Bitcoin’s worth surge towards the $100,000 mark on December 20 appeared bittersweet for buyers within the US spot Bitcoin exchange-traded funds (ETFs). Whereas Bitcoin briefly exceeded $99,000 earlier within the day, the constructive worth motion contrasted sharply with the online outflows from Bitcoin spot ETFs, which noticed a big drain of capital.

Monday started on a constructive be aware for Bitcoin (BTC) buyers, with the cryptocurrency’s worth rising from round $101,000 to surpass $108,000 by Tuesday, marking a brand new all-time excessive. Expectations had been excessive for a possible rise towards $110,000, particularly following the US fee lower on Wednesday. Nonetheless, Bitcoin’s momentum rapidly stalled, and the cryptocurrency started retracing its positive aspects.

Bitcoin first dropped beneath $100,000, and the promoting strain continued as the worth fell additional, reaching a three-week low of $92,000 on Friday. This prompted hypothesis about whether or not the market was present process a traditional correction or if it was the tip of the continuing bull run.

Report outflows and worth pressures

On December 20, Bitcoin ETFs skilled a web outflow of $277 million, as reported by a number of sources, together with Farside Buyers. The iShares Bitcoin Belief (IBIT) confronted its largest web outflows on report, shedding $72.7 million. In the meantime, Grayscale’s Bitcoin Belief (GBTC) noticed a web outflow of $57.36 million.

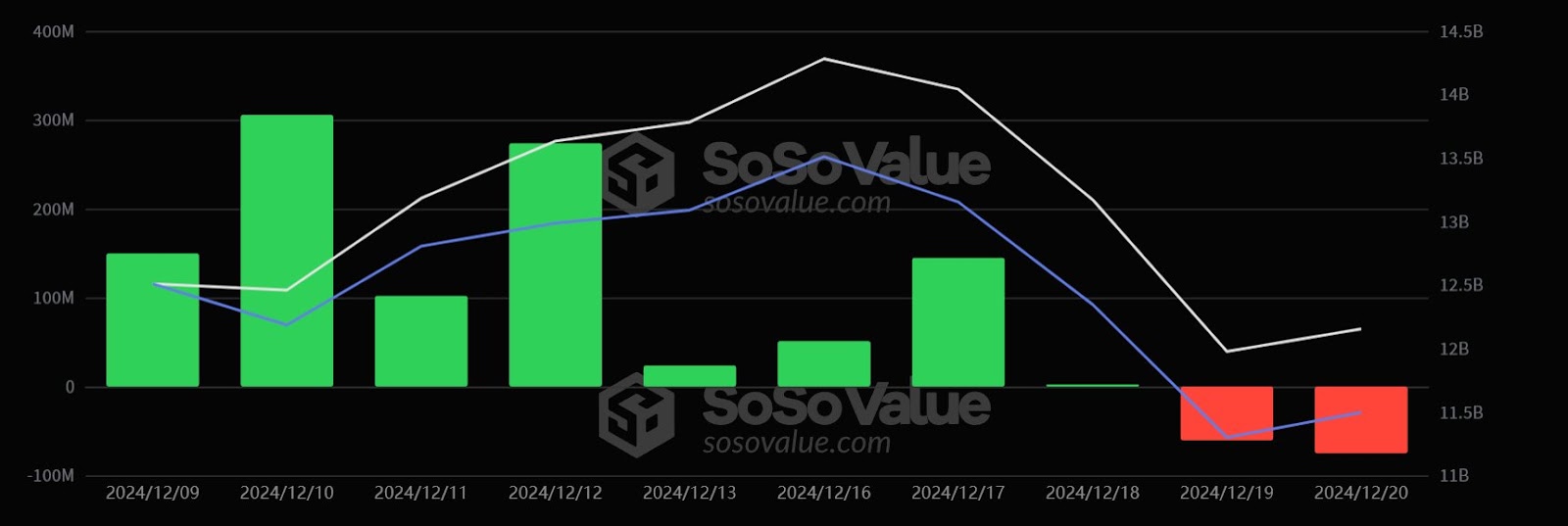

In keeping with Sosovalue knowledge, the full web asset worth of Bitcoin spot ETFs stood at $109.7 billion by the tip of the day, a notable lower from the $121.7 billion recorded on December 17.

Bitcoin spot ETFs outflows – Supply: Sosovalue

This decline in BTC ETF belongings adopted a very powerful day for the sector on December 19, when Bitcoin ETFs logged an astonishing $671.9 million in web outflows, the most important single-day outflow of the yr.

The outflows had been led by Grayscale’s GBTC, which misplaced $208.6 million, adopted by ARK Make investments’s ARKB, which noticed a lower of $108.4 million. These outflows coincided with BTC’s worth dipping to round $96,409, exacerbating the market downturn, which noticed over $1 billion in liquidations inside 24 hours.

Ethereum ETFs additionally expertise outflows

Ethereum’s ETF efficiency mirrored Bitcoin’s struggles on December 20, with Ethereum spot ETFs going through a web outflow of $75.12 million. As reported by Colin Wu, the full web asset worth of Ethereum ETFs stood at $12.16 billion, with cumulative web inflows reaching $2.33 billion.

