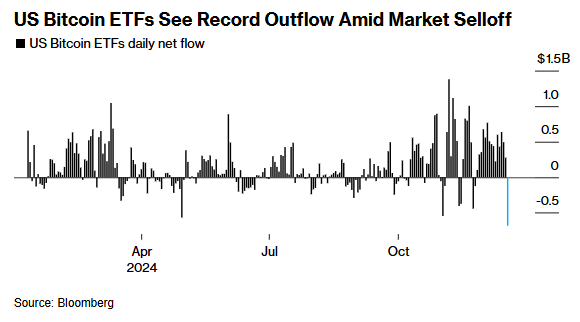

This projection comes after Bitcoin briefly dipped to $92,000 earlier than rebounding because the cryptocurrency market skilled sustained volatility. Notably, these situations had been triggered by the Federal Reserve, which signaled the potential of fewer rate of interest cuts in 2025.

Certainly, this state of affairs noticed the market file important outflows that additionally impacted spot exchange-traded funds (ETF). To this finish, on December 19, Bitcoin ETFs recorded a $680 million outflow, the biggest of their historical past.

What subsequent for Bitcoin?

Following the latest worth motion, cryptocurrency buying and selling skilled Alan Santana harassed in a TradingView publish on December 21 that the latest drop will not be trigger for concern.

Santana acknowledged that the drop to $92,000 must be thought of a wholesome correction. The cryptocurrency has already rebounded to $97,000, reinforcing its bullish momentum.

The skilled highlighted that $90,000 stage, aligning with the 55-day Exponential Shifting Common (EMA) on the each day chart, is a essential help stage that continues to be untested—an indication of market power.

Whereas $100,000 was quickly breached, it stays inside attain for one more try. Santana famous that longer-term projections level to key Fibonacci extension ranges at $113,968, $138,794, and $163,620 as Bitcoin advances.

General, he attributed the shakeout to profit-taking by main buyers as a part of a broader bullish development that continues to unfold. Santana urged that the subsequent major progress section may decide up velocity by late February, whereas intervals of consolidation and altcoin growth present interim alternatives.

“Bitcoin gained’t transfer in a single day, it takes time to develop. We’re two months, late February, for optimum velocity and most progress. However we will expertise some excessive, some sideways, some consolidation whereas the Altcoins develop,” he stated.

Bitcoin worth evaluation

Bitcoin was buying and selling at $98,510 by press time, rallying over 3.5% within the final 24 hours. On the weekly chart, BTC is down 3%.

As issues stand, Bitcoin’s technical setup is pointing to a continuation of renewed bullish momentum, with the asset effectively positioned above its 50-day easy shifting common ($91,185) and the 200-day SMA ($69,891).

Regardless of this, market sentiment is bearish, although the Concern & Greed Index sits at 73 (Greed), reflecting investor confidence. The 14-day Relative Energy Index (RSI) at 50.65 signifies impartial momentum.

General, consideration is on bulls to maintain the continuing momentum and assist Bitcoin set up its worth above $99,000 for a attainable stab at a brand new file excessive.

Featured picture by way of Shutterstock