Bitcoin’s underwhelming fundamentals have change into an growing concern inside the group.

Some have identified that the cryptocurrency’s on-chain quantity is nowhere close to the 2021 peak.

This has prompted somebody to query whether or not a brand new bull run is definitely coming this time.

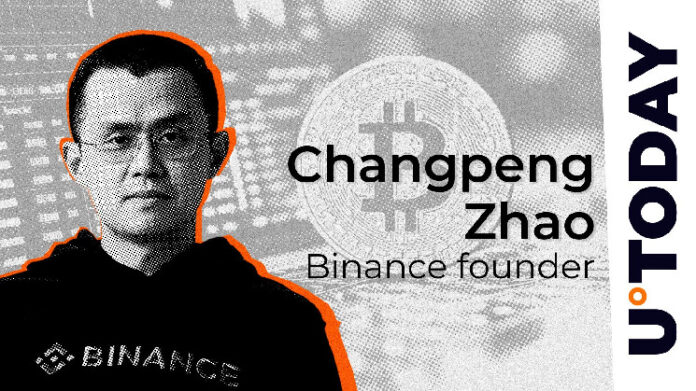

Nonetheless, Changpeng Zhao, the previous CEO of cryptocurrency trade Binance, has opined that the declining fundamentals will be defined by the truth that Bitcoin is rising as a reserve asset.

After the introduction of extremely profitable Bitcoin exchange-traded funds (ETFs), many traders are actually getting publicity by means of them.

“My intestine feeling is that BTC is now extra of a reserve asset and fewer of a transaction foreign money on account of excessive charges and lengthy block instances. A number of the brand new cash is shopping for ETFs, which do not replicate in on-chain TX. I may very well be unsuitable,” CZ stated.

This echoes the latest level made by Chris Kuiper, director of analysis at Constancy’s crypto unit. As reported by U.Right now, Kuiper defined that the dominance of Bitcoin ETFs is the important thing motive why the mempool has change into just about empty.

Therefore, the poor on-chain efficiency doesn’t essentially imply that one other bull run is just not attainable.

Some analysts now count on Bitcoin to make a serious transfer within the close to future after its volatility reached its lowest degree for the reason that fourth quarter of 2023.

Bitcoin is at the moment altering palms at $97,190, in keeping with CoinGecko information.