Coin Metrics’ newest State of the Community report reveals bitcoin miners are balancing stabilized revenues and chronic charge pressures post-halving by means of {hardware} upgrades and renewable power adoption, amid geopolitical provide chain dangers.

China Tariffs, Texas Renewables, and AI: Inside Bitcoin Mining’s 2025 Transformation

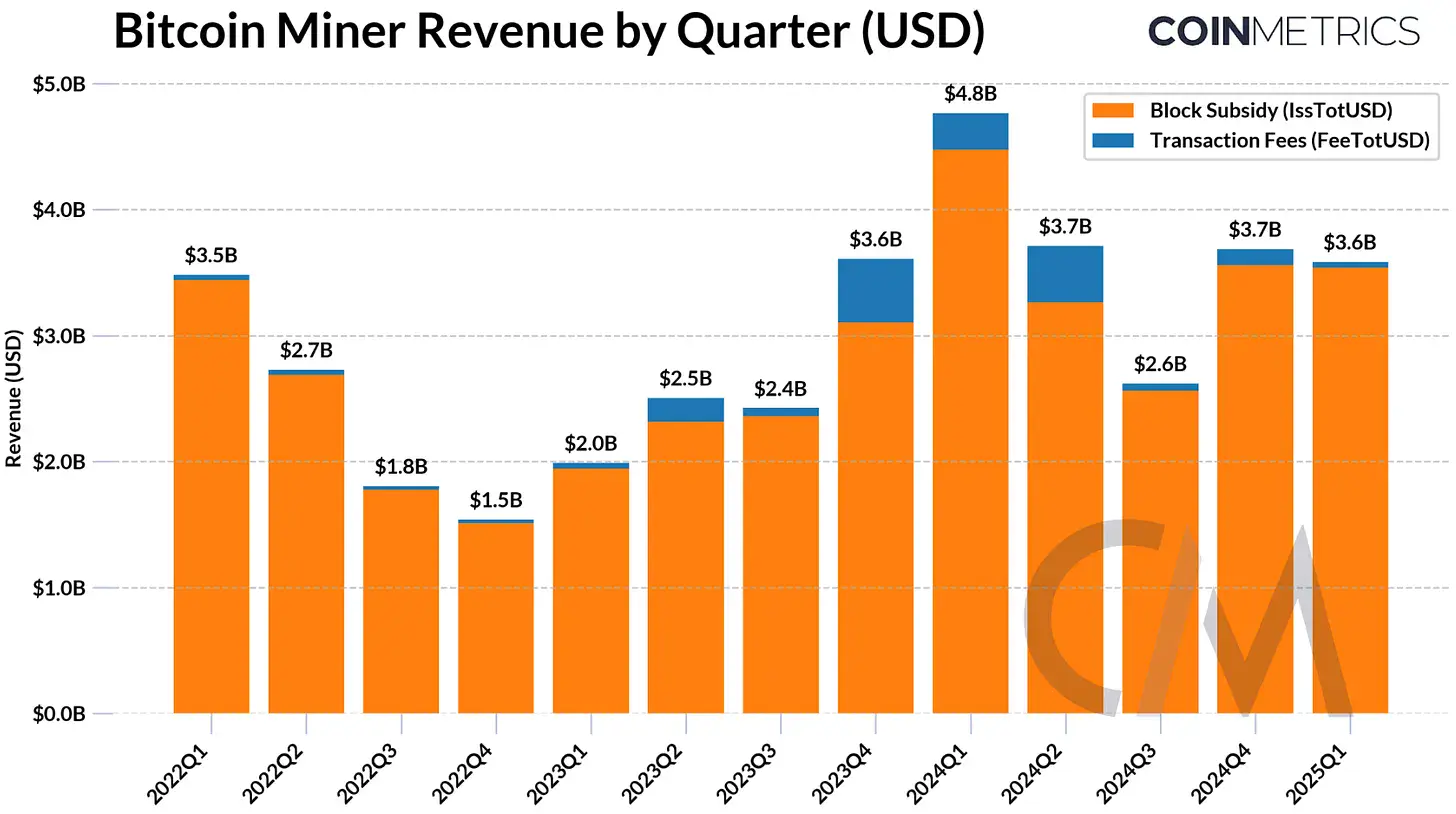

Coin Metrics’ Q1 2025 State of the Community report highlights stabilized bitcoin mining revenues following the 2024 halving, although persistently low transaction charges—beneath 2% of complete earnings—proceed difficult long-term incentives. In response to the report, complete miner income hit $3.7 billion in This fall 2024, a 42% quarterly enhance pushed by improved operational effectivity and bitcoin value restoration. Coin Metrics knowledge exhibits the 30-day common hashrate rose to 807 EH/s in early 2025, reflecting sustained community progress.

The report notes mining operations are more and more adopting energy-efficient ASICs and relocating to areas with cheaper renewable power, comparable to Texas and elements of Africa and Latin America. Bigger, well-capitalized corporations are diversifying income streams, with Coin Metrics citing examples like Core Scientific’s pivot to internet hosting AI knowledge facilities utilizing 200 MW of current infrastructure.

The report notes mining operations are more and more adopting energy-efficient ASICs and relocating to areas with cheaper renewable power, comparable to Texas and elements of Africa and Latin America. Bigger, well-capitalized corporations are diversifying income streams, with Coin Metrics citing examples like Core Scientific’s pivot to internet hosting AI knowledge facilities utilizing 200 MW of current infrastructure.

