Bitcoin sellers are grappling with a decisive assist zone on the 100-day shifting common, with a possible breakdown paving the best way for a retest of the important $90K area.

Nonetheless, heightened volatility is anticipated, as value motion will dictate the market’s subsequent path.

Technical Evaluation

By Shayan

The Each day Chart

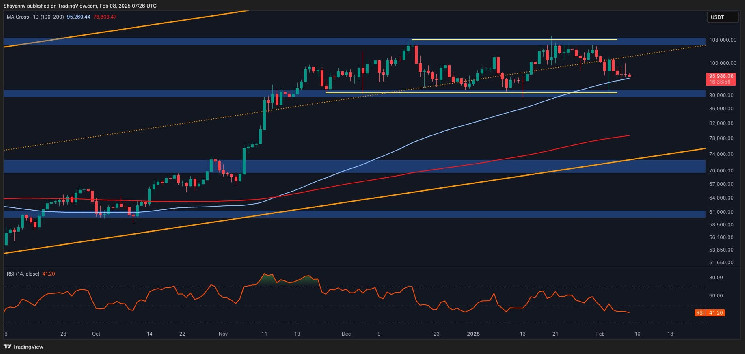

After sustained declines, Bitcoin has approached a vital assist zone the place important demand will probably emerge. This stage is especially essential because it aligns with the 100-day shifting common and the important thing psychological assist at $95K. A confirmed breakdown beneath this area might speed up promoting strain, pushing BTC towards the substantial $90K assist space.

Conversely, a powerful bullish rebound from this stage might set off a restoration, with patrons concentrating on a retest of the ascending channel’s midline at $100K. Bitcoin stays range-bound between $90K and $108K, and a definitive breakout from this consolidation section will decide the market’s subsequent main pattern.

The 4-Hour Chart

On the decrease timeframe, Bitcoin’s value motion has been uneven, characterised by a section of low-volatility consolidation, reflecting market contributors’ indecision. The cryptocurrency fluctuates throughout the $90K-$108K vary with out establishing a transparent pattern.

The decrease boundary at $90K stays a vital demand zone, offering sturdy assist since November 2024. Bitcoin might stage one other rally towards $108K within the mid-term if patrons efficiently defend this stage. Nonetheless, a breakdown beneath this threshold might invalidate this state of affairs and expose the value to deeper corrections.

Till Bitcoin decisively exits this extended buying and selling vary, merchants ought to stay cautious, as heightened volatility is anticipated.

On-chain Evaluation

By Shayan

The realized value of UTXO age bands, particularly the 1-3 month cohort, supplies essential perception into short-term holders’ conduct and total market sentiment. This metric displays the common acquisition value of latest patrons, serving as a dynamic assist or resistance stage that alerts market confidence.

Traditionally, when Bitcoin checks this stage from above, it usually acts as assist, suggesting that short-term holders stay assured of their positions regardless of elevated value ranges. Bitcoin has declined towards the realized value of the 1-3 month UTXO cohort, which is round $96K. Holding above this key stage reinforces a bullish market sentiment, rising the chance of an prolonged upward pattern.

Nonetheless, if Bitcoin fails to take care of assist at this important threshold and breaks beneath, it might set off a shift in sentiment towards concern, probably resulting in a distribution section. In consequence, value motion round this stage will play a decisive function in shaping Bitcoin’s short- to mid-term trajectory.