For a lot of buyers, 2025 looks as if an especially bullish yr for the broader crypto market. However on the primary day, Bitcoin (BTC) faces intense promoting strain on day one, which has raised considerations concerning the flagship cryptocurrency’s capacity to interrupt above $95,000.

On this evaluation, BeInCrypto examines Bitcoin’s short-term worth outlook utilizing key indicators.

Bitcoin Buyers Put Sustained Uptrend in Doubt

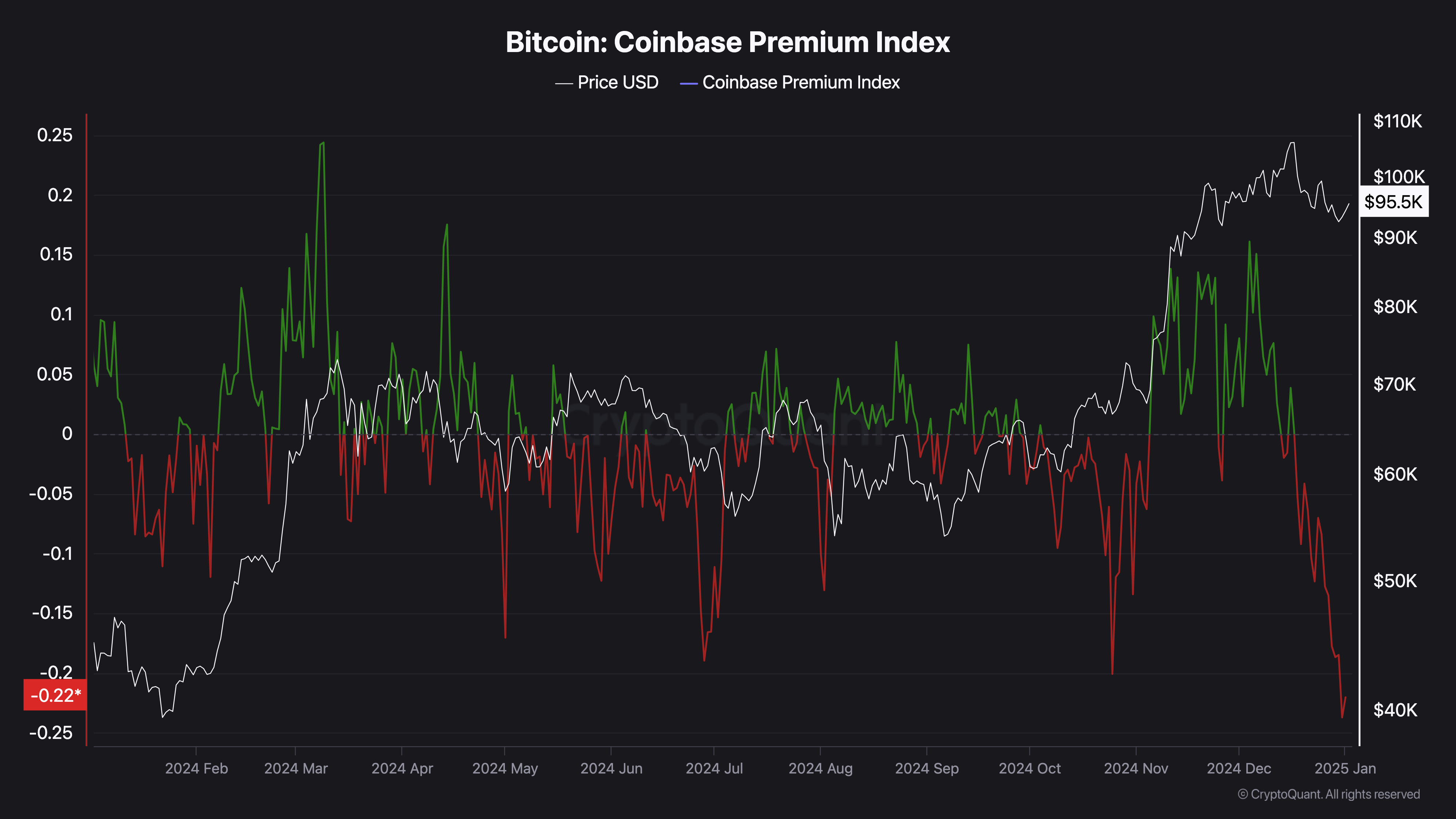

After the US elections in November 2024, the Bitcoin Coinbase Premium Index climbed to 0.14. The Coinbase Premium Index measures whether or not there’s sturdy shopping for strain amongst US buyers or whether or not they’re promoting in massive volumes.

Excessive values, like these in November, point out sturdy promoting strain. Nonetheless, as of this writing, the index has dropped to -0.22, the bottom stage within the final 12 months. This important decline signifies that Bitcoin buyers within the US are promoting their property.

