Bitcoin’s worth has not too long ago skilled notable volatility, pushed by vital market developments and investor exercise. Following an preliminary decline in current days, BTC surged above $94,000 on Sunday.

This enhance was fueled by stories of an upcoming US strategic crypto reserve that features BTC and different main digital belongings. Nevertheless, as of as we speak, BTC is buying and selling slightly below $93,000, signaling an unstable upward momentum within the crypto market.

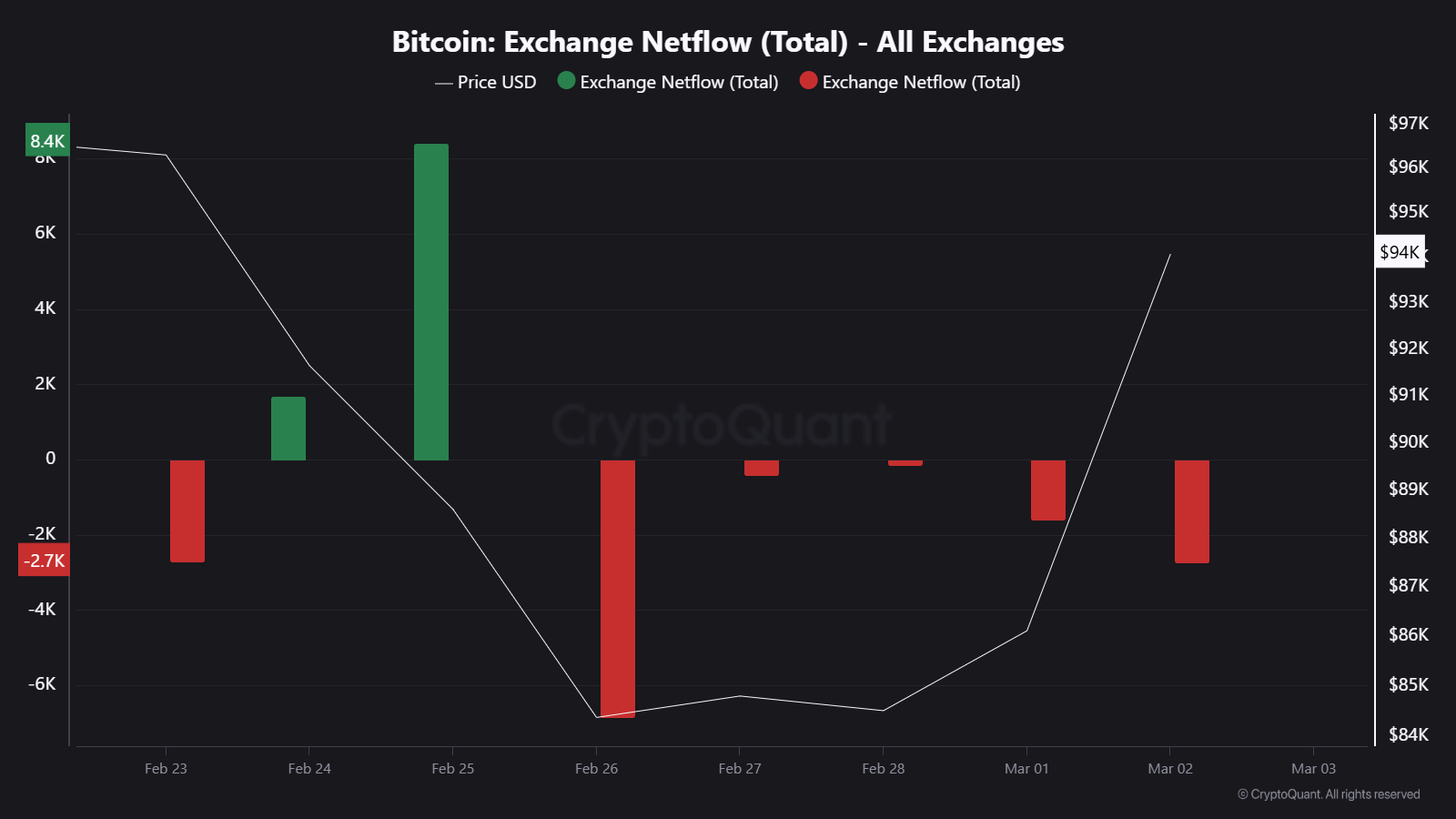

Amid this worth motion, a current evaluation by CryptoQuant analyst KriptoBaykusV2 highlights an evolving sample in Bitcoin’s web trade move, providing perception into investor sentiment. This information means that trade inflows and outflows could play a vital position in shaping Bitcoin’s short-term worth path.

Bitcoin Alternate Flows and Investor Sentiment

In keeping with KriptoBaykusV2, on February 25, Bitcoin noticed a big influx to exchanges, with roughly 8,400 BTC being deposited. Traditionally, massive inflows recommend elevated promoting strain, as merchants transfer belongings to exchanges in preparation for liquidation.

