Donald J. Trump gained because the forty seventh POTUS and ushered in fairly a Bitcoin and shares rally. Now, that rally has met unexpected issues. In keeping with information from IntoTheBlock, there was a major drop within the quantity of Bitcoin held by short-term merchants.

Per on-chain information, short-term BTC reserves have reached the bottom level since mid-November 2024. Analysts attribute this to diminished curiosity from speculative merchants. Additionally, there’s a decline in new market entrants. The development additionally suggests the market is consolidating as traders await clearer worth motion alerts.

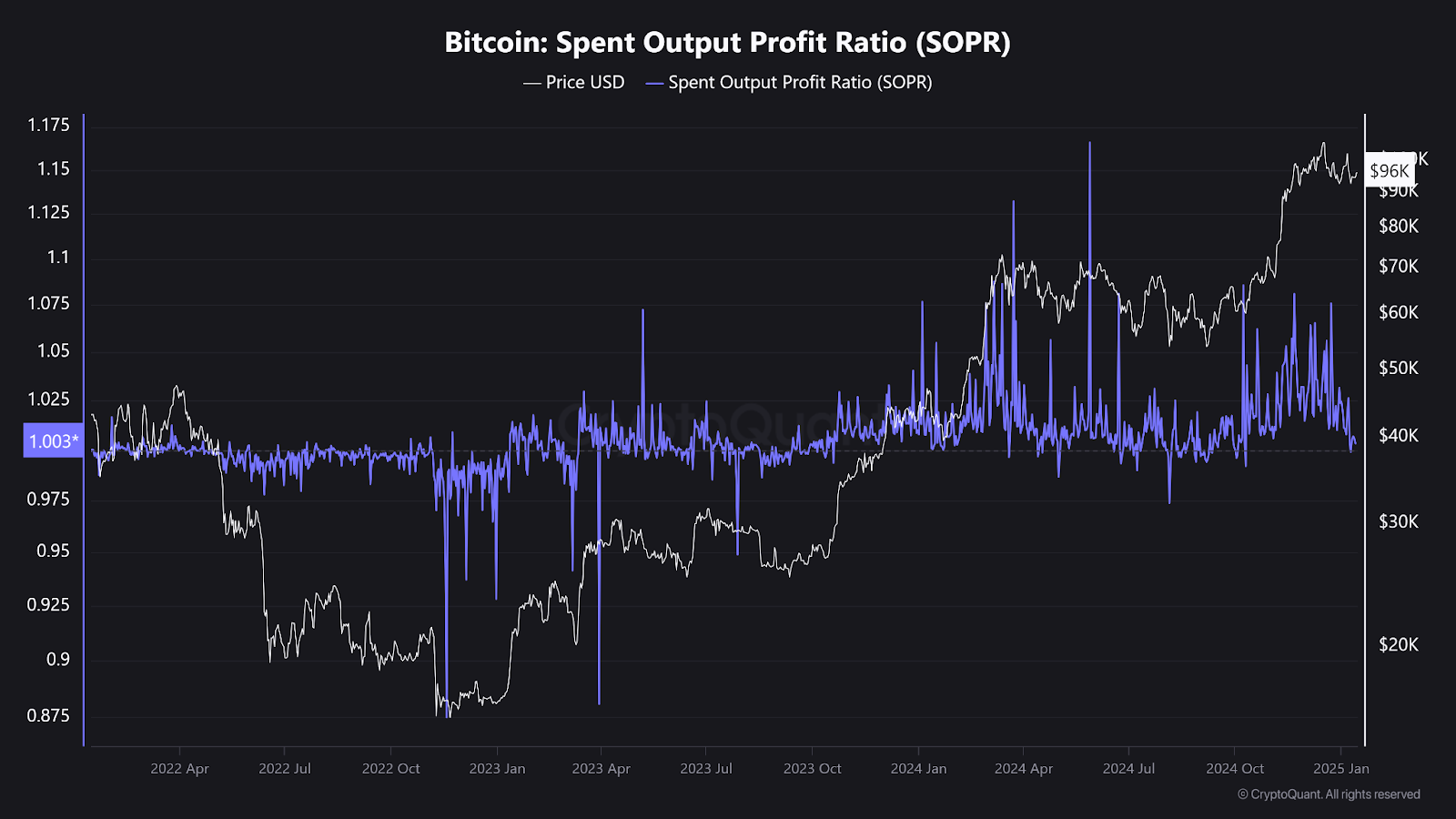

As well as, a number of merchants on social media have pointed to latest declines. The Bitcoin Spent Output Revenue Ratio (SOPR) for short-term holders is weak.