Regardless of that, Bitcoin worth trades at $95,318, representing a gentle 2.06% improve within the final 24 hours. Nonetheless, ought to these buyers proceed to let go of their BTC, this development may change, and the worth of cryptocurrency may slide decrease.

Bitcoin Coinbase Premium Index. Supply: CryptoQuant

Following this growth, crypto analyst Burak Kesmeci famous that it may change into troublesome for the Bitcoin worth to climb.

“Such tendencies can create a difficult atmosphere for Bitcoin’s short-term worth restoration until we see a shift in macroeconomic circumstances or renewed curiosity from institutional or retail patrons,” Kesmeci opined through CryptoQuant.

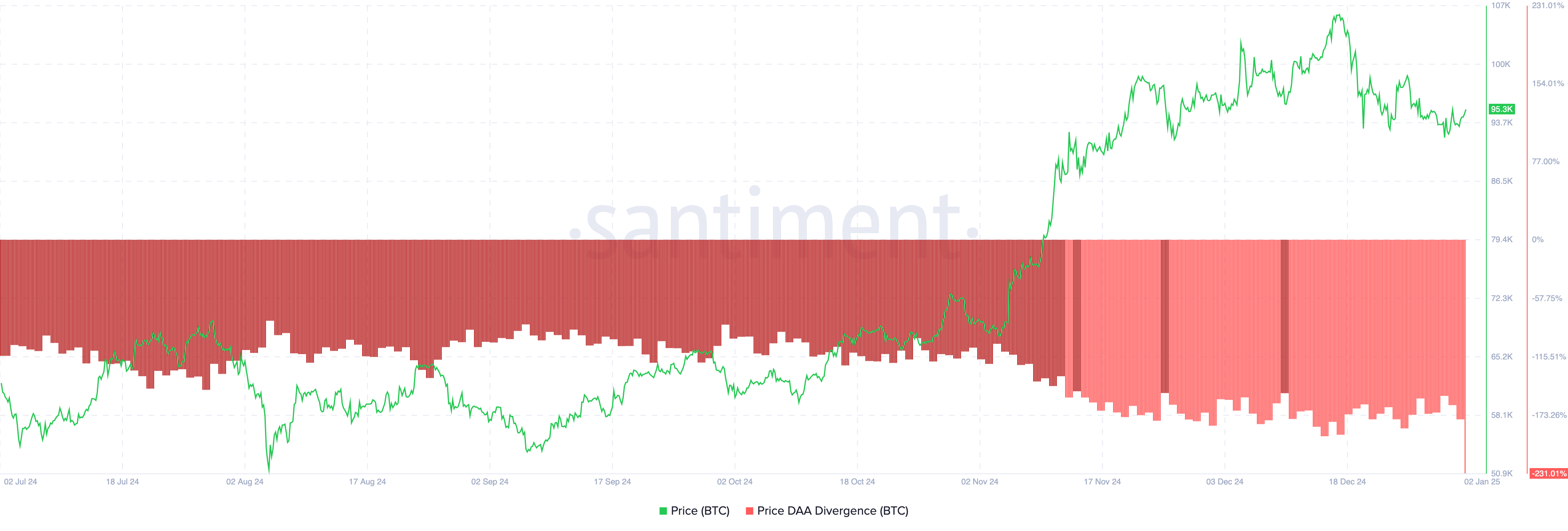

One other indicator that helps this outlook is the worth — Every day Lively Addresses (DAA) divergence. This metric measures the connection between consumer engagement on a blockchain and the worth motion.

When it’s optimistic, it implies that consumer participation has improved, which is bullish for the cryptocurrency. Alternatively, a detrimental studying signifies reducing consumer engagement, which is, in flip, bearish.

Bitcoin Worth DAA Divergence. Supply: Santiment

As proven above, Bitcoin’s worth DAA divergence is all the way down to 231%, indicating the latter. If this development persists, the chance of BTC buying and selling beneath the $95,000 mark may develop even stronger.

BTC Worth Prediction: Sub-$90,000 Ranges Nonetheless Potential

Despite the fact that BTC has not too long ago elevated, the Exponential Shifting Common (EMA) means that the latest upswing may not final. The EMA is a technical indicator that gauges development course relative to the worth.

When the EMA slopes above the worth, the development is bearish. However when the worth is above the indicator, the development is bullish. As of this writing, Bitcoin’s worth is beneath 20 EMA (blue), suggesting that the worth of cryptocurrency may proceed to say no.

Bitcoin Every day Evaluation. Supply: TradingView

Ought to the crypto fail to rise above the 20 EMA and Bitcoin promoting strain will increase, then the worth may drop to $85,851. Nonetheless, if US buyers contribute to Bitcoin’s shopping for strain, this development may change. In that situation, the coin’s worth may bounce to $108,398.