Ethereum spot ETF had a complete web outflow of $75.1159 million on December 20, and the full web asset worth of Ethereum spot ETF was $12.155 billion. The historic cumulative web influx has reached $2.328 billion. https://t.co/Tvs2oCSxTg pic.twitter.com/accHR00Ko3

— Wu Blockchain (@WuBlockchain) December 21, 2024

Whereas Ethereum’s worth suffered throughout the market-wide crash, it confirmed indicators of restoration by mid-week. Ethereum dropped to $3,300 however rebounded to hover close to $3,500, marking a 6% each day enhance.

Patrons return to the market

Bitcoin’s downward spiral slowed in direction of the tip of Friday, and consumers returned to the market, resulting in a resurgence in worth. On December 20, Bitcoin made a formidable rebound, surpassing $99,000 earlier than stabilizing at round $98,500.

Bitcoin’s worth over the weekend – Supply: TradingView

The rebound in BTC’s worth might be attributed, partly, to renewed shopping for exercise, significantly on the most important US trade, Coinbase. After a interval of sell-side strain, consumers started to step in, serving to to halt BTC’s freefall.

“Coinbase shopping for so much since lows,” famous standard dealer Exitpump on X, who pointed to the distinction between shopping for volumes on Coinbase and Binance. This inflow of shopping for help helped buoy Bitcoin’s worth and reversed its latest downward development.

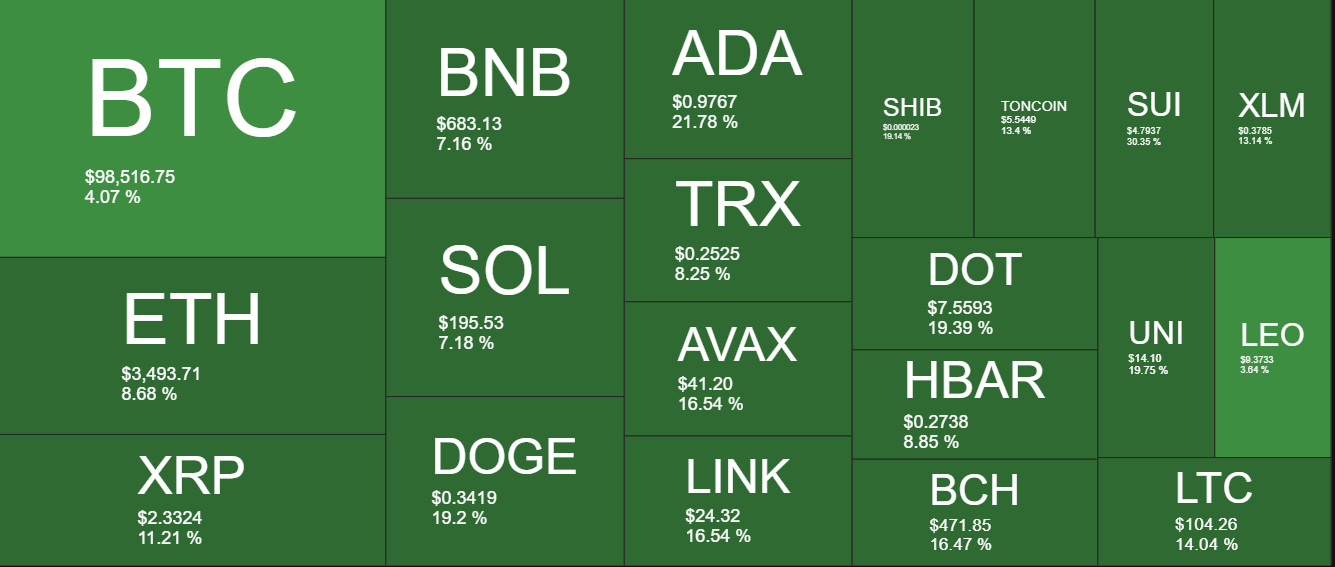

Altcoins get well because the market turns inexperienced

The broader cryptocurrency market, which had been rocked by the sharp downturn earlier within the week, noticed altcoins start to get well. A number of altcoins that had taken important hits throughout the market-wide crash began to realize floor.

Crypto market restoration – Supply: TradingView

BNB, SOL, TRX, and HBAR every posted each day will increase of 5-6%. Extra substantial positive aspects had been seen from the likes of DOGE, ADA, AVAX, LINK, SHIB, TON, and DOT, which noticed double-digit will increase.

Because the market steadied, many altcoins had been recovering their losses, providing a glimmer of hope for buyers after a turbulent interval. The numerous rebound of Ethereum and different high altcoins signaled potential stabilization for the broader cryptocurrency sector, although BTC’s efficiency remained the important thing focus for market members.

With BTC’s worth nonetheless hovering close to $98,500, merchants and buyers are intently monitoring the asset’s subsequent strikes, hoping it’ll regain and preserve ranges above $100,000.

From Zero to Web3 Professional: Your 90-Day Profession Launch Plan