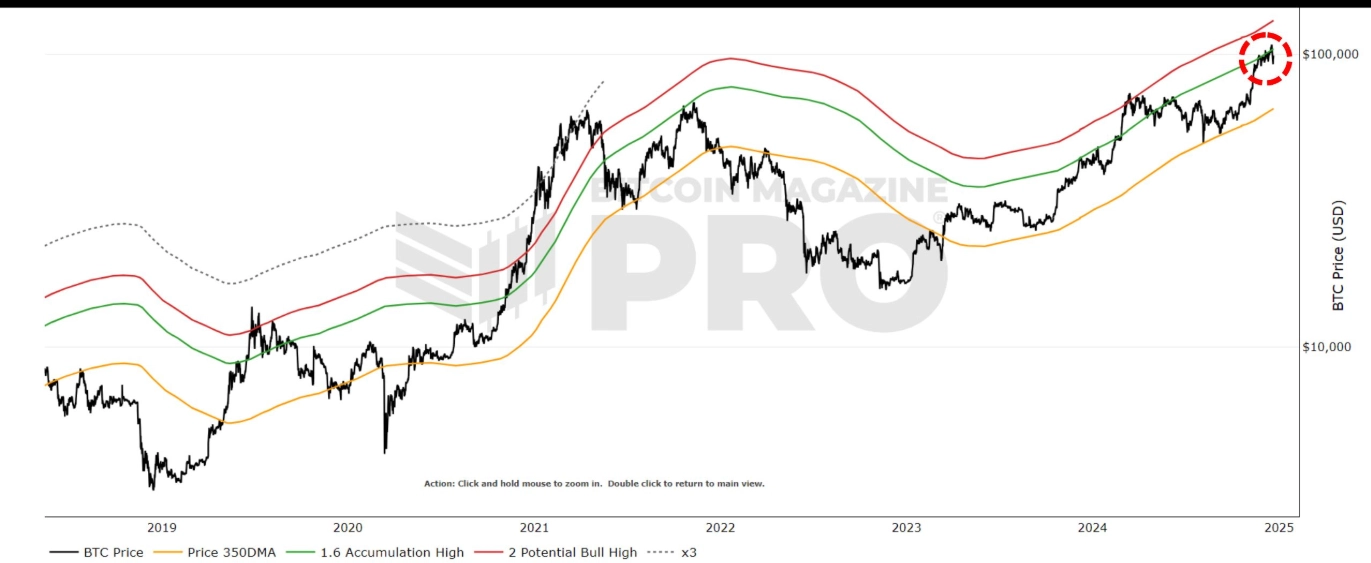

The largest cryptocurrency, Bitcoin (BTC) has as soon as once more been rejected on the 1.6x Golden Ratio Multiplier resistance, a stage that coincides with its earlier all-time excessive. Cryptocurrency is testing its resilience in opposition to this formidable barrier as the present all-time excessive revolves across the $108,000 mark.

(Supply: Bitcoin Journal Professional)

Based on Bitcoin Journal Professional, If BTC breaks by way of this significant resistance, it may set off a attainable rally towards the 2x multiplier resistance at $135,000. With the bullish sentiment rising in 2025, the upcoming days may decide if BTC’s subsequent leg of its historic run begins or if additional consolidation is on the playing cards.

Bitcoin was rejected as soon as once more on the 1.6x Golden Ratio Multiplier resistance at our most up-to-date all-time excessive! 🐻

Presently at ~$108,000 and rising, can BTC connivingly break this stage and rally to the higher 2x resistance at $135,000 within the close to future? 🤔

Let me know! 👇 pic.twitter.com/spRoKHk7rf

— Bitcoin Journal Professional (@BitcoinMagPro) January 2, 2025

The Golden Ratio Multiplier is a technical evaluation software designed to establish key assist and resistance ranges in an asset’s value primarily based on the Golden Ratio (1.6). It multiplies the 350-day transferring common by ratios like 0.618, 1.6x, or 2x to undertaking these ranges, which additionally aligns with crucial psychological and market boundaries.

Bitcoin (BTC) Reclaims $97,000 Mark with a New Yr Rally

BTC costs climbed for the third consecutive day, rising above $97,000. The brand new 12 months started on a constructive word, with merchants gearing as much as refocus on the crypto market. Regardless of the momentum in BTC’s value being hindered, optimism nonetheless prevails.

The crypto market’s confidence was boosted after President-elect Donald Trump’s dedication to increasing the U.S. position within the house with a top-tier group.

In the meantime, BTC ETFs noticed minimal exercise through the vacation season, with simply $5.3 million in inflows on December 31, 2024, following $700 million in outflows earlier. Nonetheless, these funds collectively handle over $100 billion in belongings.

Additionally Learn: A Strategic Bitcoin Reserve: Is This Clever?