Bybit, some of the broadly used exchanges prior to now 12 months, is migrating its choices platform to Tether (USDT). Paolo Ardoino, the CEO of Tether, Inc., acknowledged this is able to permit Bybit to realize entry to unprecedented liquidity.

Bybit will change its choices and linear expiry futures contracts to Tether (USDT). The platform will cease issuing new USDC-settled contracts after February 26, with the objective of accelerating platform liquidity. Bybit’s transfer arrives at a time when USDC utilization is rising on each centralized and decentralized markets, whereas USDT is being divested, particularly from Euro space exchanges.

Paolo Ardoino, CEO of Tether, Inc., steered the transfer will deliver extra liquidity to Bybit.

ByBit is migrating its Choices platform to Tether USDT 🔥

Unmatched liquidity for institutional clients.Thanks for the help ♥️ https://t.co/LuKbvMpoJ6

— Paolo Ardoino 🤖🍐 (@paoloardoino) February 14, 2025

The entire already current USDC contracts will proceed their standard buying and selling, although ByBit will likely be cautious to not create USDT contracts that expire on the identical date as USDC merchandise. That is to make sure the liquidity isn’t fragmented and all contracts stay well-funded with no confusion.

The contracts affected embrace SOLUSC and ETHUSDC futures, which will likely be changed over the approaching weeks as they expire. The fundamental buying and selling guidelines and parameters, charges, and margin ranges for USDT-settled contracts will likely be much like the USDC variations. For Unified Buying and selling Account (UTA) holders, hedging between the 2 varieties of choices and futures will likely be supported. For some accounts in Portfolio Margin mode, the hedging can even be potential in its riskier margin model, till all USDC contracts expire.

Bybit not affected by USDT limitations

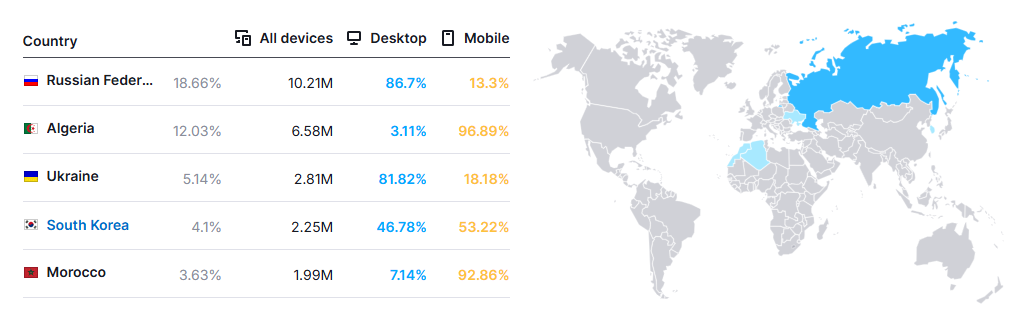

Bybit is making a shift in the other way, whereas most companies change to USDC. The explanation for that is that the alternate positive aspects most of its site visitors from the Russian Federation.

Bybit receives most of its website site visitors from the Russian Federation, the place USDT utilization isn’t restricted. | Supply: Semrush

For that cause, USDC might pose a much bigger risk of potential sanctions or pockets freezes. For now, the token has seen solely restricted deal with blacklisting, however there are nonetheless skeptical customers that change to different belongings.

USDT stays some of the liquid stablecoins, regardless of the latest regional limitations. The token elevated its provide to $145.2B, whereas USDC stays at $54.9B. The main stablecoin stays extra liquid, retaining its main place within the Ethereum ecosystem. On the similar time, massive elements of the provision of USDC have shifted to Base and Solana.

Bybit can be posting one in every of its highest volumes up to now, boosted by the 2024 bull market. The alternate is without doubt one of the few to submit outcomes competing with Solana. The market carries $22.2B in day by day buying and selling volumes, with 648 pairs on its by-product market.

Essentially the most lively pairs are centered round Bitcoin (BTC) and Ethereum (ETH), already settling in opposition to USDT. The stablecoin dominates each the by-product and spot markets on Bybit, making the USDC merchandise a distinct segment that’s now being divested.

Bybit tries to regain authorized standing in Europe

Regardless of utilizing USDT for settlement, Bybit has not given up on regaining its standing as a dependable alternate for the Euro space. Bybit hopes to realize a MiCA license, which nonetheless means it must restrict a few of its USDT merchandise for European merchants.

Not too long ago, Bybit has been faraway from the blacklist of the French monetary authorities (AMF) after years of makes an attempt to develop into compliant. Ben Zhou, co-founder and CEO of the alternate, broke the information on X, with the hopes of increasing actions as a legalized alternate within the Euro space.

After greater than 2 years of working with the French regulator by way of a number of remediation efforts, BYBIT is now formally faraway from France AMF blacklist. MiCA license subsequent. pic.twitter.com/irPf5bOSBp

— Ben Zhou (@benbybit) February 14, 2025

Bybit stays a regionally restricted alternate, which has been minimize off from a number of the principal crypto markets as a result of regulatory restrictions. The service stays restricted for the USA, Canada, mainland China, France and the UK, in addition to a lot of the sanctioned nations and territories with restricted entry to crypto buying and selling.

Bybit has an 88/100 security ranking primarily based on the CER safety system. Regardless of the chance and restrictions, the centralized alternate was typically chosen for its straightforward listings, tapping the most recent token tendencies nearly instantly. Bybit stays risk-aware, not too long ago declining to record and help Pi Community, which different centralized exchanges are additionally proscribing.