- Ethereum ETFs’ sustained inflows point out excessive bullish sentiment amongst institutional traders.

- Ethereum staking outflows counsel elevated profit-taking amongst traders.

- ETH may rally to check its all-time excessive resistance of $4,868 after reaching a nine-month excessive.

Ethereum (ETH) is up 2% on Monday, surging above a key symmetry triangle following sustained institutional curiosity through ETH exchange-traded funds (ETFs) traders. Nevertheless, rising withdrawals throughout staking protocols may halt the bullish momentum.

Ethereum bullish momentum fueled by ETF inflows amid rising staking outflows

US spot Ethereum ETFs posted document internet inflows of $818.8 million final week after extending its influx streak to fifteen days of constructive flows, per Coinglass knowledge.

The flows had been dominated by inflows of $523.1 million and $258.6 million into BlackRock’s ETHA and Constancy’s FETH, respectively. The sustained inflows have boosted their cumulative flows to $3.2 billion and $1.38 billion.

Notably, on Friday, Grayscale’s ETHE flipped to constructive flows for the primary time since launch, recording internet inflows of $7.2 million. This might mark a serious turning level for Ethereum ETFs, which now have a complete internet inflows of $2.27 billion.

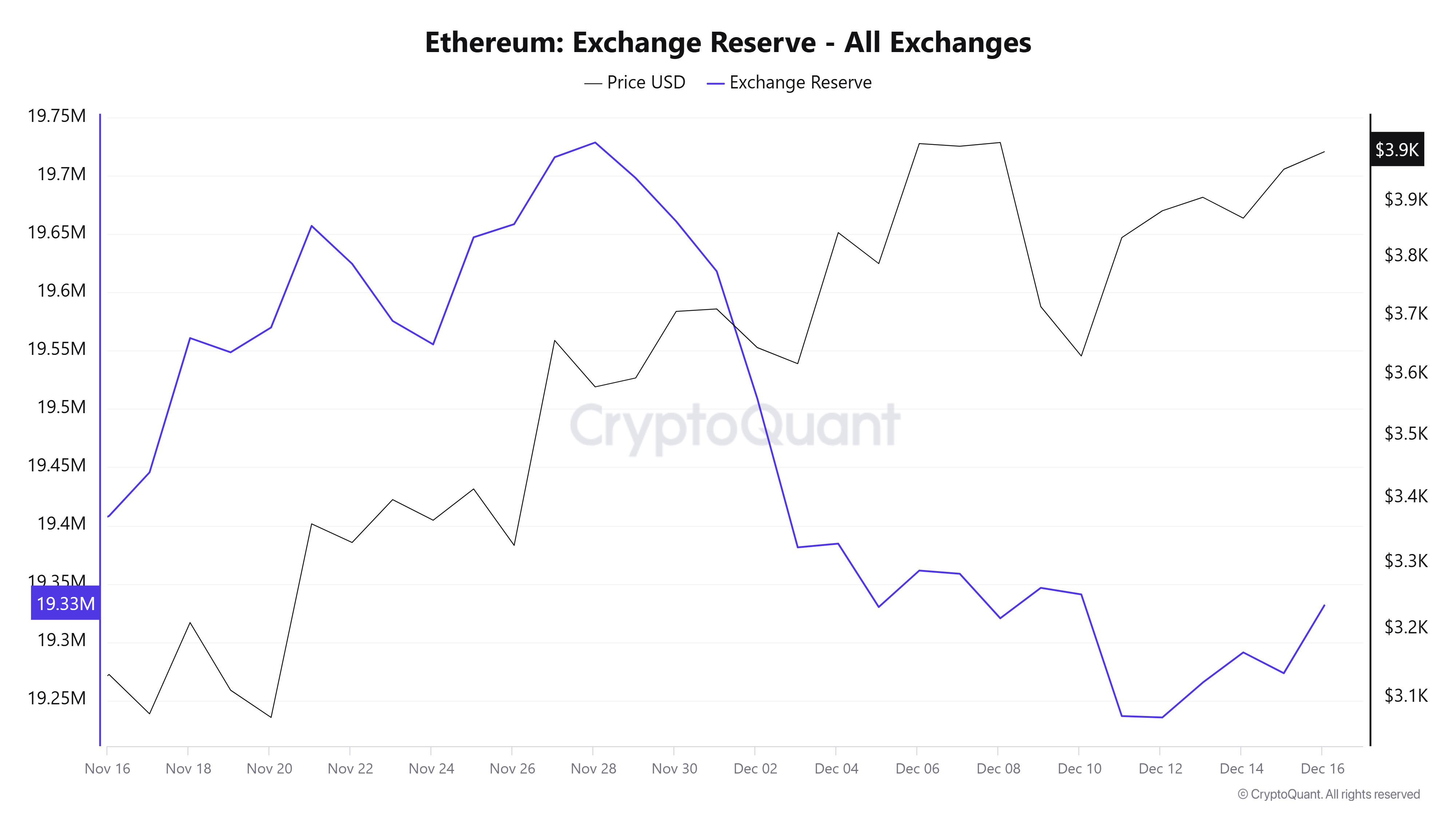

Regardless of the sustained bullish sentiment amongst institutional traders through ETH ETFs, Ethereum change reserves have been trending upward over the previous 4 days. The reserves elevated by almost 100K ETH, value about $400 million, indicating that Ethereum may see promoting strain after the current worth rise.

Ethereum Trade Reserve | CryptoQuant

Moreover, the entire quantity of staked ETH has declined by over 490K ETH previously month on account of elevated outflows throughout staking protocols. Such outflows point out that traders are both regularly taking income because of the current worth enhance or shedding curiosity in holding onto ETH in the long run.

Ethereum Staking Flows | IntotheBlock

That is evidenced by the current exercise surrounding Tron founder Justin Solar’s Ethereum handle. In accordance with the crypto analytics platform Spot On Chain, Solar’s handle utilized to withdraw 52,905 ETH from the staking protocol Lido Finance.

Justin Solar (@justinsuntron) utilized to withdraw 52,905 $ETH (now $209M) from #LidoFinance an hour in the past.

That is a part of the web 392,474 $ETH he allegedly purchased at ~$3,027 ($1.19B) through 3 wallets from Feb-Aug, now having an est. complete revenue of $349M (+29%).

Word that on Oct 4,… https://t.co/r5z7l8YSUq pic.twitter.com/GAalq1imjO

— Spot On Chain (@spotonchain) December 16, 2024

Ethereum Value Forecast: ETH may rally to check its all-time excessive resistance after reaching a nine-month excessive

Ethereum is up 2% after sustaining $90.44 million in liquidations previously 24 hours, per Coinglass knowledge. Liquidated lengthy and brief positions accounted for $31.25 million and $59.19 million respectively.

ETH examined its yearly excessive resistance of $4,093 for the primary time in 9 months after transferring above the higher boundary of a symmetry triangle.

ETH/USDT every day chart

If ETH manages to beat its yearly excessive of $4,093 with a excessive quantity transfer and set up the triangle’s higher boundary as a key help stage, it will probably surge to check its all-time excessive resistance at $4,868.

The Relative Energy Index (RSI) is above its impartial stage and trending upward, indicating rising bullish momentum. In the meantime, the Stochastic Oscillator is within the overbought area, indicating ETH could also be due for a correction.

A every day candlestick shut under $3,550 will invalidate the thesis.