Bitcoin at the moment hovers close to $86,668, boasting a $1.71 trillion valuation and $69.5 billion in day by day transactional exercise, fluctuating between $84,971 and $90,940. Technical patterns throughout diversified intervals tilt decisively towards warning, portray a somber portrait for near-term prospects.

Bitcoin

Bitcoin‘s day by day timeframe reveals persistent liquidation pressures after a swift retreat from the $106,000 pinnacle triggered a cascading drop. A fleeting stabilization at $78,197 now anchors interim stability, although the $94,000 ceiling stifles restoration efforts. Pronounced bearish formations, amplified by vigorous transactional flows, fortify pessimistic expectations, with $82,000 rising as a believable ground ought to downward forces intensify.

BTC/USD 1D chart through Bitstamp on March 7, 2025.

Whereas shorter-term metrics—such because the exponential shifting common (EMA 10) at $88,933 and easy shifting common (SMA 10) at $87,407—flash warnings of frailty, the enduring exponential shifting common (EMA 200) at $85,831 and easy shifting common (SMA 200) at $83,037 whisper of latent demand.

Zooming to the four-hour window, bitcoin’s swift downturn from $95,152 illustrates faltering vitality above $90,000. Escalating sell-side participation cements the descent, whereas the exponential shifting common (EMA 10) and easy shifting common (SMA 10) linger beneath present valuations, echoing bearish rhythms.

BTC/USD 4H chart through Bitstamp on March 7, 2025.

An unsuccessful rally above $91,000 solidifies this zone as a formidable barrier, positioning short-term bearish methods as prudent if costs falter between $88,000 and $90,000, eyeing $85,000 or $82,000 as locations.

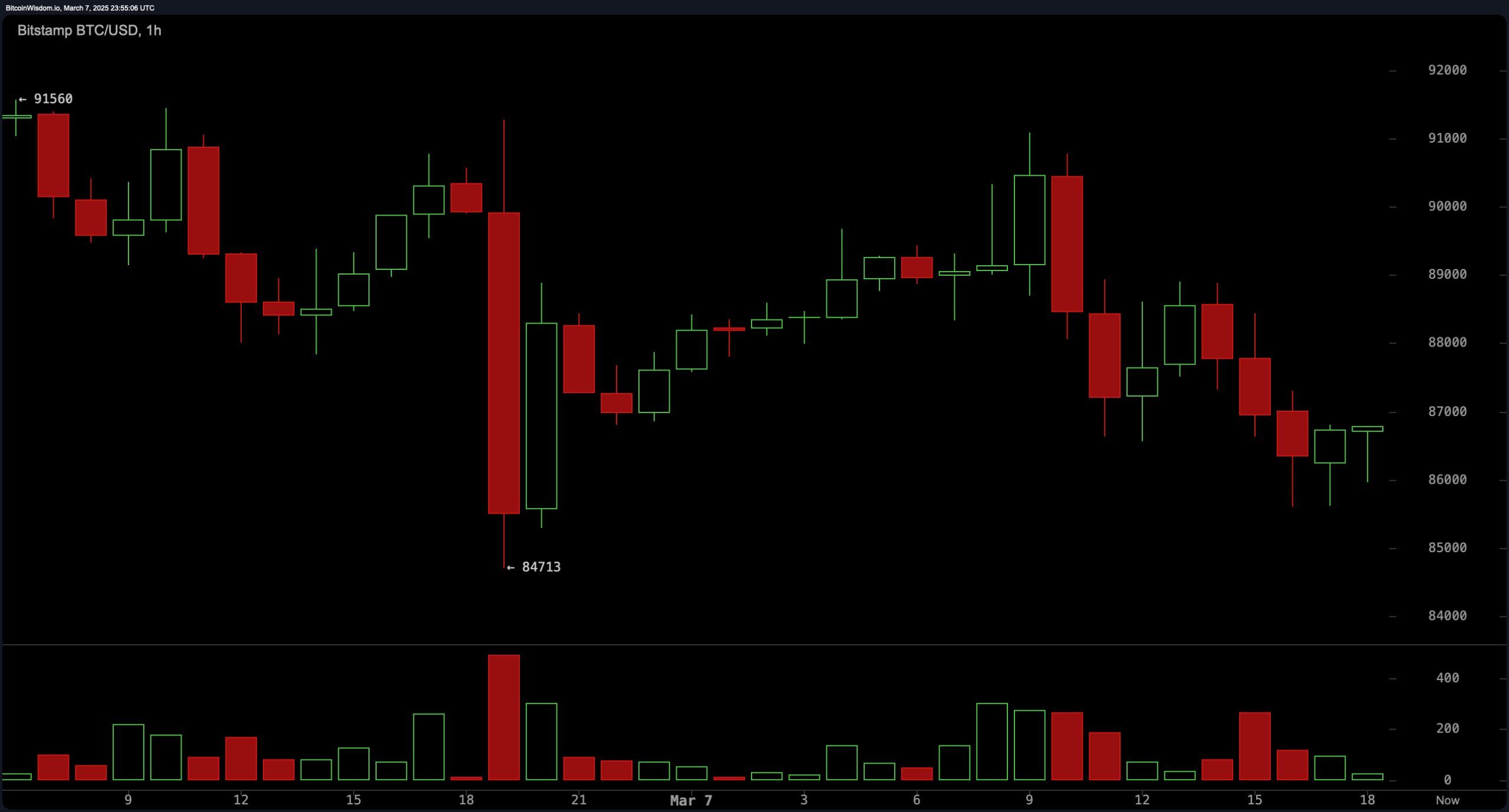

The hourly lens echoes rapid liquidation patterns, with repeated denials close to $91,560 propelling valuations to $84,713. Subdued transactional exercise hints at waning conviction, but directional momentum leans downward.

BTC/USD 1H chart through Bitstamp on March 7, 2025.

Impartial readings from the relative power index (RSI) at 42 distinction with the superior oscillator (AO) and momentum gauges, which tilt towards distribution. Failure to beat $88,500 could invite retreats towards $86,000 or beneath, although a spirited push previous $87,000 with heightened participation might spark ephemeral rallies towards $89,000 or $90,000.

Momentum metrics and trend-following instruments collectively reinforce cautionary narratives. The commodity channel index (CCI) at -55 sits idle, whereas the superior oscillator (AO) and momentum readings tilt towards pessimism.

Each short- to medium-term development tracker—from the exponential shifting common (EMA 10) to the easy shifting common (SMA 100)—broadcasts promote directives. Solely the distant easy shifting common (SMA 200) at $83,000 gives a glimmer of foundational help.

With bitcoin (BTC) ensnared beneath gravitational resistance, near-term dangers skew downward. Foundational tiers at $85,000, $82,000, and $78,000 could face scrutiny earlier than equilibrium resurfaces. Absent a decisive thrust above $91,000, the trail of least resistance slopes southward, inviting checks of deeper thresholds in classes forward.

Bull Verdict:

Regardless of short-term bearish momentum, long-term help close to $83,000 and $85,000 might present a stable basis for a rebound if consumers step in. A breakout above $91,000 could sign renewed upside potential.

Bear Verdict:

Bitcoin stays in a transparent downtrend, with sturdy resistance at $90,000 and key indicators favoring additional draw back. If promoting stress persists, BTC might take a look at decrease help ranges close to $82,000 and $78,000 earlier than any important restoration.