As bitcoin’s valuation experiences a notable upswing, miners are deriving substantial monetary benefits from an elevated hashprice—the metric denoting each day income earned per petahash per second (PH/s) of computational energy dedicated to the Bitcoin community.

BTC Mining Revenues Soar as Hashprice Climbs

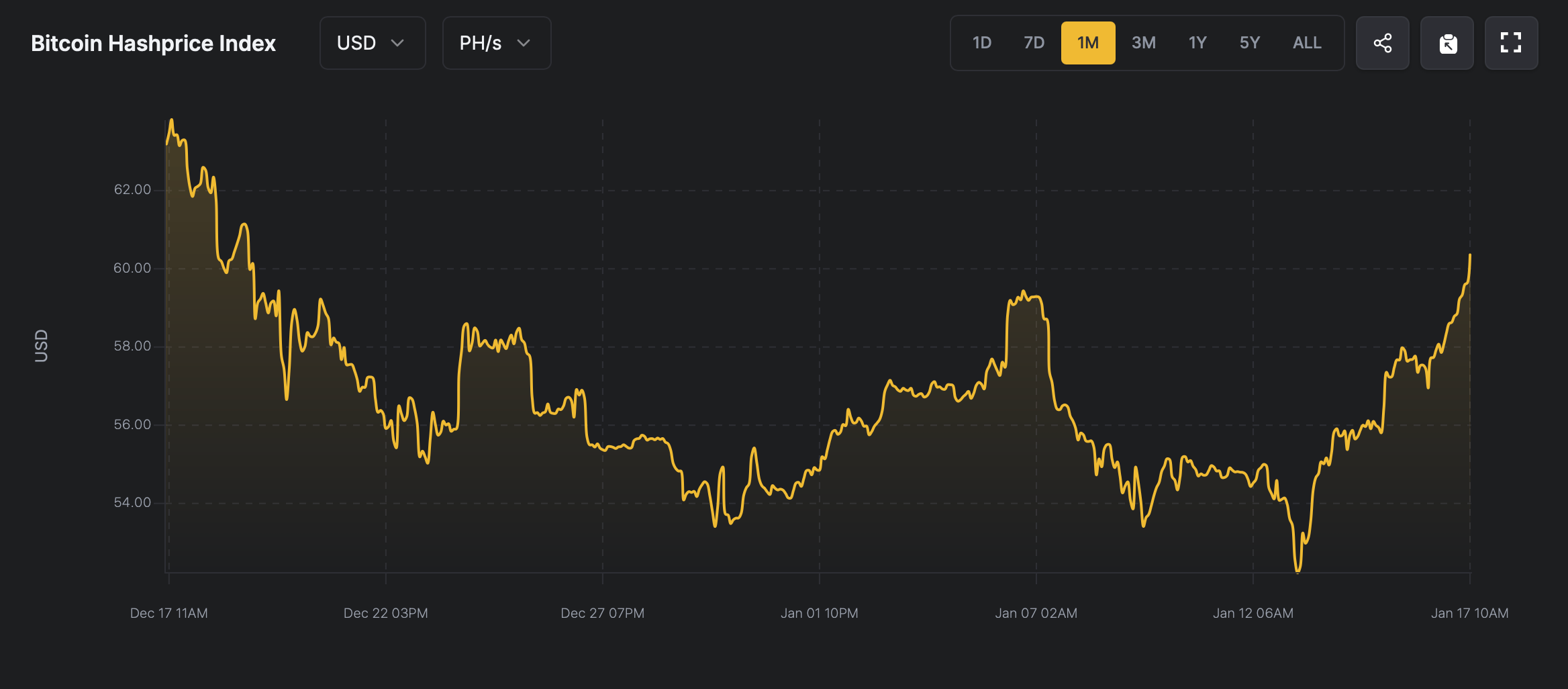

Miners have seen a marked improve in profitability as BTC exceeded the $105,000 threshold on Fri. On Jan. 13, hashprice descended to its lowest stage throughout the previous 30 days, with the valuation of 1 PH/s estimated at $52.22, per knowledge from hashrateindex.com. By right now, this determine has climbed to $60.85 per petahash, reflecting a 16.53% improve since Mon.

Supply: hashrateindex.com

Regardless of this enchancment, present hashprice stays beneath the 30-day peak of $63.81 per petahash, noticed on Dec. 17—a date carefully aligned with BTC’s ascent to $108,364 per coin, an all-time excessive. In the meantime, transaction charges have marginally elevated from Jan. 12, when the typical payment stood at $1.217. Presently, charges quantity to 0.000019 BTC or roughly $1.95, equivalent to 7.4–9 satoshis per digital byte (sat/vB).

The community’s hashrate, nonetheless, stays beneath its Jan. 6 peak of 824 exahashes per second (EH/s), now registering at 788.62 EH/s. Slower block intervals counsel a possible downward adjustment in mining problem, anticipated to happen on Jan. 27. In keeping with projections from hashrateindex.com, the adjustment might end in a 3.06% decline, although this estimation might shift because the week progresses.

As of right now, Foundry instructions the most important share of the community’s computational sources, contributing 33.23% of the whole hashrate, equal to 260 EH/s. Antpool ranks second, managing 138 EH/s, which constitutes 17.62% of the whole, whereas Viabtc follows with 106 EH/s, or 13.6%. Altogether, 69 distinct entities are allocating hashrate to the Bitcoin blockchain as of Jan. 17.