BTC SOPR chart | Supply: CryptoQuant

The chart above exhibits a transfer from profit-taking to loss realization. The 7-day easy transferring common (SMA) of the STH SOPR dropped to 0.99. To that finish, loss realization now barely exceeds worthwhile gross sales.

As well as, it may imply these merchants have been promoting cash whereas counting losses greater than income. This has prompted them to carry off on making gross sales.

Over the last months of 2024, when BTC hit highs, the SOPR spiked above 1. It is because bulls had been having fun with a interval of profit-taking. Nevertheless, the following market crash has led short-term holders to liquidate positions at a loss.

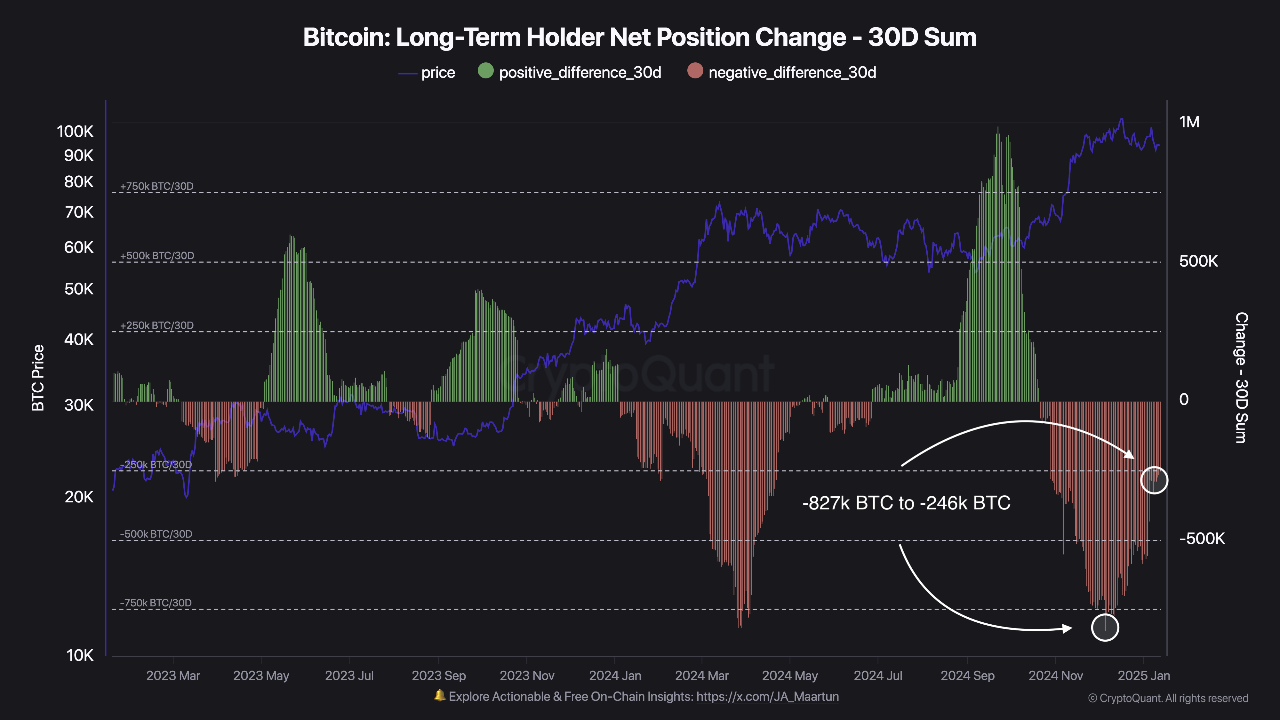

Lengthy-term holder’s exercise alerts declining promoting stress

Over the last 12 months, BTC holdings amongst long-term traders have additionally proven a reducing development. In keeping with CryptoQuant’s Darkfost, the web place change of long-term holders peaked at −827,000 BTC. This was when Bitcoin’s worth reached $97,000 on December 5.

