Though it’s plain that President Donald Trump has been lively with regard to cryptocurrencies since taking workplace, his engagement to date has, arguably, not been as many locally had hoped.

Particularly, whereas many anticipated a swift and decisive transfer within the course of making a strategic Bitcoin (BTC) – or a special, ‘America-first’ – reserve, Trump and his household used the inauguration to launch a number of thematic meme cash.

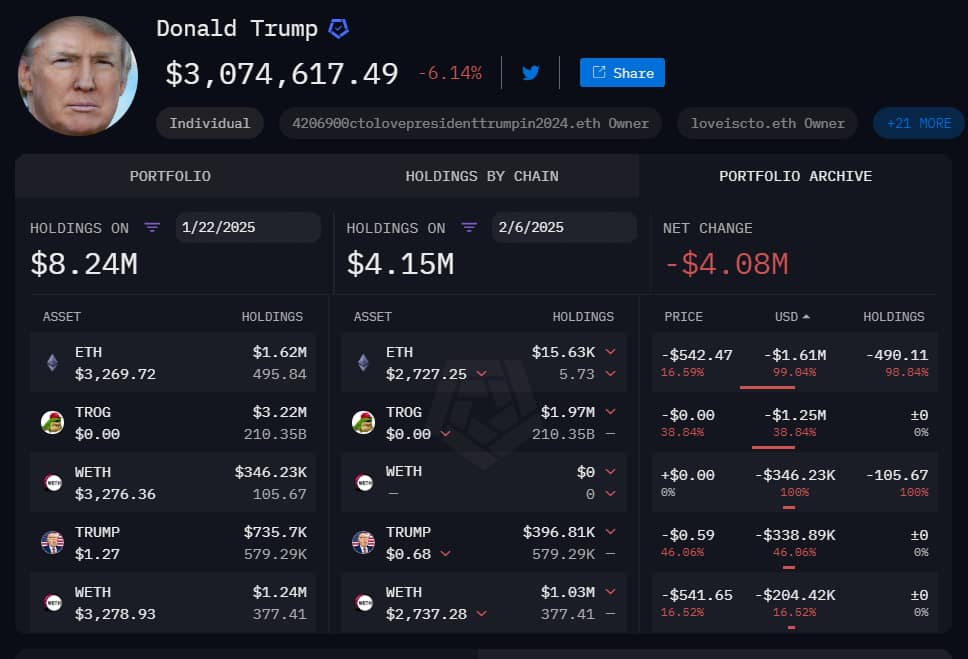

Moreover, whereas Finbold was inspecting on-chain information to find out the present state of the President’s cryptocurrency portfolio, we uncovered important outflows of Ethereum (ETH) and wrapped Ethereum (wETH) from Trump’s private crypto handle.

Did Donald Trump dump greater than 1,000 ETH?

Certainly, Donald Trump’s ETH stability dropped from almost 500 to simply below 6 between January 22 and press time on February 6.