Coin Metrics’ analysis highlights considerations round {hardware} centralization, estimating that Bitmain-manufactured ASICs—together with the S19 collection—energy 59%–76% of Bitcoin’s hashrate. This reliance creates provide chain vulnerabilities exacerbated by geopolitical friction. The report particulars delays in Bitmain {hardware} shipments to U.S. miners in early 2025 because of Chinese language import tariffs, illustrating dangers tied to concentrated manufacturing.

Bitcoin’s use as a medium of change stays restricted, per Coin Metrics, with its function more and more skewed towards store-of-value functions. Nevertheless, layer two (L2) options just like the Lightning Community and sidechains comparable to Stacks purpose to revive transactional utility. Whereas Lightning Community channels declined to 52,700 in Q1 2025, secure channel liquidity (4,500–5,000 BTC) suggests improved effectivity, in line with the report.

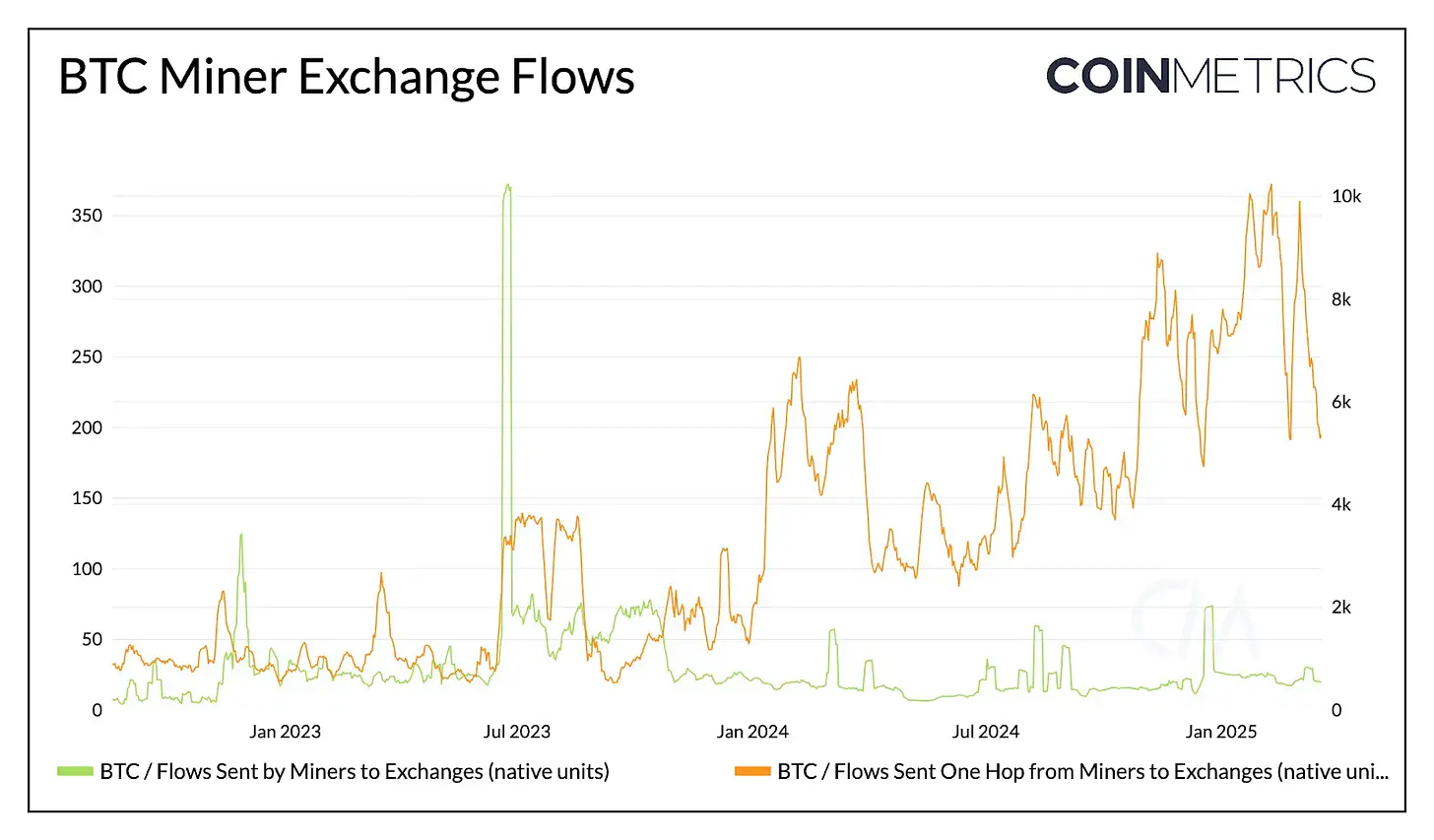

Coin Metrics change circulate knowledge signifies regular promote stress from miners, with direct (0-hop) transfers to exchanges remaining secure and oblique (1-hop) flows rising progressively. Smaller miners seem to liquidate holdings incrementally, whereas bigger operations optimize treasury administration amid volatility.

The report concludes that sustaining miner incentives as block rewards diminish will probably require larger transaction charges pushed by L2 adoption and competitors for block area. Coin Metrics emphasizes ongoing dangers to community decentralization from {hardware} centralization and geopolitical disruptions, urging continued adaptation throughout the mining ecosystem.