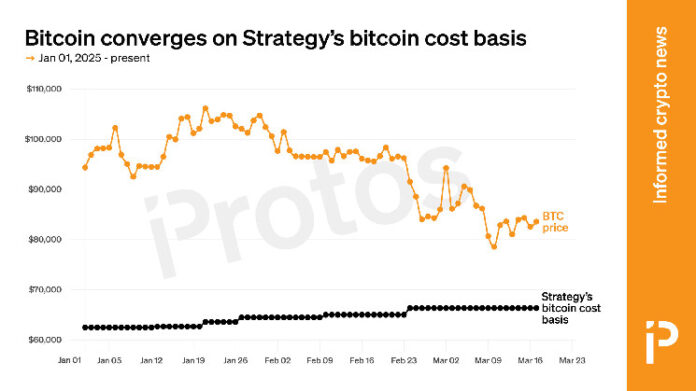

As bitcoin’s (BTC) worth has fallen since Donald Trump took workplace, it’s converging towards the company price foundation at Technique.

Michael Saylor’s big BTC holding firm owns 499,226 cash acquired for a mean of $66,360 apiece. Immediately, a concerningly slim, 27% cushion separates BTC’s declining worth from the corporate’s price foundation.

For years, Technique (previously MicroStrategy) loved a beneficiant worth cushion between BTC and its prior purchases. For instance, in celebration of Trump’s January 20 inauguration, BTC hit an all-time excessive of $108,786 — 73% above Technique’s common buy worth of $62,691 on the time.

There have been even higher occasions, resembling 2021 or mid-2024, when the value of BTC was greater than double Technique’s price foundation.

Nonetheless, crypto entered a bear market shortly after Trump entered the White Home. The president continued to advertise memecoins, declined proposals for getting Saylor’s beneficial 4 million BTC or Cynthia Lummis’ beneficial 1 million BTC for any US Strategic Bitcoin Reserve, and vacillated on tariff insurance policies that decimated broad markets, together with BTC.

As BTC’s worth has declined, it has revealed Saylor’s dwindling energy. Though the run-up to Trump’s inauguration was an excellent setting for him to inform tales about what BTC might do throughout Trump 2.0, the world is studying what the forex is definitely doing throughout Trump 2.0.

To date, it’s not doing properly.

Click on to enlarge

BTC worth cushion and Technique share premium down 50% YTD

Bitcoin is presently buying and selling round $84,500 and has wiped roughly 50% off Technique’s price foundation cushion because the day Trump took workplace. The premium traders are keen to pay for Technique shares (MSTR) above its BTC holdings has equally halved from above 3.4X on November 20 to roughly 1.8X per primary share at present.

Most of Technique’s BTC purchases since November 18, 2024, are within the pink. On November 18, Technique purchased 51,780 BTC at $88,627. Since then, it made a number of extra massive BTC purchases, together with 4 purchases over $100,000.

Naturally, this induced Technique’s greenback price common to spike from slightly below $40,000 initially of November to its present $66,360.

Saylor lately introduced his intention to purchase a memetic amount of BTC: $21 billion. In fact, he has not truly bought that a lot but. On March 10, he introduced the beginning of the popular share sale. To this point, he hasn’t even spent his first billion.

This morning, Technique introduced it had bought 130 BTC — its second-smallest buy in historical past moreover a paltry 32 BTC purchase in late March 2024.

Learn extra: Why have MicroStrategy insiders been dumping MSTR?

The lengthy highway to $21 billion extra bitcoin

It’s too early to inform whether or not this morning’s comparatively small BTC buy is an indication that Saylor is dialing again his intentions.

The lengthy highway from at present to really spending $21 billion to accumulate BTC can be an instance of the issue of holding a company’s price foundation down and never converging towards BTC’s worth itself.

There are claims that Technique’s purchases straight influenced the value of BTC in 2024, with one estimate suggesting that the corporate was behind 28% of final 12 months’s capital inflows.

That’s removed from a holistic evaluation of all sources of demand for BTC, nevertheless, with different estimates putting Technique under 1% of BTC buying and selling volumes — most of which is offshore, crypto-to-crypto, and never traceable to USD.