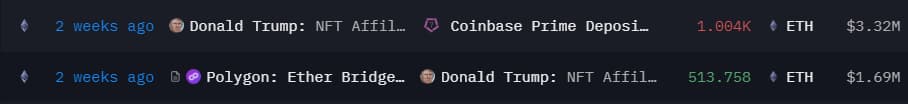

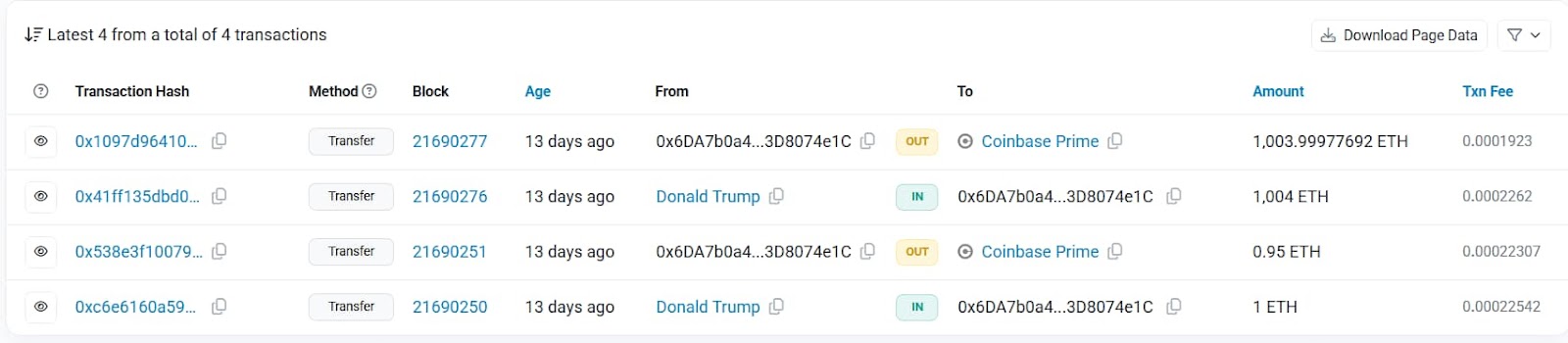

A better examination uncovered that within the afternoon of January 23, the handle recognized because the President’s most important cryptocurrency portfolio obtained about 513 Ethereum from one other pockets related to non-fungible token (NFT) proceeds.

Minutes later, greater than 1,000 ETH was transferred both to an middleman handle or a centralized alternate reception pockets earlier than being forwarded to a Coinbase Prime sizzling pockets.

The 2 transactions have been executed inside 10 minutes of each other as per Etherscan information, with the primary probably being a take a look at involving 1 ETH and the opposite constituting the primary switch of 1,004 ETH, minus the price.

There’s a restrict of traceability for many on-chain evaluation when a cryptocurrency, ETH on this case, enters an alternate pockets like Coinbase Prime due to the pooling and mixing of property.

At this level, Trump’s ETH is blended with Coinbase Prime’s holdings, and its particular person path turns into harder to trace additional until there’s a related outbound transaction matching his deposit.

Whereas no wrongdoing may be alleged based mostly on the transactions alone, and the present state of the new pockets Ethereum can’t be decided based mostly on the on-chain information, the speedy rise and fall of the worth of Trump household meme cash, paired with a February 3 Eric Trump X publish saying ‘in my view, it’s a good time so as to add ETH,’ raises some uncomfortable questions.

For my part, it’s a good time so as to add $ETH.

— Eric Trump (@EricTrump) February 3, 2025

WLFI urges the general public to not speculate because it strikes $300 million price of crypto

Concurrently, it’s noteworthy that the on-chain insights platform Spot On Chain revealed on the night of February 4 that World Liberty Monetary – an organization during which Donald Trump is listed because the ‘chief crypto advocate,’ Barron Trump as ‘DeFi visionary,’ and Eric Trump and Donald Trump Jr. as ‘Web3 ambassadors’ – is transferring huge quantities of cryptocurrency.

World Liberty Monetary (@worldlibertyfi) moved $307.41M in 8 property to #CoinbasePrime 6 hours in the past—as a part of treasury administration and enterprise operations.

Shortly after, the challenge unstaked 19,423 $stETH to $ETH and additional spent 5M $USDC to purchase 1,826 $ETH at $2,738.… https://t.co/Rp9NAFUs5N pic.twitter.com/5bfIvJma7U

— Spot On Chain (@spotonchain) February 4, 2025

Particularly, the agency transferred greater than $300 million price of 8 cryptocurrencies to Coinbase Prime mere hours earlier than the X publish was made. Together with Ethereum, Bitcoin is among the many moved property. Late on February 5, Eric Trump endorsed BTC in an X publish that mentioned: ‘Appears like a good time to enter BTC!’

The social media assertion additionally featured a rocket – an emoji related to the ‘to the moon’ meme – and likewise included a point out of World Liberty Monetary.

Appears like a good time to enter #BTC! 🚀 @worldlibertyfi

— Eric Trump (@EricTrump) February 6, 2025

Lastly, regardless of the sequence of occasions elevating uncomfortable questions, it’s price declaring that the precise motion of the cryptocurrency and its state at press time is troublesome to find out, and World Liberty issued a press release already on February 3 explaining that any noticed transactions are ‘a part of common treasury administration, and fee of charges and bills and to handle working capital requirement.’

We’re making routine actions of our crypto holdings as a part of common treasury administration, and fee of charges and bills and to handle working capital necessities. To be clear, we’re not promoting tokens—we’re merely reallocating property for abnormal enterprise functions.…

— WLFI (@worldlibertyfi) February 3, 2025

The corporate additionally pressured that it’s ‘not promoting tokens’ and that it’s ‘supposed to be a part of sustaining a robust, safe, and environment friendly treasury.’ World Liberty Monetary additionally urged the general public to not speculate.

Featured picture through Shutterstock