Bitcoin long-term holders market exercise | Supply: CryptoQuant

Nevertheless, this determine has since recovered to −246,000 BTC. This means a threefold discount in promoting stress. This shift suggests long-term holders have gotten much less inclined to promote at present worth ranges. This comes at the same time as Bitcoin’s worth traits downward.

Over the previous 12 months, the quantity of Bitcoin held by long-term holders has been declining.

The pink arrows on the chart under spotlight comparable durations in previous cycles.

Whereas these indicators do not exactly forecast worth peaks, it is vital to grasp that long-term… pic.twitter.com/fllfjl4B6V

— IntoTheBlock (@intotheblock) January 13, 2025

Darkfost says that whereas the market stays in a corrective section, the diminished promoting stress from long-term holders is a optimistic sign. For the market to transition right into a bullish section, these holders should return to an accumulation section.

One other market dealer, Percival, notes a slight slowdown in on-chain quantity. The quantity now stays at a peak of $12 billion in change inflows and outflows. This exhibits sustained curiosity in Bitcoin regardless of latest worth corrections.

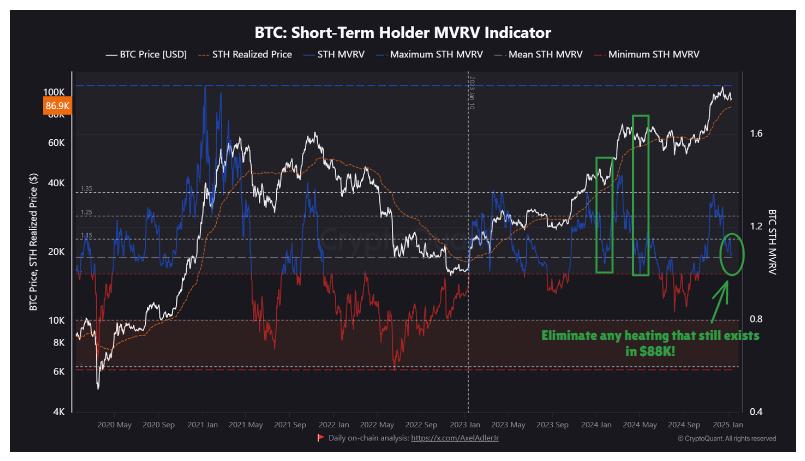

BTC Brief-term buying and selling MVRV chart | Supply: CryptoQuant contributor Percival.

Nevertheless, the analyst clarified that there’s nonetheless a discrepancy between the short-term holder price base of $88,000 and the common of the Brief-Time period Holder Market Worth to Realized Worth (STH MVRV), which may pose issues.

Bitcoin in the midst of a bear-bull race

In keeping with Coingecko’s on-chain information, Bitcoin not too long ago skilled a pointy drop to $89,000. This comes as key short-term assist ranges broke. Nevertheless, the value rapidly rebounded. It’s now holding its earlier key assist degree, breaching the $95,000 worth barrier and altering fingers above it.

This sample is called “cease searching.” It typically alerts elevated volatility and opens the opportunity of a development reversal. Analysts notice that for a full reversal to happen, exercise from main market gamers is important.

Regardless of the potential for a reversal, information from Coinbase Premium Hole (CPG) suggests whale entities stay centered on promoting.

In contrast to earlier market dips the place shopping for whales hoarded vital provide, no such exercise has been detected this time.

Market merchants imagine the shortage of noticeable whale exercise from exchanges like Binance reinforces a bearish sentiment available in the market.

