- The height was at $94K, now right down to $86K because the promoting elevated.

- It was above the value peak 54 weeks after the ETF launch, simply as QQQ.

- Retail merchants moved funds into new tokens, weakening Bitcoin’s rally.

It’s following a historic ETF cycle sample and peaking at $94,468 earlier than entering into for a correction section. The extended impact of promoting continued available in the market from January 20, 2025, with Bitcoin at the moment priced at $86,170. The share deducted weekly is a big 8.64. The timing is exactly a yr and per week after the launch of the Bitcoin ETF in 2024, nearly the identical as a sample with its earlier counterpart, the Nasdaq QQQ ETF, launched in 1999. Analysts have famous that QQQ additionally topped 54 weeks post-launch earlier than coming into a protracted correction, suggesting that Bitcoin could also be following the identical path.

I nonetheless take into consideration the QQQ and BTC ETF comparability so much, although I maintain eager to see some sort of divergence. However reasonably than diverge, they proceed to current similarities.

I see lots of people screaming that it is the golden age of crypto however Bitcoin has principally achieved… https://t.co/y7NNeyyvs8 pic.twitter.com/o6AOl7j2N1

— Benjamin Cowen (@intocryptoverse) March 8, 2025

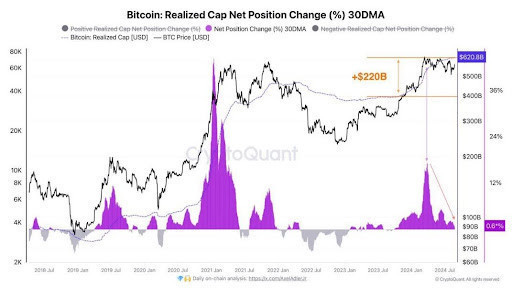

Designated as “Inauguration Day” on January 20, 2025, presumably culminated in a serious paradigm shift for the market members. Some would most likely nonetheless suppose Bitcoin had an upward path from that day on. Nevertheless, from that cut-off date, Bitcoin has been on a downward journey. Merchants have grown paranoid with the historic comparisons to QQQ ETF as a result of each devices achieved all-time highs on the 54-week mark after which noticed very robust resistance. The post-ETF eruption that lifted the cryptocurrency from just under $30,000 to just about $100,000 could have run out of steam, and liquidity has began to maneuver away from the crypto house.

Retail Liquidity Drained as Market Faces Correction

Market correction is one other issue that has affected Bitcoin’s worth downwards, aside from the ETF cycle. For instance, the sight of all these new movie star and political-sponsored meme cash has achieved very nicely at attracting retail cash from Bitcoin. Capital rotation was created by the sudden surge in all new tokens, whose induction subsequently weakened Bitcoin’s skill to maintain its highs. Thus, as retail buyers busily commit their sources to speculative tasks, dominance over Bitcoin steadily started loosening, feasting additional into the present downtrend.

As long as Bitcoin continues to observe QQQ, there may be loads of room for the market to finish up consolidating for some years. For peak efficiency, QQQ performed a spread recreation for years earlier than returning to the uptrend. The identical would possibly occur to Bitcoin, the place the long-term resistance band will likely be from $80K to $100K. This correction may proceed for much longer relying on the overall liquidity development or institutional positioning. Merchants’ optimism relating to the bounce however, historic precedent would recommend that Bitcoin would possibly want to sit down by means of a prolonged accumulation interval earlier than reclaiming its earlier highs.