Bitcoin (BTC) has as soon as once more surpassed the $100,000 mark reaching an intraday excessive of $102,514, its first breakthrough above this psychological degree since mid-December 2024.

$103K Resistance Looms as Bitcoin Climbs to $102,514 Amid Quantity Spike

This newest bitcoin surge displays robust bullish momentum, with consumers stepping in decisively to drive costs greater. The 1-hour BTC/USD chart signifies a gentle uptrend with clear indicators of accumulation across the $97,000–$98,000 vary, as evidenced by the consolidation zone seen earlier within the week.

Following this consolidation, BTC broke out with a powerful upswing accompanied by a major spike in quantity at exactly 9:54 a.m. Japanese Time (ET), pushing the value previous $100,000 and peaking at $102,514 by roughly 11:25 a.m. Proper now, the $99,000–$100,000 vary represents a powerful demand zone, supported by current value motion and the amount profile.

BTC/USD by way of Bitstamp on Jan. 6, 2025, 4-hour perspective.

If BTC retraces to this zone, it might supply a good shopping for alternative for day merchants, notably if accompanied by a assured and bullish candlestick sample or a continuation in greater buying and selling volumes. The $103,000 via $103,500 degree represents the fast resistance the place promoting stress is extra seen.

Brief-term merchants might take partial earnings round this degree. For longer-term holders, monitoring value conduct at $103,500—one other potential resistance degree—might assist decide exits. The transfer above $100,000 on Monday follows Microstrategy’s newest BTC buy. The publicly listed enterprise intelligence (BI) agency now holds 447,470 BTC.

The quantity spike in the course of the breakout above $100,000 and $101,000 is sort of a bullish indicator. Nevertheless, the four-hour and one-hour charts additionally replicate minor overextension, suggesting a doable short-term pullback or consolidation earlier than additional upward motion. This occurred after the intraday peak. Momentum-driven merchants ought to watch carefully for confirmations above $103,000 to make sure continued bullish power.

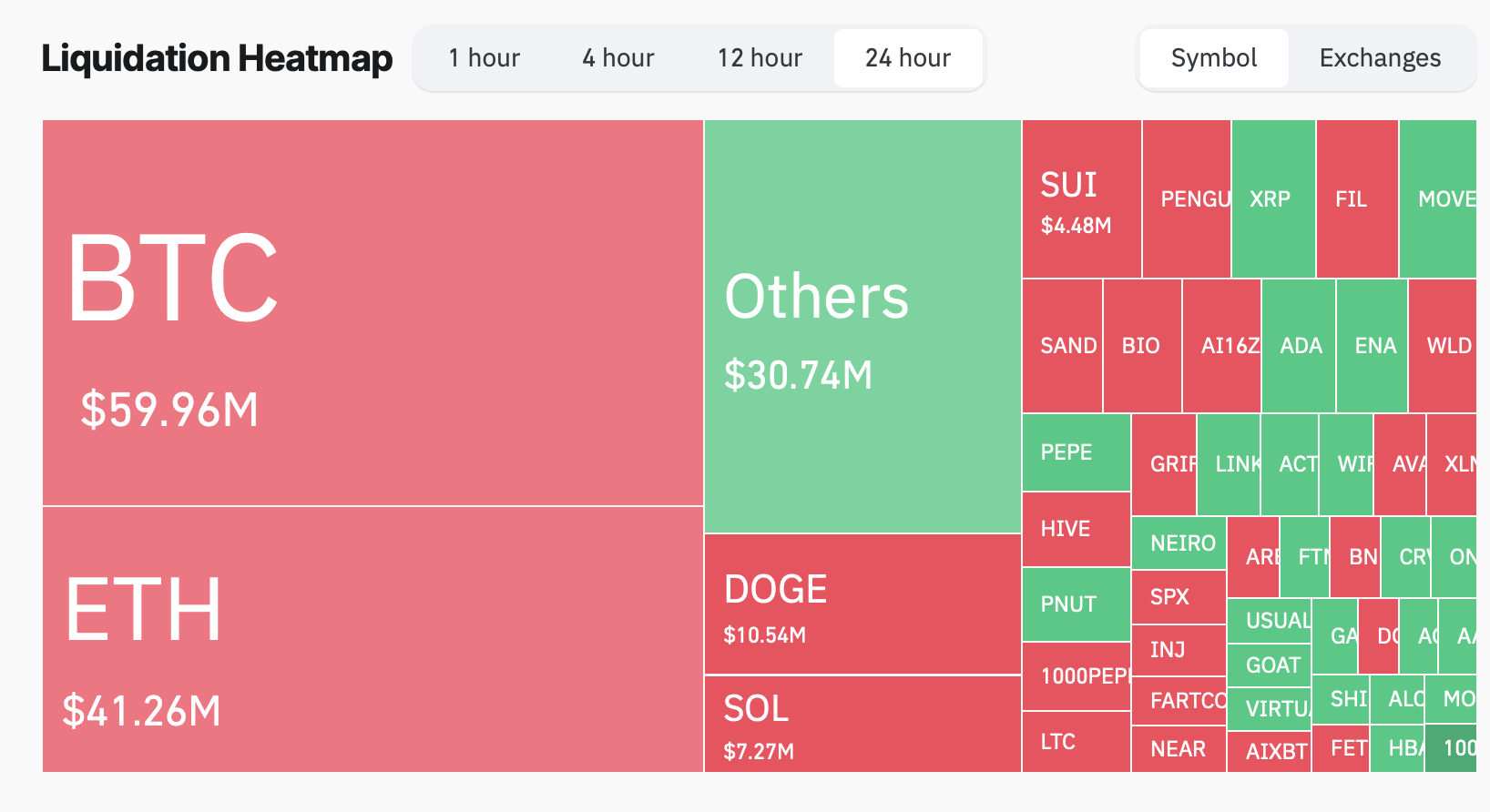

Crypto derivatives markets noticed 75,093 merchants liquidated , the entire liquidations is available in at $220.70 million.

Bitcoin’s break above $100K this week displays renewed market optimism and powerful shopping for curiosity. Strategic entries close to help ranges and vigilant monitoring of resistance zones might be essential for navigating bitcoin’s dynamic value motion. Over the 24 hours, $48.13 million in bitcoin quick positions have been liquidated, on account of BTC’s swift value rise beginning at 10 a.m. As of 1:30 p.m. ET, round 74,997 merchants have been liquidated over the past 24 hours throughout your complete crypto derivatives markets.