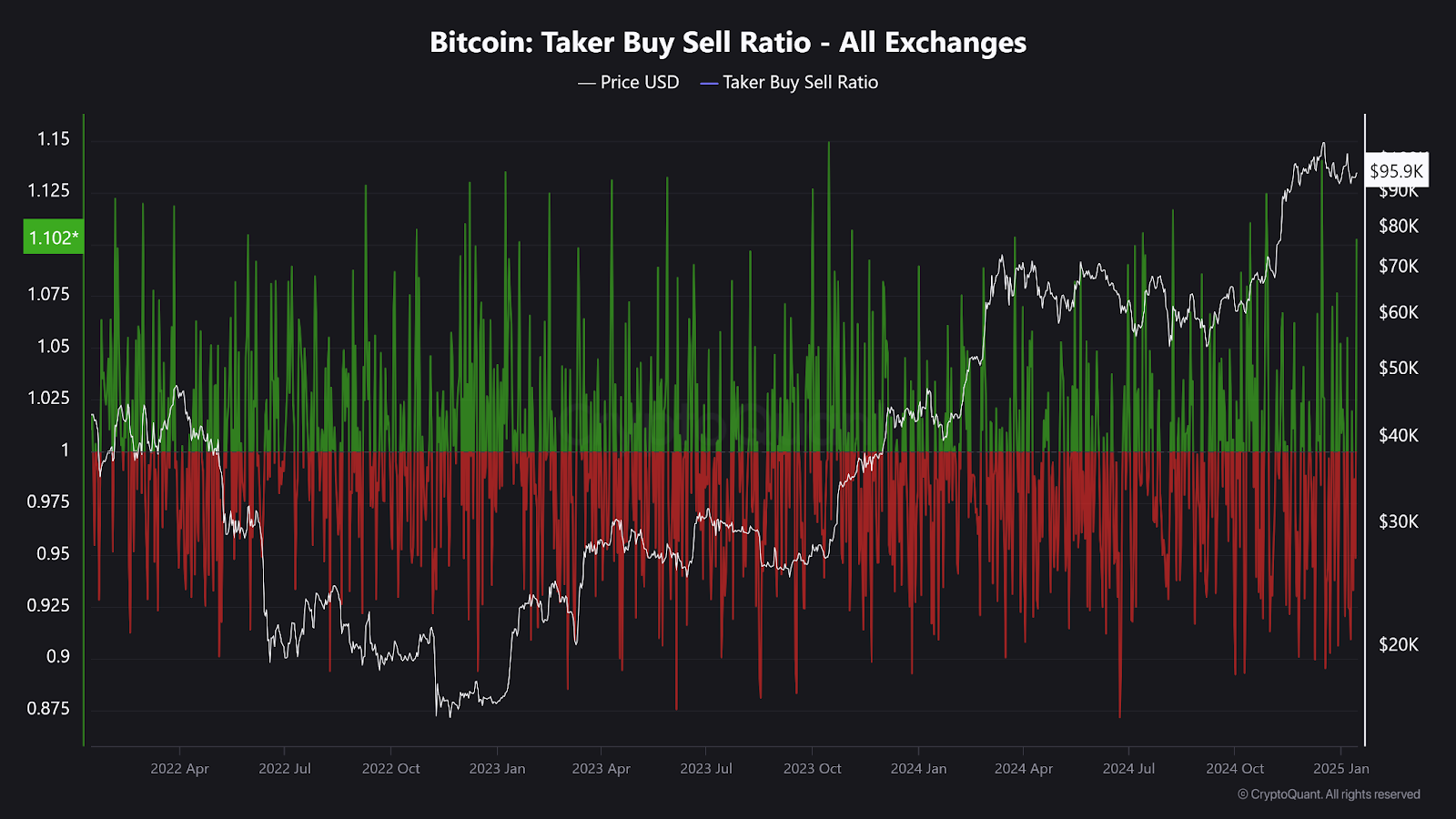

Indicators level to short-term promoting stress

In the meantime, indicators just like the Take Purchase Promote Ratio replicate a dominance of market promoting. At current, provide exceeds demand within the brief time period. This habits typically coincides with vital profit-taking at resistance ranges, main to cost corrections that precede “sideways” buying and selling durations.

BTC Taker Purchase Promote Ratio chart | Supply: CryptoQuant

Brief-term holders have been driving latest promoting exercise. They typically liquidate positions with little to no revenue, contributing to elevated market volatility and putting downward stress on BTC’s worth.

On the value chart, a bearish construction seems to be forming. There’s a excessive chance of continued declines within the coming weeks.

A Step-By-Step System To Launching Your Web3 Profession and Touchdown Excessive-Paying Crypto Jobs in 90 Days.