Bitcoin worth has moved right into a technical correction and located help on the 50-day transferring common.

Bitcoin (BTC) retreated to $94,830, down by over 12% from its highest degree this month because the Santa Claus rally did not materialize.

The retreat occurred in a low-volume atmosphere, as many traders and merchants remained within the Christmas season mode.

In line with CoinGecko, Bitcoin’s quantity of $22 billion on Sunday, Dec. 29 was down from $41 billion a day earlier. Its quantity on Friday was $45 billion, greater than $33 billion on Thursday. Bitcoin tends to have each day quantity of over $100 billion in regular market situations.

Bitcoin misplaced its momentum after the Federal Reserve delivered a extremely hawkish financial coverage assembly earlier this month. It slashed rates of interest by 0.25%, whereas its dot plot pointed to only two cuts. The Fed had hinted that it could ship as many as 4 cuts in 2025.

Bitcoin has additionally struggled as doubts a few Strategic Bitcoin Reservefell and ETF inflows retreated. Polymarket odds of Donald Trump creating these reserves within the first 100 days have dropped to 29%, down from the November excessive of 60%.

You may also like: US is not going to approve strategic Bitcoin reserve: CryptoQuant CEO

In the meantime, ETF inflows have been sluggish previously few days. Information by SoSoValueshows that Bitcoin ETFs have shed property in 6 of the final seven market days. These funds have collected internet property of $35.6 billion since inception.

Will BTC have a January impact?

The so-called Santa Claus rally, the place property rally forward of Dec. 25, didn’t come to fruition. Subsequently, Bitcoin traders hope that it’ll obtain a so-called January impact — a idea that implies most monetary property (i.e., shares and crypto) rally within the first month of the 12 months as individuals create their portfolios.

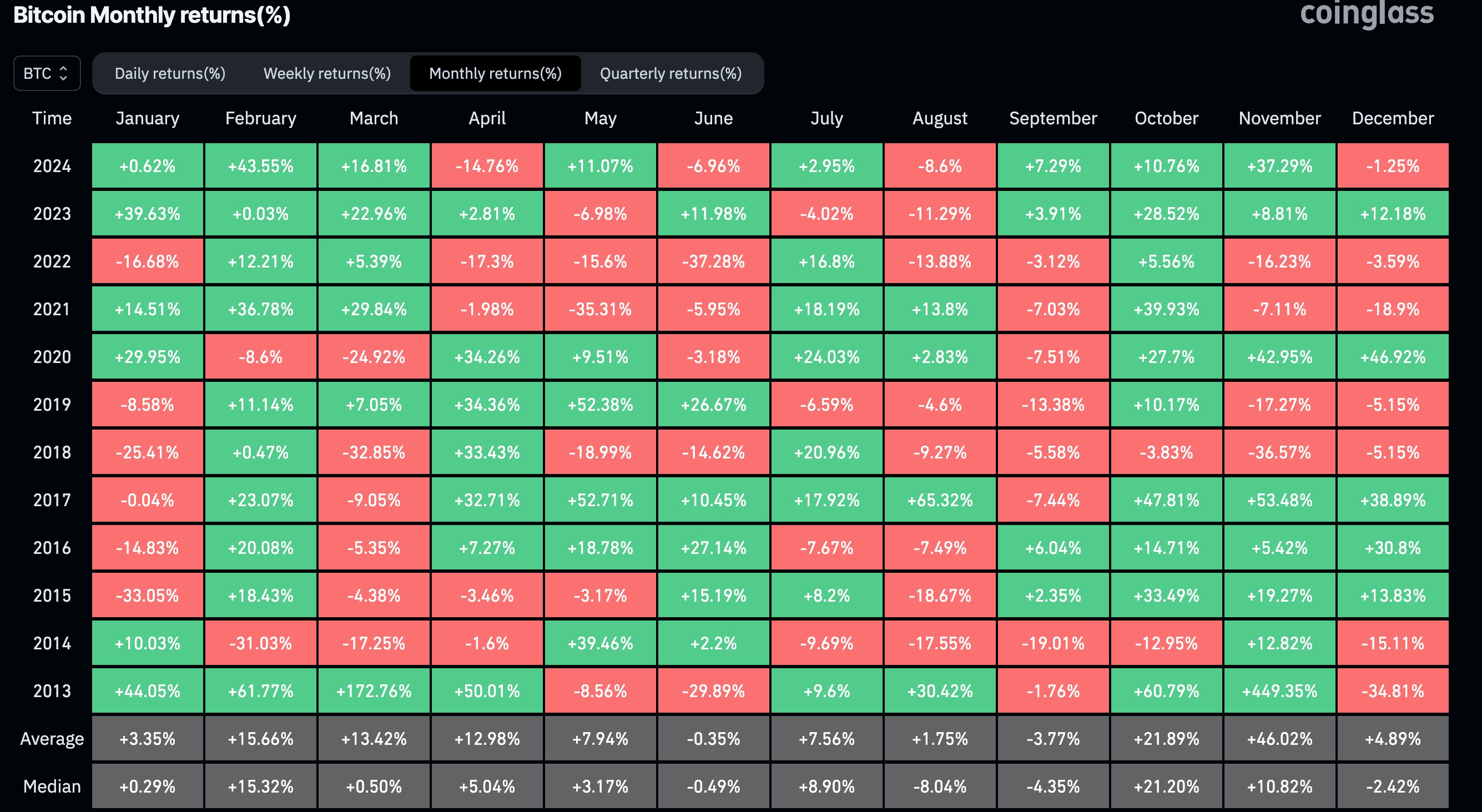

Historical past means that Bitcoin doesn’t essentially have sturdy beneficial properties in January. As proven under, BTC was constructive six occasions since 2023. It rose by simply 0.62% on this 12 months’s January and 39% a 12 months earlier.

February is normally a robust month for Bitcoin; it moved within the pink simply two occasions.

Bitcoin efficiency monthly | Supply: CoinGlass

Bitcoin worth is at an important help

The each day chart exhibits that Bitcoin is at an important help degree, which may level to extra beneficial properties within the coming weeks. It has discovered help on the 50-day transferring common. Additionally, the coin has failed to maneuver under the ascending trendline that connects the bottom swings since Nov. 17.

The chance, nevertheless, is that the coin has shaped a rising broadening wedge sample, a preferred bearish signal. Subsequently, a drop under its decrease aspect could level to extra draw back, doubtlessly to $73,777, its March excessive.

Bitcoin worth chart | Supply: crypto.information

The choice situation is the place Bitcoin worth rebounds and retests the higher aspect of the wedge at $110,000.

Learn extra: VERUM surges 88%, PHALA jumps 44%, Bitcoin struggles at $94k