As Bitcoin (BTC) continues to commerce within the low $80,000 vary, a key macroeconomic growth guarantees to profit the main cryptocurrency. If historic patterns maintain true, then BTC is probably not too removed from one other huge value rally.

Rise In M2 Cash Provide To Profit Bitcoin?

Based on an X put up by crypto analyst Grasp of Crypto, a rebound in international M2 cash provide holds the potential to reignite BTC’s bullish momentum. The analyst defined that M2 – a number one indicator – typically predicts important shifts in Bitcoin’s value trajectory.

For the uninitiated, M2 cash provide is a measure of the full cash circulating in an financial system, together with money, checking deposits, financial savings accounts, and different liquid property. It’s a key indicator of liquidity, influencing inflation, financial progress, and monetary markets, together with rising property like Bitcoin.

Grasp of Crypto famous that traditionally, M2 actions are likely to predict BTC’s value momentum with a 70-day lag. The analyst added:

Lately, as M2 started to rebound earlier than BTC, it’s now totally recovered and poised to hit new peaks suggesting BTC may do the identical. Analysts have insights on why this upcoming BTC rally might surpass all earlier ones.

Fellow analyst James echoed these views, highlighting that BTC might expertise one other value rally after a quick interval of dip and consolidation.

Crypto analyst The M2 Man offered additional perception, suggesting that if the 70-day lag holds, BTC’s subsequent rally might begin round March 24. He added that an alternate situation – based mostly on a 107-day lag – factors to April 30 because the potential breakout date.

Technicals Level Towards BTC Take-Off

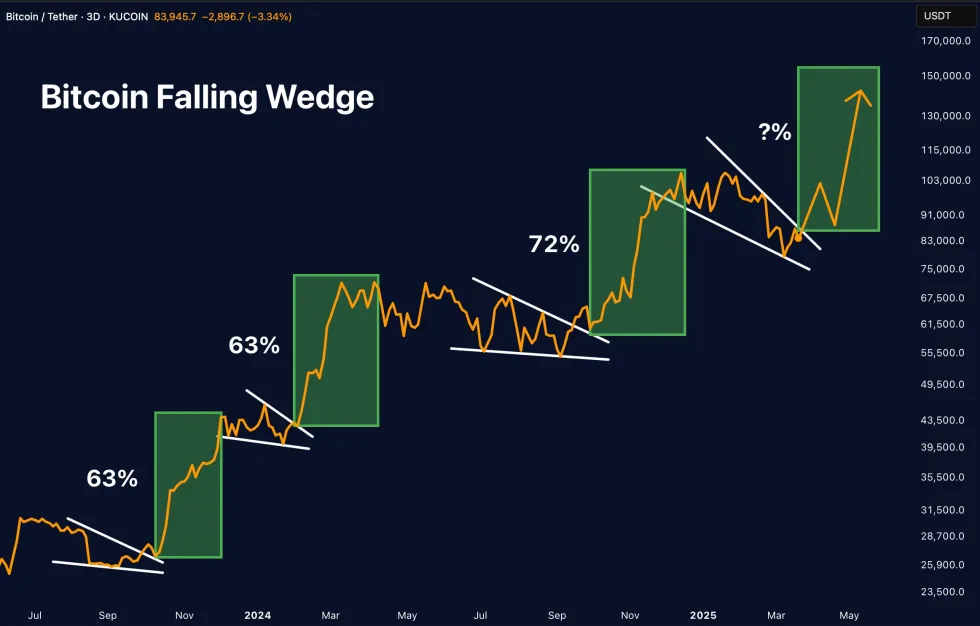

Crypto dealer Merlijn The Dealer recognized a doable breakout from a falling wedge sample – a traditionally bullish formation for Bitcoin. On common, BTC has delivered 66% returns following a breakout from this sample on the three-day chart. An analogous transfer now might propel BTC to new all-time highs (ATH).

Furthermore, Merlijn famous that BTC can also be monitoring a megaphone sample. Nevertheless, he cautioned that Bitcoin should maintain above $72,000 for this bullish construction to stay intact.

Crypto professional Burak Kesmeci pointed out {that a} restoration within the U.S. inventory market could also be essential for Bitcoin’s subsequent surge. He emphasised the sturdy correlation between cryptocurrencies and conventional equities, suggesting BTC might wrestle if shares stay weak.

In the meantime, well-known American gold advocate Peter Schiff issued a bearish warning. He argued that BTC isn’t out of the woods but – predicting a possible “catastrophic drop” if the NASDAQ enters a bear market. At press time, BTC trades at $83,826, down 1.7% up to now 24 hours.

Featured Picture from Unsplash.com, charts from X and TradingView.com

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.