This was adopted by a decline in Bitcoin’s worth, aligning with earlier market developments the place elevated provide on exchanges usually results in downward worth actions.

The next day, February 26, Bitcoin skilled a shift, with a considerable quantity of BTC being withdrawn from exchanges. Massive-scale outflows usually point out a choice for holding, lowering the out there provide on exchanges and probably supporting worth stability.

This shift coincided with Bitcoin’s worth discovering help and starting to get better, reflecting investor confidence within the asset’s long-term prospects. The analyst famous:

In abstract, these intently monitoring Bitcoin’s trade actions ought to take be aware: Massive inflows into exchanges could point out heightened promoting strain, requiring warning. However, vital outflows recommend that buyers are opting to carry, which may result in worth appreciation. We’ll see within the coming days how these developments proceed.

Quick-Time period Promoting and Market Traits

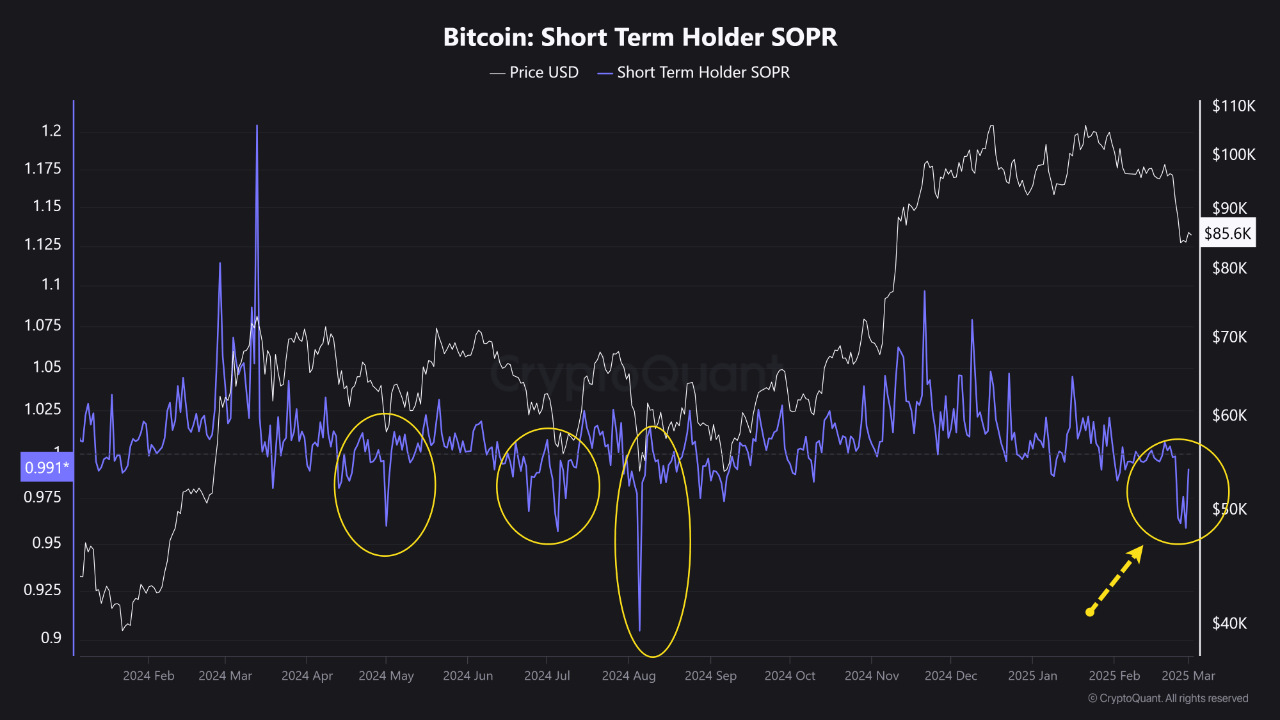

In the meantime, a separate evaluation by one other CryptoQuant analyst, abramchart, means that Bitcoin holders have began promoting at a loss. The Spent Output Revenue Ratio (SOPR) index, which measures the profitability of short-term buyers, based on the analyst not too long ago recorded a worth of 0.95.

This stage, the bottom since August 2024, means that extra merchants are promoting BTC at a loss, a sign of capitulation. Traditionally, such durations have been adopted by market recoveries as promoting strain eases and accumulation phases start. The CryptoQuant analyst wrote:

The SOPR measures the proportion of Bitcoin wallets which have held Bitcoin for greater than 1 hour and fewer than 155 days. Values over ‘1’ point out extra short-term buyers are promoting at a revenue. Values under ‘1’ point out extra short-term buyers are promoting at a loss., which is an indication of capitulation and a return to an upward pattern.

Featured picture created with DALL-E, Chart from TradingView