This can be a phase from the Ahead Steering e-newsletter. To learn full editions, subscribe.

Simply days into the brand new 12 months, bitcoin’s worth is again to 6 figures.

The asset’s worth rose above $102,400 on Monday morning. It hovered round $101,750 at 2 pm ET — up practically 9% from per week in the past.

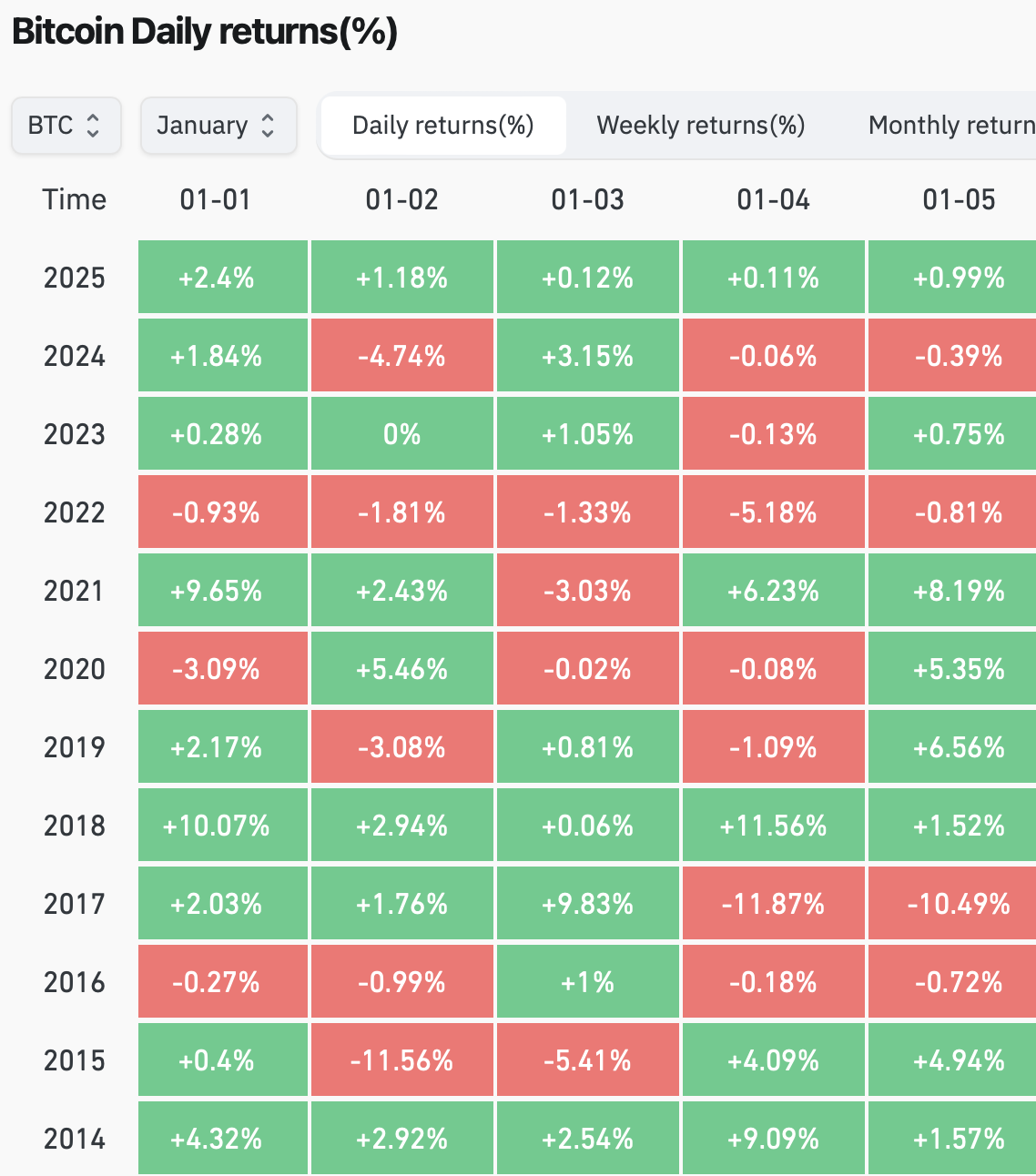

Crypto is thus far seeing its personal “January impact” — a time period alluding to the potential rise of inventory costs throughout the 12 months’s first month. CoinGlass knowledge exhibits bitcoin noticed worth good points — albeit slight ones — throughout every of the month’s first 5 days. That hasn’t occurred since 2018.

You recognize by now about BTC’s historic rise to an all-time peak of $108,000 a little bit over a month after Trump’s election win. Then there was what some known as a “wholesome” correction fueled by hawkish Fed vibes and profit-taking, with BTC dropping under $92,000 on Dec. 30.

Grayscale product and analysis head Rayhaneh Sharif-Askary famous momentary drawdowns throughout bull markets are frequent, mentioning the FTSE/Grayscale Crypto Sectors Market Index’s 6% decline in December.

“Nevertheless, sturdy demand from US-listed Bitcoin ETPs and treasuries like MicroStrategy’s might assist bitcoin’s worth,” she stated when requested in regards to the outlook for January.

The US bitcoin ETFs welcomed $908 million in internet new belongings on Friday — rebounding from a mixed $940 million value of outflows over the earlier 4 buying and selling days, Farside Buyers knowledge exhibits.

96% of monetary advisers surveyed by Bitwise obtained a crypto-related query from shoppers in 2024. This discovering jibes with the anticipated ongoing wealth manager-fueled capital inflow into the crypto phase.

As for Sharif-Askary’s mentioning of treasuries, MicroStrategy’s newest bitcoin purchase (on Dec. 30-31) was 1,070 BTC for roughly $100 million. Although smaller than its BTC buys in earlier weeks, the corporate additionally simply revealed concentrating on a $2 billion capital elevate by way of perpetual most popular inventory choices to amass extra BTC.

On that be aware, Metaplanet CEO Simon Gerovich simply famous his firm plans to spice up its BTC holdings (at the moment at 1,762 BTC) to 10,000 BTC in 2025. Then there’s KULR Know-how Group, which stated Monday it purchased a further $21 million value of bitcoin.

Additionally set for January, in fact, is Trump’s inauguration. And with members of the 119th Congress sworn in final week, hearings on the president-elect’s cupboard nominees are anticipated to kick off quickly.

Affirmation listening to happenings, and subsequent alerts on the tempo and extent of future crypto regulatory readability, might impression BTC worth all through the month, Sharif-Askary instructed me.

“Delays or restrictive coverage bulletins might dampen sentiment,” she stated, earlier than including: “Macro components — together with Federal Reserve alerts on rates of interest and market responses to a stronger US greenback — might additionally play a job.”