Ethereum’s value is but to indicate any willingness to get better, because the market has been shifting sideways over the previous week.

Nonetheless, the present degree can provoke a rebound if the worth holds above it.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Day by day Chart

ETH’s every day chart stays bearish, with the worth struggling to carry above the $1,900 help space after a protracted downtrend. A breakdown of this degree may reinforce additional draw back, doubtlessly focusing on the $1,600 help zone if promoting strain persists. The 200-day shifting common stays effectively above, positioned across the $2,900 mark, signaling a powerful bearish bias.

In the meantime, the RSI is within the oversold territory, which suggests a short-term bounce may happen. A decisive break above $2,000 with robust quantity may shift momentum towards $2,200, however failure to take action would possible affirm continued weak point within the quick time period.

The 4-Hour Chart

The 4-hour chart exhibits a breakout from the descending wedge sample, indicating a possible pattern reversal. Nonetheless, value motion stays trapped across the $1,900 resistance zone, with a number of rejections signaling a scarcity of robust bullish momentum.

The RSI is recovering however nonetheless under overbought circumstances, suggesting room for additional upside if ETH can shut above this key resistance space. A confirmed breakout above $2,000 may set off a rally towards $2,100-$2,200, whereas failure to carry above $1,900 might result in a retest of the $1,800 help degree. Quantity affirmation will probably be essential in figuring out whether or not this breakout sustains or leads to one other rejection.

Onchain Evaluation

By Edris Derakhshi (TradingRage)

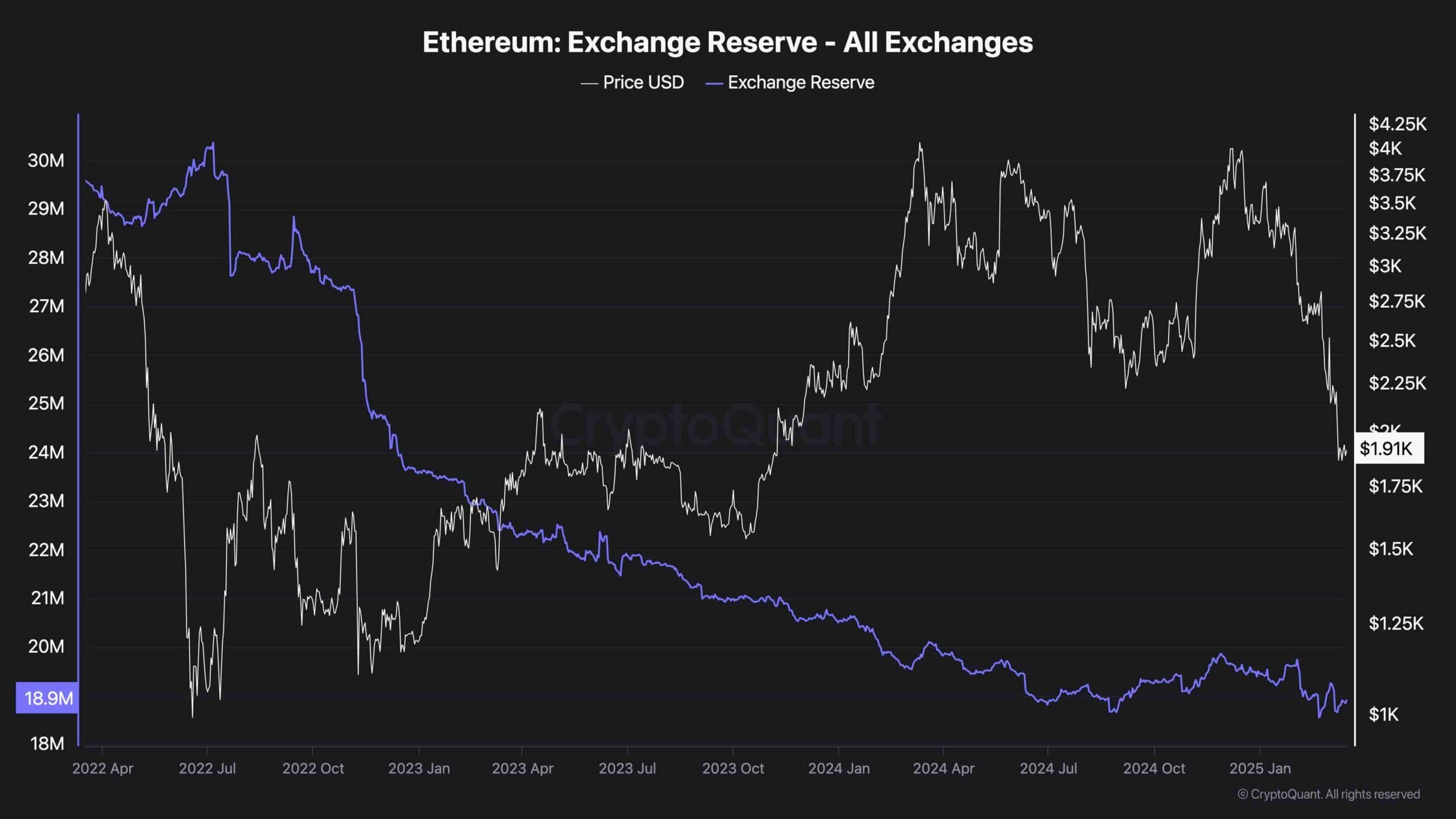

Trade Reserve

The Ethereum alternate reserve chart exhibits a steady decline within the quantity of ETH held on exchanges, at the moment close to multi-year lows at round 18.8 million. This implies a long-term pattern of accumulation, as fewer tokens can be found for rapid promoting. Sometimes, declining alternate reserves point out that buyers are shifting ETH to self-custody or staking, lowering potential promoting strain.

Regardless of the worth drop to $1,900, the shortage of a big spike in alternate reserves implies that panic promoting won’t be totally materialized, which helps the concept that long-term holders someway stay assured. From a technical perspective, ETH is at a vital resistance zone close to $1,900-$2,000, and if consumers step in, the availability squeeze may result in a powerful restoration.

Nonetheless, if the asset fails to reclaim key ranges and sentiment worsens, some ETH may movement again to exchanges, growing promoting strain. Watching reserve developments alongside value motion will probably be essential in figuring out whether or not the present downtrend is nearing exhaustion or if additional draw back stays possible.